Online Insurance Market is estimated to be worth USD 40.2 Billion in 2022 and is projected to grow at a CAGR of 9.0 % between 2024 to 2032. The study has considered the base year as 2023, which estimates the market size of market and the forecast period is 2024 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Enterprise Type, by Insurance Type, by End User and by region/country.

With digitalization progressing globally, the number of internet users has seen a remarkable and unprecedented increase. Many countries have embraced online transactions, indicating a substantial surge in both the e-commerce sector and the insurance industry. The rise in internet and mobile usage has a profound impact on customer preferences, with an increasing number of people conducting online research before making purchases. While traditional channels such as agencies and third-party distribution still hold a dominant position in the market, online channels are gaining popularity for insurance purchases. Furthermore, global market trends suggest that growing economies necessitate more insurance services due to increased vulnerability of families and businesses to risks. Globalization has introduced challenges and opportunities, making markets more competitive and consumers more discerning, demanding, and protected.

Region wise Comparison:

After reviewing the data shown below, it can be determined that the North American region dominates the Online Insurance Market for the following reasons.

The North American Online Insurance market reflects a growing interest in technology adoption. The rapid integration of technology has heightened reliance on the internet for transactions, data storage, financial management, leading to a surge in connected devices, cloud services, and mobile applications. Consequently, cyber-attacks have increased globally in both frequency and severity. Cyber insurance covers events like data breaches, network interruptions, and cyber extortion. The rising cyber threats are expected to drive an increased demand for cyber insurance in the forecast period.

In Europe, the Online Insurance market stands out with a favorable regulatory framework, serving as the catalyst for its development. This framework creates an environment conducive for insurers to expand their digital presence and offerings. Additionally, the region experiences substantial growth in internet penetration, contributing to the demand for Online Insurance and providing further opportunities for insurers.

The Asia Pacific region emerges as a dynamic participant in the Online Insurance Market, driven by significant digital growth in countries like India. The rapid digitalization, especially in financial services, places India at the forefront. The stable potential customer base for the digital economy is contributed by the increasing youth populations in Bangladesh, Indonesia, and Vietnam.

Latin America witnesses a booming expansion in the Online Insurance market, fueled by a growing interest in buying online motor insurance. Online insurance platforms offer convenience, allowing customers to compare policies, obtain quotes, and purchase motor insurance from the comfort of their homes or on-the-go. The motor insurance sector, which suffered during the pandemic, is now rebounding as the region recovers.

The Online Insurance market in Africa is experiencing significant growth in the field of telemedicine. Private health insurers are progressively integrating telemedicine services into their offerings, enabling policyholders to access medical care remotely and enhancing convenience and accessibility. Increasing awareness about the importance of health insurance coverage is driving demand for online health insurance products across Africa, resulting in heightened penetration and market growth within the sector.

Australia's aging population is a key factor fueling the growth of the online life insurance market. The demand for life insurance products is on the rise with an increasingly older demographic profile, resulting in an increased need for online life insurance services. Australia is undergoing an accelerated aging process, and by 2026, over 22 percent of Australians will be aged over 65, up from 16 percent in 2020. This figure is already double the 8.3 percent recorded at the start of the 1970s.

The Online Insurance market in the Middle East is experiencing gradual growth amid rising geopolitical uncertainties. This surge in uncertainties is fueling the demand for property insurance, including home insurance, as individuals and businesses seek protection against risks arising from geopolitical challenges in the region. Additionally, the online motor insurance sector is witnessing significant growth due to the expanding economies, contributing to the rapid boom of the Online Insurance market in the forecasted period.

Online Insurance Market

Segmentations

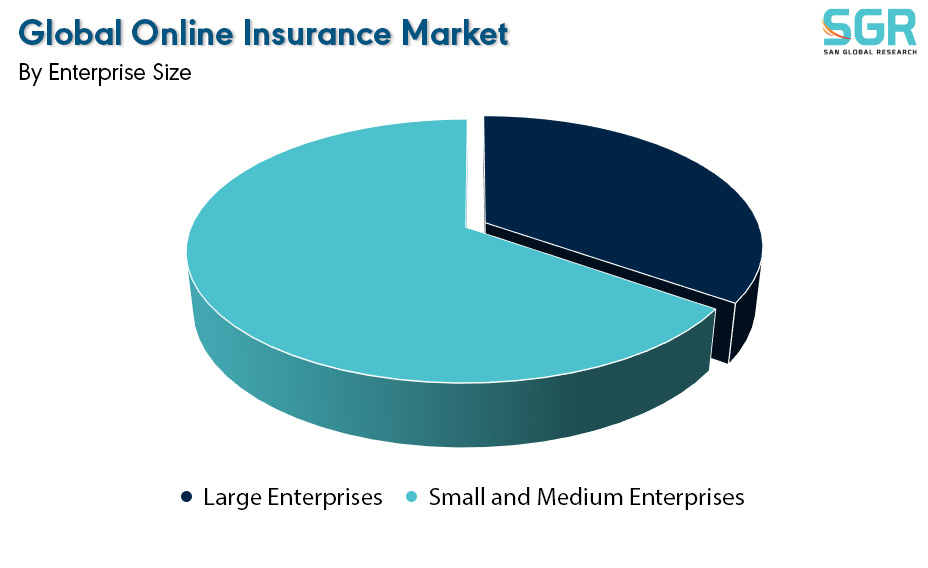

By Enterprise Size

Based on the Enterprise Size, the Online Insurance Market is bifurcated into Large Enterprise and Small and Medium Enterprise – where Small and Medium Enterprise is dominating and ahead in terms of share.

Small and medium-sized enterprises (SMEs) dominate the market share in the online insurance sector when compared to large enterprises. SMEs, encompassing businesses with fewer than 250 employees, wield considerable influence in the industry due to their abundance and adaptability to market dynamics. These enterprises, often more agile, innovative, and responsive to customer needs, can secure a substantial market share. Moreover, SMEs make noteworthy contributions to employment and economic growth, positioning them as crucial participants in the online insurance sector.

By Type

Based on the type, the Online Insurance Market is bifurcated into Life Insurance, Health Insurance, Auto Insurance and Property Insurance– where Life Insurance is dominating and ahead in terms of share.

Life insurance products, due to their intricacy and extended commitments, typically entail higher premiums and larger policy values. This complexity and scale of life insurance policies play a crucial role in shaping the market share within the online insurance sector. Life insurance is a vital element in risk management and financial planning, serving as a fundamental component in the financial portfolios of individuals and families. The pivotal role that life insurance assumes in risk mitigation and financial security further solidifies its leading position in the online insurance market.

By End User

Based on the type, the Online Insurance Market is bifurcated into Insurance Companies Third Party Administrators, Insurance Brokers and Insurance Web Aggregators – where Insurance Companies is dominating and ahead in terms of share.

Insurance companies predominantly control the online insurance market, holding the largest share in the industry. These companies serve as the primary providers of insurance products and services, overseeing policy underwriting, risk management, and claims disbursement to policyholders. Their substantial presence and influence in the market dynamics underscore their central role in shaping the online insurance sector.

Key Players

• Swiss Re

• Allianz SE

• Tesco

• Admiral

• Munich Re

• Aviva

• AXA Group

Drivers

Digitalization and Internet Penetration

Digital transformation is fundamentally altering the operations and customer interactions of insurance companies. It streamlines processes, enhances customer experiences, and fosters innovation in the industry, ultimately contributing to increased competitiveness and growth. In the realm of digitization, there are substantial shifts occurring in the insurance industry's value chain. Nevertheless, there is a relative limitation in existing research regarding its understanding and measurement. This study addresses this gap by constructing an index system for digital transformation in the insurance industry, encompassing three key components: digital infrastructure, digital platform, and digital applications.

Opportunity

Technological Advancement

Continuous innovations in Insurtech, such as AI-driven underwriting processes, blockchain for secure transactions, and IoT devices for risk assessment, are rapidly advancing the online insurance market. These technological developments revolutionize the sector, attracting more customers. AI streamlines underwriting processes, robotics enhances operational efficiency, blockchain ensures secure transactions, and IoT devices improve risk assessment capabilities. These technologies reshape how insurers interact with customers, automate tasks, and personalize insurance offerings. Consequently, they drive market growth and enhance competitiveness within the online insurance sector.

| Report Attribute | Details |

| Market Value in 2022 | 40.2 Billion |

| Forecast in 2032 | 86.7 Billion |

| CAGR | CAGR of 9.0 % from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2024 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Enterprise, By Insurance Type, By End User |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • Swiss Re • Allianz SE • Tesco • Admiral • Munich Re • Aviva • AXA Group |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355