Report Overview

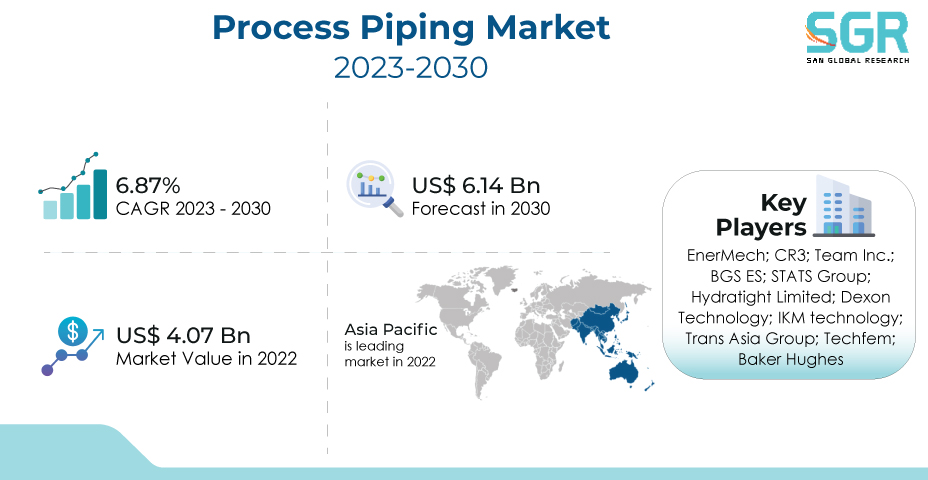

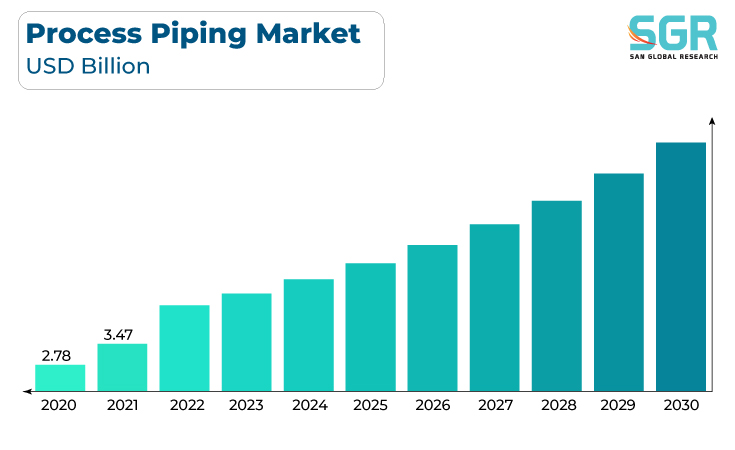

The Process Piping Market was valued at 4.07 Billion in 2022 and expected to grow at CAGR of 6.87% over forecast period.

The continuous growth of industries such as oil and gas, chemicals, pharmaceuticals, and power generation, all of which rely heavily on efficient and reliable fluid and gas transportation systems, is a significant driver in the process piping market. As these industries grow, so does the demand for intricate and specialized process piping networks to facilitate the seamless movement of materials, fluids, and gases through various manufacturing and distribution processes.

Moreover, the integration of advanced technologies such as Industry 4.0 and the Industrial Internet of Things (IIoT) requires sophisticated process piping systems to accommodate data transmission, monitoring, and control. With safety, efficiency, and cost-effectiveness at the forefront, industries are investing in modern process piping solutions that adhere to stringent regulations and leverage cutting-edge materials and techniques, driving the growth of the process piping market.

Product Outlook

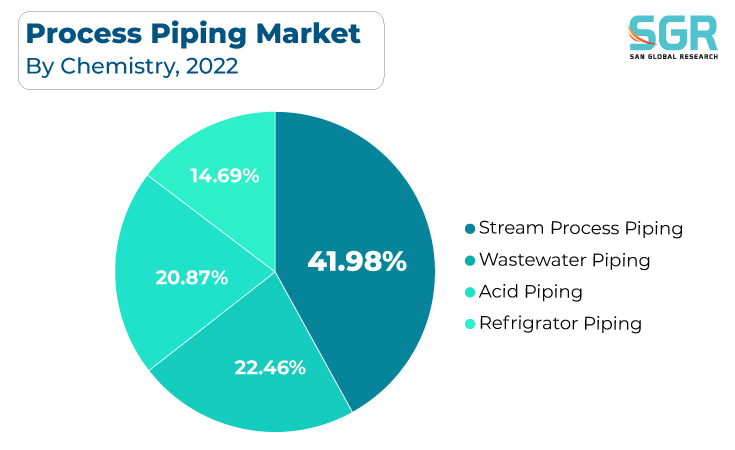

Based on Chemistry, the Process Piping Market is segmented into Steam Process Piping, Wastewater Piping, Crude Oil Piping, Acid Piping, Refrigerant Piping. Steam Process Piping segment accounted for largest share in 2022. Steam process piping systems are critical for transporting high-temperature, high-pressure steam to power turbines, heat exchangers, and other industrial processes. Because of the growing demand for energy-efficient and sustainable solutions, industries are investing in modern steam process piping that reduces energy losses, improves system reliability, and adheres to safety standards. Furthermore, advances in materials and construction techniques are enabling the development of more durable and corrosion-resistant steam piping systems, driving market growth as industries seek to optimize their operations while reducing environmental impact.

As urbanization and industrialization increase, so does wastewater generation, necessitating the development of robust process piping systems to effectively convey, treat, and dispose of wastewater. Investments in advanced piping technologies, such as corrosion-resistant materials and specialized coatings, are being driven by the demand for innovative and sustainable solutions to handle complex wastewater streams. Furthermore, stringent wastewater treatment regulations compel industries to adopt efficient piping networks for transporting industrial effluents and municipal sewage, which contributes to the growth of the wastewater process piping market as industries seek to reduce their environmental footprint and ensure regulatory compliance.

End-Use Outlook

Based on End-Use, Process Piping Market is segmented into Oil refineries, Food and beverage manufacturing, Paper Mills, Power plants, Chemical processing . To prevent contamination and ensure product integrity, the industry's stringent hygiene standards and quality control regulations necessitate the use of specialized materials and design considerations. As consumer preferences shift toward healthier, more diverse food options, the need for adaptable piping networks that can accommodate a variety of ingredients and manufacturing methods becomes critical. Furthermore, the adoption of process piping systems that enable precise control, monitoring, and data integration is fueling the growth of the food and beverage manufacturing process piping market as companies seek to meet evolving consumer demands while optimizing operational efficiency.

The global reliance on fuels, chemicals, and petrochemicals emphasizes the need for dependable process piping networks capable of handling a variety of materials under varying conditions. As the industry focuses on optimizing production processes, ensuring operational safety, and meeting stringent environmental regulations, refineries invest in advanced piping systems that improve efficiency, reduce leaks and emissions, and allow for the seamless movement of substances critical to the production of fuels and petrochemicals, driving the growth of the oil refineries process piping market.

Regional Outlook

Asia Pacific is emerged as leading market for Process Piping Market in 2022. The Asia Pacific process piping market is driven by the region's rapid industrialization, urbanization, and infrastructure development, which has resulted in increased demand for dependable and efficient piping systems in industries such as oil and gas, chemicals, power generation, and water treatment. As industries expand to meet the demands of growing populations and economies, the need for sophisticated process piping networks to ensure seamless operations and minimize downtime becomes critical.

Europe is expected to be the second-most prominent area in terms of Process Piping Market share. As industries strive to reduce emissions, waste, and optimize resource utilization, there is a growing demand for advanced process piping networks capable of handling diverse materials while ensuring minimal leaks and emissions. Energy efficiency, combined with the integration of digital technologies and automation, is driving the adoption of intelligent piping systems that enable precise monitoring, control, and maintenance. Government initiatives and incentives to promote green technologies further support the adoption of environmentally friendly and dependable process piping solutions, positioning Europe as a key driver of innovation and growth in the process piping market.

Process Piping Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 4.07 Billion |

| Forecast in 2030 | USD 6.14 Billion |

| CAGR | CAGR of 6.87% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Product, By End-use |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | EnerMech; CR3; Team Inc.; BGS ES; STATS Group; Hydratight Limited; Dexon Technology; IKM technology; Trans Asia Group; Techfem; Baker Hughes |

Global Process Piping Market, Report Segmentation

Process Piping Market, By Product

- Steam Process Piping

- Wastewater Piping

- Crude Oil Piping

- Acid Piping

- Refrigerant Piping

Process Piping Market, By End-use

- Oil refineries

- Food and beverage manufacturing

- Paper Mills

- Power plants

- Chemical processing

Process Piping Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355