Report Overview

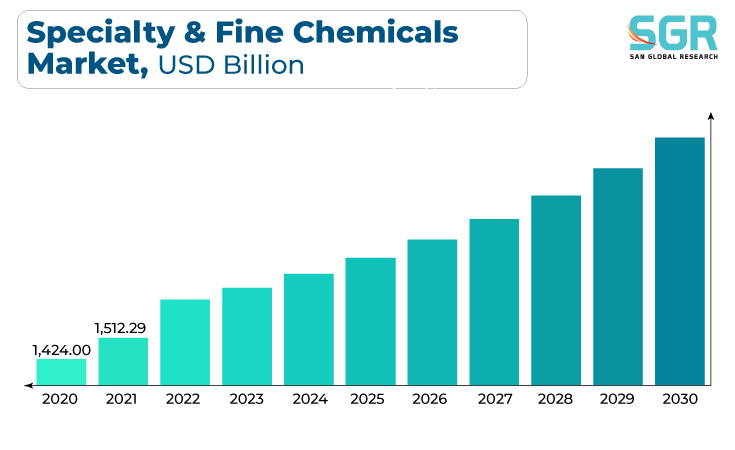

The specialty & fine chemicals were valued at USD 1,607.47 billion in 2022 and expected to grow at CAGR of 6.8% over forecast period.

Specialty chemicals are designed for specific applications and industries such as electronics, automotive, aerospace, and healthcare. The demand for these chemicals is often driven by advancements and innovations such as the integration of digital technologies, data analytics, and automation is transforming the specialty chemicals industry gradually. Thus, Companies are leveraging digital solutions for improved process efficiency, supply chain optimization, and predictive analytics which is driving the growth of the market.

Furthermore, Fine chemicals play a critical role in the pharmaceutical industry. The growth of the pharmaceutical sector, driven by factors such as an aging population and increased healthcare spending, fuels the demand for fine chemicals used in drug synthesis and manufacturing.

Stringent regulations govern the production of pharmaceuticals and agrochemicals, which require the use of high-quality fine chemicals. Changes in regulations can impact the demand for specific fine chemicals.

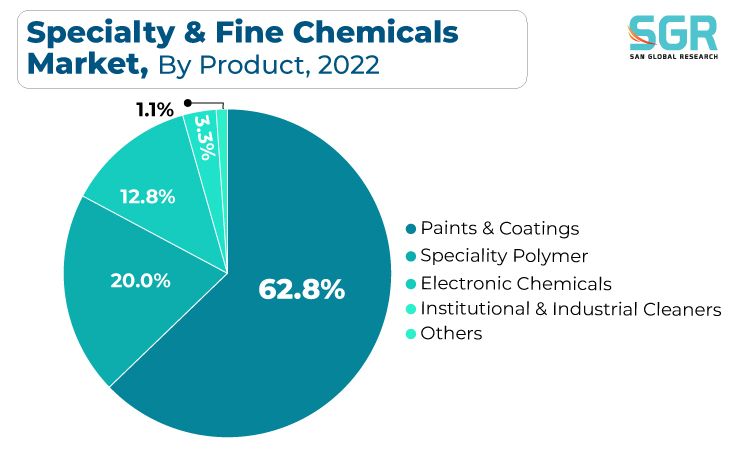

Product Outlook

Based on product, the specialty & fine chemicals are segmented into specialty polymer, electronic chemicals, institutional & industrial cleaners and others. Others segment such as plastic additives, construction chemicals, textile chemicals, flavors and fragrances, water chemicals, paper chemicals and agrochemicals are accounted for largest share in 2022. The development and use of specialized agrochemicals with improved efficacy and reduced environmental impact have driven the demand for specialty chemicals. Companies in the specialty chemicals sector often develop and supply these specialized agrochemicals.

For instance-

In 2020, Eastman Chemical Company, a global advanced materials and specialty additives company and Clariant, a world leader in specialty chemicals, announced an exclusive cooperation agreement for the distribution of Eastman’s Tamisolve NxG solvent, an innovative, low-tox, and highly effective solvent for the agrochemical industry.

Moreover, the demand for specialized paints and coatings with unique properties, such as high durability, corrosion resistance, fire resistance, or low toxicity, drives the need for innovative specialty chemicals. Specialty chemical companies develop and provide these chemicals to meet the specific requirements of the paint and coating industry, which is fueling the growth of specialty & fine chemicals market.

Regional Outlook

Asia-Pacific has emerged as leading market for specialty & fine chemicals in 2022. Several key factors are driving the Asia-Pacific Specialty & fine chemicals such as the Asia-Pacific region has experienced significant urbanization in recent decades, increasing infrastructure investment, and high demand in major end markets, such as construction, automotive, agriculture, packaging, textiles, and personal care are fueling the growth of region. In addition, the high demand for specialty chemicals in China and India are creating ample growth opportunities for the Asia-Pacific specialty chemicals market.

Furthermore, greater demand for paints and coatings for residential, commercial, and infrastructure development in countries like China, India, and Southeast Asian nations are driving the growth of specialty chemicals and fine chemicals in the region.

The automotive industry is one of the most lucrative industries for the specialty chemicals market share. These are used as polymers and plastic additives, paints and coatings and adhesives and sealants in the automotive industry. Major contribution of China, Japan, India, and South Korea in automotive industry are making Asia-Pacific major consumer for specialty and fine chemicals.

Specialty & Fine Chemicals Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 1,607.47 Billion |

| Forecast in 2030 | USD 2,708.54 Billion |

| CAGR | CAGR of 6.8% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Product |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | BASF SE, Dow Inc., Evonik Industries AG, AkzoNobel, Lanxess AG, Covestro AG, Clariant AG, Solvay S.A, Lubrizol Corporation, Ashland Global Holdings, Eastman Chemical Company |

Global Specialty & Fine Chemicals Market, Report Segmentation

Specialty & Fine Chemicals Market, By Product

- Specialty Polymer

- Electronic Chemicals

- Institutional & Industrial Cleaners

- Other

Specialty & Fine Chemicals Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355