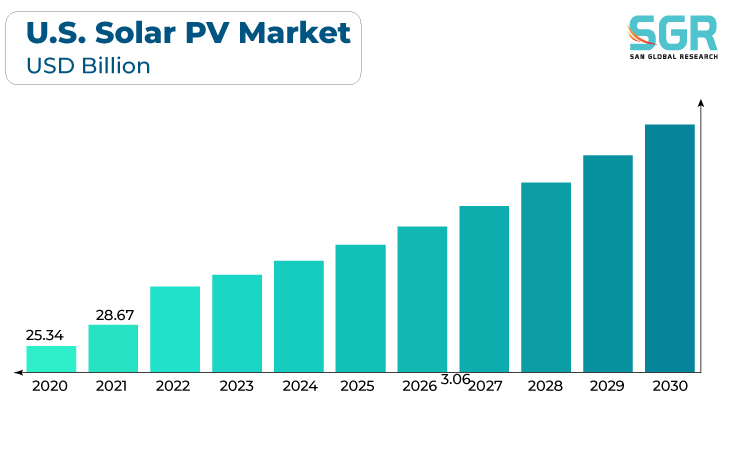

The U.S. Solar PV Market was valued at 30.34 billion in 2023 and expected to grow at CAGR of 12.9% over forecast period.

There is growing consumer and policy awareness and commitment to sustainable and clean energy solutions, creating a favorable environment for solar adoption. The decreasing cost of solar technologies, combined with government incentives and mandates promoting renewable energy, has accelerated the market's growth.

PV system technological advancements and innovations improve efficiency and affordability, making solar energy a more competitive and viable option. Furthermore, growing concerns about climate change, as well as a desire to reduce greenhouse gas emissions, are driving a shift toward renewable energy sources, positioning solar PV as a key player in the nation's energy transition.

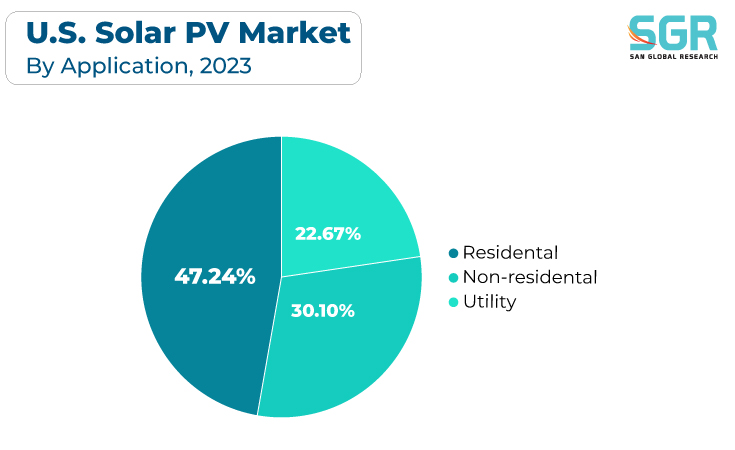

Application Outlook

Based on Application, the U.S. Solar PV Market is segmented Residential, Non-residential, Utility. Utility segment accounted for largest market share in 2023. Several key drivers are propelling the utility-scale solar photovoltaic (PV) market in the United States. One important factor is the rising cost of solar energy, which is being driven by economies of scale, technological advancements, and improved efficiency in utility-scale PV installations. Federal and state policies, such as tax breaks and renewable portfolio standards, are critical in encouraging utilities to invest in solar projects and creating a favorable regulatory environment. The decreasing costs of energy storage technologies add to the appeal of utility-scale solar by addressing intermittent issues and providing grid reliability.

Commercial entities are increasingly turning to solar PV installations to benefit from long-term cost savings, with falling solar technology costs and favorable financing options making these projects economically appealing. Commercial adoption of solar PV is also driven by environmental sustainability and corporate social responsibility goals, as businesses seek to reduce their carbon footprint and demonstrate their commitment to green practices. Businesses are encouraged to invest in solar projects by federal and state incentives, as well as favorable regulatory policies. Scalability is enabled by the modular nature of commercial solar PV systems, giving businesses flexibility in meeting their energy needs and adapting to growth. As energy resilience becomes more important, solar PV systems provide a dependable and decentralized energy source for commercial establishments, contributing to the growth of the industry.

State Outlook

Based on State, U.S. Solar PV Market is segmented into California, Nevada, Arizona, Texas, Massachusetts, North Carolina, Florida, Utah, Colorado, Georgia. California accounted for largest share in 2022. With ambitious renewable portfolio standards and incentives promoting solar development, California has consistently led the way in renewable energy initiatives. The state's commitment to reducing greenhouse gas emissions and mitigating climate change is in line with the growing societal and corporate emphasis on sustainability, which is driving demand for solar PV installations. Solar technologies' declining costs, combined with innovative financing mechanisms, make solar projects economically viable for businesses and residents. The emphasis on energy resilience in California, combined with a strong regulatory framework that supports distributed generation, positions solar PV as a key player in the state's energy landscape.

With its vast land and abundant sunlight, Texas is an ideal location for large-scale solar projects. The competitive electricity market in the state, as well as the decreasing costs of solar technologies, contribute to the economic viability of solar PV installations. Corporate demand for renewable energy in Texas has increased significantly, driven by both environmental sustainability goals and cost-effectiveness. The state's Renewable Portfolio Standard (RPS), in conjunction with federal tax breaks, creates a favorable regulatory environment for solar development.

Recent Key Developments in U.S. Solar PV Market

- In September 2023, Grenergy announced expansion of solar and energy storage with USD 2.6 billion by 2026

- In April 2023, The Saatvik Group has announced the formation of "Saatvik Green Energy USA Inc.", a Texas-based organization dedicated to distributing made-in-India "Saatvik" Premium quality Solar PV Modules throughout the United States. The organization will provide renewable energy solutions to improve energy efficiency and reduce carbon footprint while maintaining affordability and dependability.

- In June 2023, Vikram Solar has announced the construction of a $1.5 billion vertically integrated factory in the United States.Vikram's new joint venture will construct a 4 GW solar module manufacturing facility in Brighton, Colorado, followed by a wafer and ingot manufacturing facility in a southern state.

U.S. Solar PV Market Report Scope

| Report Attribute | Details |

| Market Value in 2023 | USD 30.3 Billion |

| Forecast in 2030 | USD 97.3 Billion |

| CAGR | CAGR of 12.9% from 2023 to 2030 |

| Base Year of forecast | 2023 |

| Historical | 2018-2022 |

| Units | Revenue in USD billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Application, By State |

| Key Companies profiled | First Solar, SunPower Corporation, Tesla Energy, Sunrun, Vivint Solar, NextEra Energy Resources, Duke Energy Renewables, Clearway Energy Group, Canadian Solar, JinkoSolar |

U.S. Solar PV Market Segmentation

Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Residential

- Non-residential

- Utility

State Outlook (Revenue, USD Billion, 2018 - 2030)

- Pre Heating

- California

- Nevada

- Arizona

- Texas

- Massachusetts

- North Carolina

- Florida

- Utah

- Colorado

- Georgia

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355