Report Overview

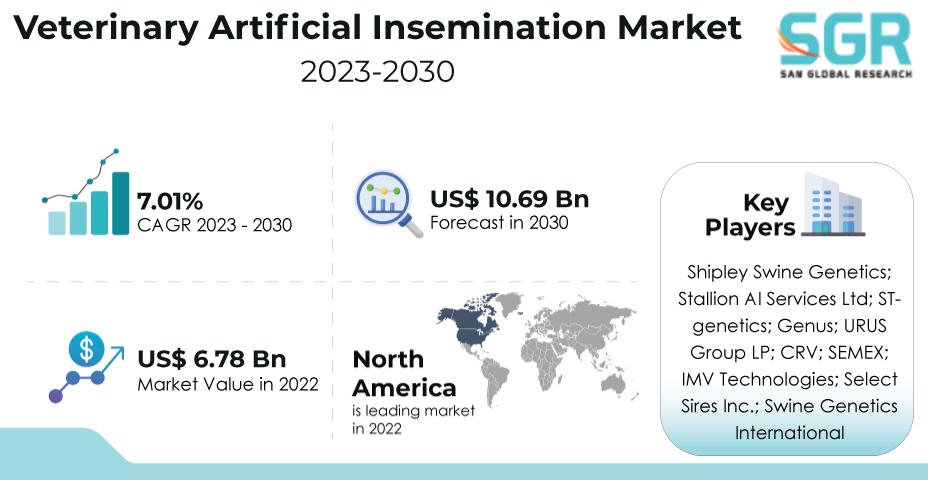

The Veterinary Artificial Insemination Market was valued at 6.78 Billion in 2022 and expected to grow at CAGR of 7.01% over forecast period.

The Veterinary Artificial Insemination market is driven by a complex interplay of factors that highlight its critical role in animal reproduction. The adoption of artificial insemination techniques is being driven by an increasing demand for improved genetics and improved animal breeding outcomes. These methods allow for greater precision in selecting desirable traits, which results in higher-quality offspring and higher production yields. Advances in reproductive technologies and equipment improve success rates, attracting veterinarians and breeders looking for cost-effective reproductive solutions.

Economic factors, such as lower breeding costs and increased productivity, encourage the use of artificial insemination in the livestock and companion animal industries. Furthermore, the emphasis on disease prevention and biosecurity promotes the use of artificial insemination to reduce the risks associated with natural breeding. Collaborations between veterinary professionals, researchers, and reproductive experts foster innovation, which helps to improve artificial insemination methods and contributes to the overall growth of the veterinary artificial insemination market.

Solution Outlook

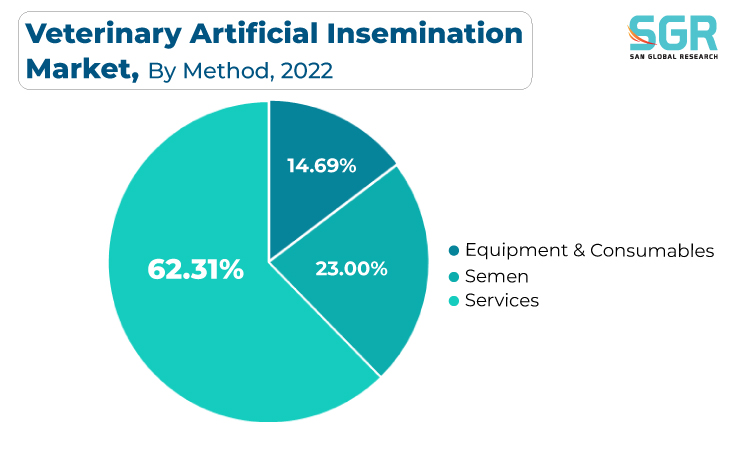

Based on Solution, the Veterinary Artificial Insemination market is segmented into Equipment & Consumables, Semen and Services. Services segment accounted for largest share in 2022.

Services in the Veterinary Artificial Insemination market are driven by a dynamic interplay of factors that highlight their critical role in animal reproduction and healthcare. Growing demand for superior genetics and optimized breeding outcomes propels the need for specialized artificial insemination services. Veterinary expertise in reproductive physiology, disease management, and genetics guides the successful implementation of these techniques. Customized solutions that address specific animal breeds and species contribute to enhanced breeding programs.

Semen in the Veterinary Artificial Insemination market is driven by a confluence of influential factors that highlight its critical role in improving animal breeding and genetic progress. The growing demand for superior traits and genetics in livestock and companion animals drives up the demand for high-quality sperm. Semen collected from genetically superior sires allows for more precise trait selection and the propagation of desirable characteristics, ultimately improving offspring quality.

Type Outlook

Based on Type, Veterinary Artificial Insemination Market is segmented into Bovine and Swine. Bovine accounted for largest share in 2022. The market for Bovine Veterinary Artificial Insemination is fueled by a complex interplay of influential factors that highlight its critical role in cattle breeding and genetic advancement. The adoption of artificial insemination techniques is fueled by the demand for improved cattle genetics, increased milk and meat production, and disease management. Bovine artificial insemination allows for greater precision in selecting desirable traits, resulting in higher-quality offspring and higher production yields.

The Swine Veterinary Artificial Insemination market is propelled by a variety of pivotal drivers that highlight its importance in swine breeding and genetic advancement. The adoption of artificial insemination techniques in the swine industry is driven by the pursuit of improved genetics for increased meat production, disease resistance, and reproductive efficiency. These methods enable producers to select desirable traits with greater precision, resulting in higher-quality piglets and increased profitability.

Distribution Outlook

Based on Distribution, Veterinary Artificial Insemination Market is segmented into private and public distribution channels. Private accounted for largest share in 2022. A number of factors are driving the Private Veterinary Artificial Insemination market, emphasizing its critical role in advancing animal breeding and genetic improvement within exclusive settings. Private veterinary artificial insemination services are appealing to breeders and livestock owners seeking precise genetic traits and improved reproductive outcomes. The private sector offers specialized expertise in animal reproduction, offering customized solutions that align with specific breed preferences and breeding objectives.

Regional Outlook

North America is emerged as leading market for Veterinary Artificial Insemination Market in 2022. The North America Veterinary Artificial Insemination market is propelled by a dynamic confluence of influential factors that highlight its importance in animal breeding and genetics. The adoption of advanced reproductive techniques is being driven by the increasing demand for superior animal traits, increased productivity, and disease resistance. The region's advanced veterinary infrastructure, technological prowess, and strong animal husbandry practices make artificial insemination more widely adopted.

The CSA region emerged as fastest growing region Veterinary Artificial Insemination market which is being propelled by a convergence of influential factors that highlight the region's critical role in animal breeding and genetics. The region's rich agricultural heritage, combined with rising demand for improved animal genetics and increased output, drives the use of artificial insemination techniques. The appeal of controlled breeding methods is heightened by limited access to natural breeding resources and the need for disease prevention.

Veterinary Artificial Insemination Market Repots Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 6.78 Billion |

| Forecast in 2030 | USD 10.69 Billion |

| CAGR | CAGR of 7.01% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Solution, By Type, By Distribution |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Shipley Swine Genetics; Stallion AI Services Ltd; STgenetics; Genus; URUS Group LP; CRV; SEMEX; IMV Technologies; Select Sires Inc.; Swine Genetics International |

Global Artificial Intelligence in Construction Market, Report Segmentation

Diagnostic Imaging Services Market, By Solution

- Equipment & Consumables

- Semen

- Services

Diagnostic Imaging Services Market, By Type

- Bovine

- Swine

Diagnostic Imaging Services Market, By Distribution

- Private

- Public

Diagnostic Imaging Services Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355