Report Overview

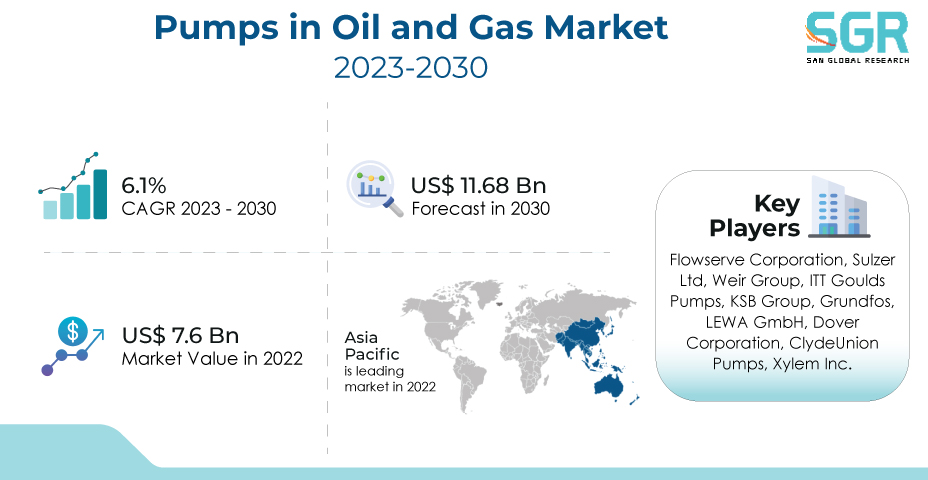

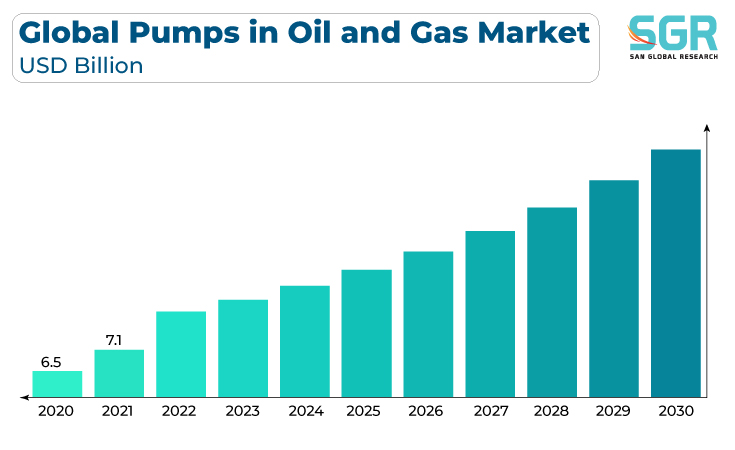

The Pumps in Oil and Gas Market was valued at USD 7.6 billion in 2022 and expected to grow at CAGR of 6.1% over forecast period.

The global oil and gas pipeline market is primarily driven by ongoing hydrocarbon demand, which necessitates the construction of extensive pipeline networks to transport oil and natural gas from production sites to consumers and export facilities. The expansion of unconventional oil and gas sources, advances in drilling and extraction technologies, and geopolitical factors that promote energy security and diversification all contribute to the need for more pipeline infrastructure.

Additionally, the development of cleaner energy sources and the transition to natural gas as a bridge to a lower-carbon future are fostering investments in gas pipelines. Technological innovations, such as automation and monitoring systems, enhance pipeline efficiency and safety, while evolving

environmental regulations encourage the adoption of more sustainable and eco-friendly energy transportation solutions, further shaping the dynamics of the oil and gas pipeline market.

Type Outlook

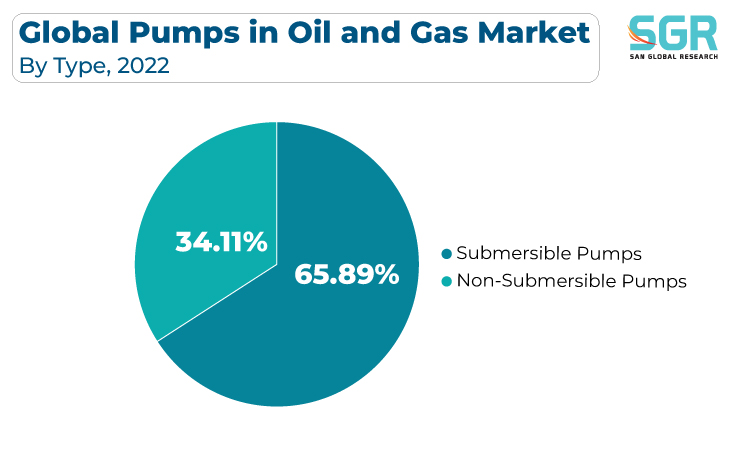

Based on Type, the Pumps in Oil and Gas Market are segmented into Submersible Pumps, Non-Submersible Pumps. Submersible Pumps segment accounted for largest share in 2022. Submersible pumps are essential in the oil and gas pipeline market because they are used to extract and transport hydrocarbons. The growing global demand for oil and gas, which necessitates the efficient extraction of resources from deeper and more difficult offshore and onshore locations, is one of the main drivers for submersible pumps in this sector. Submersible pump technology advancements, such as improved materials, design, and monitoring capabilities, improve performance and reliability while reducing downtime and maintenance costs.

Furthermore, submersible pumps are critical for maintaining pipeline flow and pressure during transportation, ensuring the efficient and uninterrupted movement of oil and gas, while ongoing efforts in the oil and gas industry to optimize operational efficiency and minimize environmental impact continue to drive demand for high-performing submersible pump solutions.

By Pump Outlook

Based on Pump, Pumps in Oil and Gas Market is segmented into Centrifugal Pumps, Positive Displacement, Screw Pumps, Rotary & Gear Pumps, Progressive Cavity Pump, Reciprocating Pumps. Centrifugal Pumps accounted for largest share in 2022. Centrifugal pumps are crucial components in the oil and gas industry, serving to transport fluids in various applications. Their market drivers include the ever-increasing global demand for hydrocarbons, necessitating efficient and reliable fluid transport in exploration, production, refining, and distribution. Advances in pump technology, such as enhanced materials, design innovations, and remote monitoring capabilities, improve their performance and reduce operational downtime.

Furthermore, advancements in PCP technology, such as improved materials, downhole monitoring, and control systems, improve reliability and performance while lowering operational costs. PCPs contribute to sustainable energy extraction by minimizing waste and water usage, positioning them as a vital solution for the oil and gas market's evolving needs as the industry strives to maximize production efficiency while addressing environmental concerns.

By Application Outlook

Based on Application, Pumps in Oil and Gas Market is segmented into Upstream, Mid-Stream, Downstream. Downstream accounted for largest share in 2022. Downstream pumps are critical in the refining and distribution processes of the oil and gas industry, and their market drivers include consistent global demand for refined products and the efficient transportation of fuels, petrochemicals, and natural gas to consumers and industries. Demand for high-performance downstream pumps is being driven by increased petrochemical production, the need for cleaner energy sources, and the expansion of liquefied natural gas (LNG) infrastructure. Pump technology advancements, such as energy-efficient designs, smart controls, and predictive maintenance capabilities, improve reliability and lower operational costs.

Midstream pumps are essential components in the oil and gas industry, facilitating the efficient and safe transportation of crude oil, natural gas, and petroleum products from production sites to refineries, storage facilities, and distribution centers. Key drivers for midstream pumps in this sector include the ongoing demand for energy resources and the expansion of unconventional oil and gas production, necessitating the development of pipeline and transportation infrastructure. Technological advancements in pump design, materials, and monitoring systems enhance their performance, reliability, and safety, reducing operational downtime.

Regional Outlook

Asia Pacific is emerged as leading market for Pumps in Oil and Gas Market in 2022. Drivers for pumps in the Asia Pacific oil and gas market include the region's rapid economic expansion, resulting in higher energy consumption and the development of new oil and gas projects. Advances in pump technology, including more efficient and reliable designs, as well as the adoption of smart and digital solutions, are enhancing the industry's capacity to meet growing demands.

Several key drivers shape the European oil and gas pump market, including the region's commitment to environmental sustainability and energy transition. With a growing emphasis on reducing carbon emissions and transitioning to cleaner energy sources, there is a demand in the oil and gas industry for more efficient and environmentally friendly pump solutions. The need to maintain and upgrade existing infrastructure, as well as the expansion of LNG terminals and renewable energy projects, drives demand for advanced pump technologies even further.

Pumps in Oil and Gas Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 7.6Billion |

| Forecast in 2030 | USD 11.68 Billion |

| CAGR | CAGR of 6.1% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2030 |

Report Coverage |

Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By Pump, By Application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

Key Companies profiled |

Flowserve Corporation, Sulzer Ltd, Weir Group, ITT Goulds Pumps, KSB Group, Grundfos, LEWA GmbH, Dover Corporation, ClydeUnion Pumps, Xylem Inc. |

Pumps in Oil and Gas Market Segmentation

Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Submersible Pumps

- Non-Submersible Pumps

Pump Outlook (Revenue, USD Billion, 2018 - 2030)

- Centrifugal Pumps

- Positive Displacement

- Screw Pumps

- Rotary & Gear Pumps

- Progressive Cavity Pump

- Reciprocating Pumps

Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Upstream

- Mid-Stream

- Downstream

Pumps in Oil and Gas Market, Regional Outlook

North America

- U.S

- .Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355