Report Overview

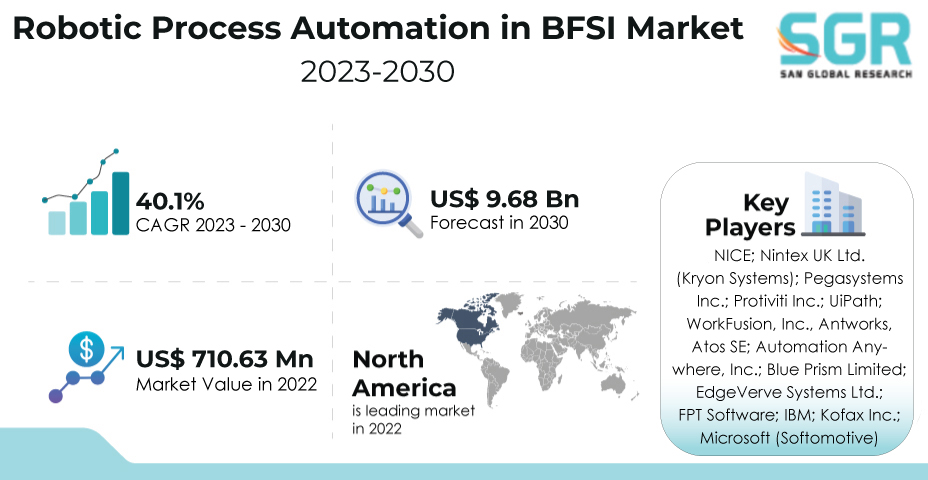

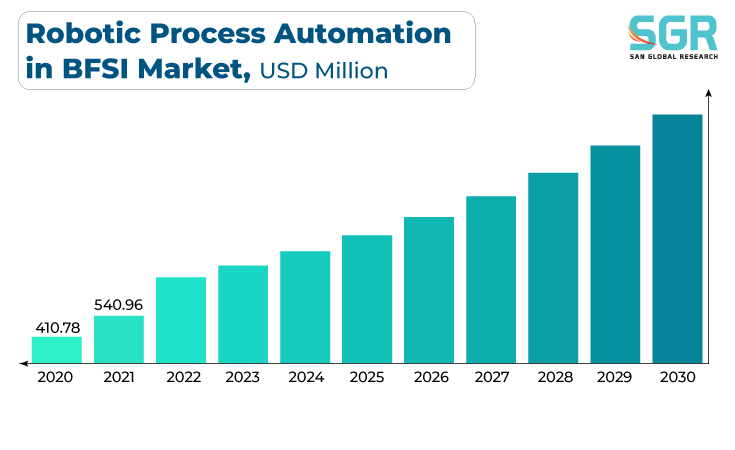

The Robotic Process Automation in BFSI Market was valued at 710.63 Billion in 2022 and expected to grow at CAGR of 40.1% over forecast period.

The BFSI market for Robotic Process Automation (RPA) is being propelled by a slew of influential factors that highlight its critical role in transforming the financial services landscape. RPA is an ideal solution for automating repetitive tasks, streamlining processes, and reducing human errors in the industry's complex and data-intensive operations, which demand high accuracy, efficiency, and compliance. Through rapid task execution, RPA enables financial institutions to reduce operational costs, improve customer experiences, and accelerate service delivery.

The adoption of RPA is driven by the need to adapt to rapidly changing regulatory requirements and market dynamics, allowing institutions to quickly implement and adjust automated processes. Furthermore, RPA's ability to integrate seamlessly with existing systems and software enables institutions to digitize legacy processes, resulting in improved data management and analytics capabilities. Collaborations between RPA providers and BFSI entities drive innovation by providing tailored solutions that address industry-specific challenges, thereby cementing RPA's position as a driving force behind the transformation of banking and financial services.

Type Outlook

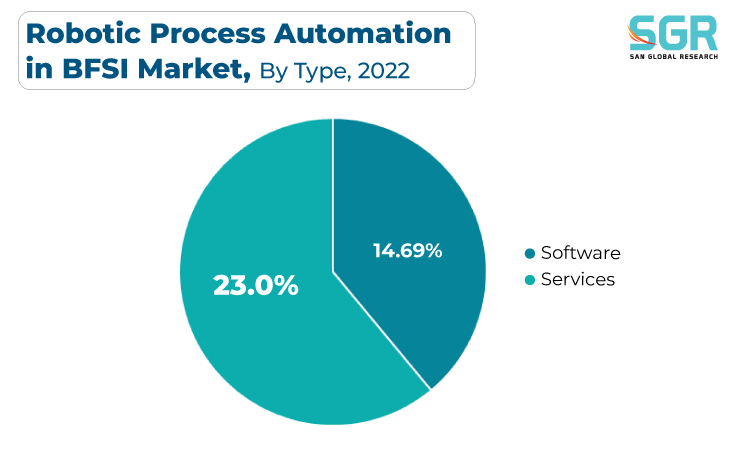

Based on Type, the Robotic Process Automation in BFSI market is segmented into Software and Services. Services segment accounted for largest share in 2022.

As the BFSI sector navigates the complexities of digitization, services play a critical role in tailoring RPA solutions to specific industry requirements ranging from back-office operations to customer service interactions. RPA service providers specialize in process assessment, implementation, integration, and maintenance, ensuring smooth automation deployment while minimizing disruptions. Financial institutions are partnering with RPA service providers to optimize processes, minimize errors, and reallocate human resources to value-added tasks in response to increased operational efficiency, lower costs, and improved compliance. Collaborations between RPA service experts and BFSI entities drive innovation by tailoring solutions to changing market demands and reaffirming the importance of services in the successful adoption and expansion of RPA within the BFSI sector.

The need to stay competitive in an ever-changing digital landscape drives the adoption of RPA software, which enables financial institutions to quickly deploy automated solutions that address industry-specific challenges ranging from transaction processing to fraud detection. RPA software's seamless integration capabilities enable institutions to improve legacy systems by enabling data-driven decision-making and analytics.

Organization Outlook

Based on Organization, Robotic Process Automation in BFSI Market is segmented into SME’s and Large Enterprises. Services accounted for largest share in 2022.Large enterprises in the BFSI market are driven by a dynamic set of factors that highlight their pivotal role in reshaping the financial services landscape. Because of the complexity of operations and vast data volumes in the BFSI sector, large institutions are adopting RPA as a strategic tool to improve efficiency, reduce costs, and ensure regulatory compliance.

Large enterprises in the BFSI market that use Robotic Process Automation (RPA) are influenced by a variety of factors that highlight their pivotal role in reshaping the financial services landscape. Because of the complexity of operations and vast data volumes in the BFSI sector, large institutions are adopting RPA as a strategic tool to improve efficiency, reduce costs, and ensure regulatory compliance.

Application Outlook

Based on Application, Robotic Process Automation in BFSI Market is segmented into banking and financial services & Insurance. Banking operations are highly regulated and data-intensive, necessitating the use of RPA to improve operational efficiency, reduce errors, and ensure compliance. RPA enables financial institutions to automate complex processes ranging from customer onboarding to transaction processing, resulting in faster service delivery and fewer manual interventions. In the digital age, the need to remain competitive and provide seamless customer experiences drives the adoption of RPA, allowing banks to optimize customer interactions, streamline workflows, and accelerate decision-making.

The intricate and compliance-driven nature of financial operations necessitates RPA adoption to streamline processes, reduce errors, and ensure regulatory adherence. RPA enables financial institutions to automate complex tasks such as claims processing and underwriting, resulting in faster service delivery and better customer experiences. The need to stay competitive in a rapidly changing digital landscape drives RPA adoption, allowing institutions to improve customer interactions, improve data-driven decision-making, and manage risk more effectively.

Regional Outlook

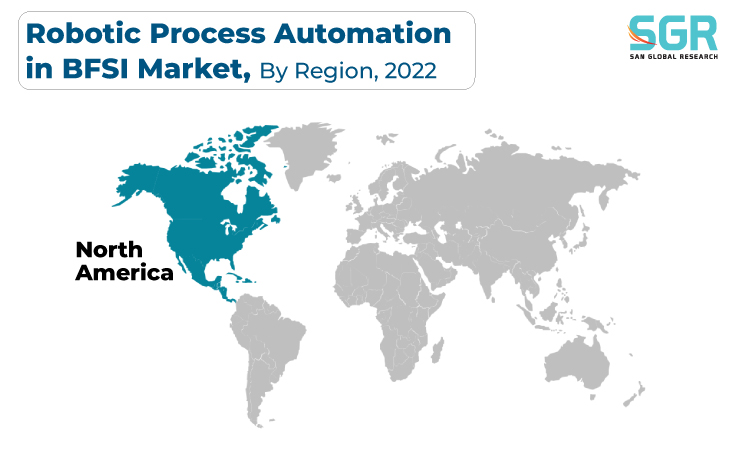

North America is emerged as leading market for Robotic Process Automation In BFSI Market in 2022. Financial institutions are being compelled to embrace RPA because of its potential to improve risk management, data analytics, and fraud detection. Collaborations between RPA providers and BFSI entities drive innovation by providing tailored solutions that address regional nuances and industry-specific challenges, cementing RPA's position as a driving force behind the modernization of financial services across North America.

Europe is expected to be the second-most prominent area in terms of Robotic Process Automation In BFSI Market share. In the digital age, institutions must embrace RPA to automate customer interactions, improve data-driven decision-making, and optimize risk management in order to remain competitive and deliver seamless customer experiences. The collaborative ecosystem that RPA providers and BFSI entities have created drives innovation by providing customized solutions that cater to regional regulations and industry-specific complexities, thereby cementing RPA's pivotal role in advancing efficiency, precision, and customer-centricity across the European financial services landscape.

Robotic Process Automation In BFSI Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 710.63 Million |

| Forecast in 2030 | USD 9.68 Million |

| CAGR | CAGR of 40.1% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By organization, by application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies Profiled | NICE; Nintex UK Ltd. (Kryon Systems); Pegasystems Inc.; Protiviti Inc.; UiPath; WorkFusion, Inc., Antworks, Atos SE; Automation Anywhere, Inc.; Blue Prism Limited; EdgeVerve Systems Ltd.; FPT Software; IBM; Kofax Inc.; Microsoft (Softomotive) |

Global Robotic Process Automation in BFSI Market, Report Segmentation

Robotic Process Automation in BFSI Market, By Type

- Software

- Services

- Services

Robotic Process Automation in BFSI Market, By Organization

- SMEs

- Large Enterprises

Robotic Process Automation in BFSI Market, By Application

- Banking

- Financial Services & Insurance

Robotic Process Automation in BFSI Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

- CSA

Brazil

- Argentina

- MEA

UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355