Report Overview

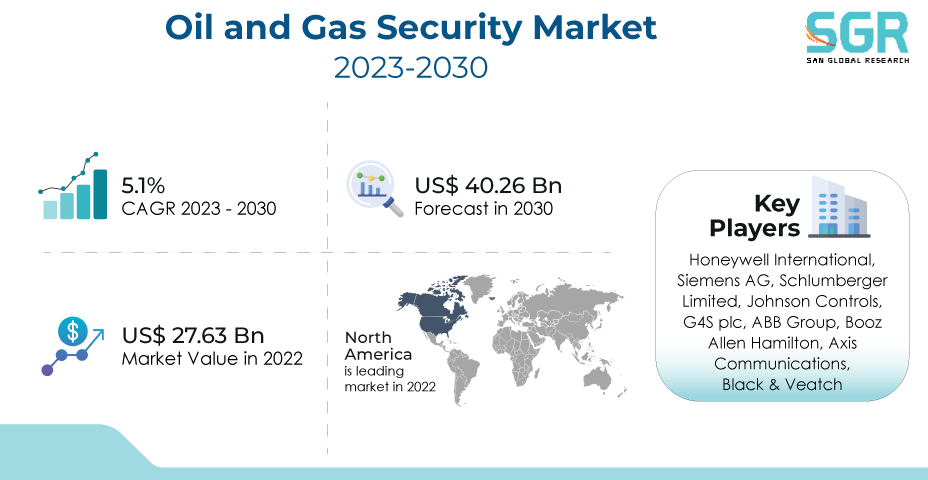

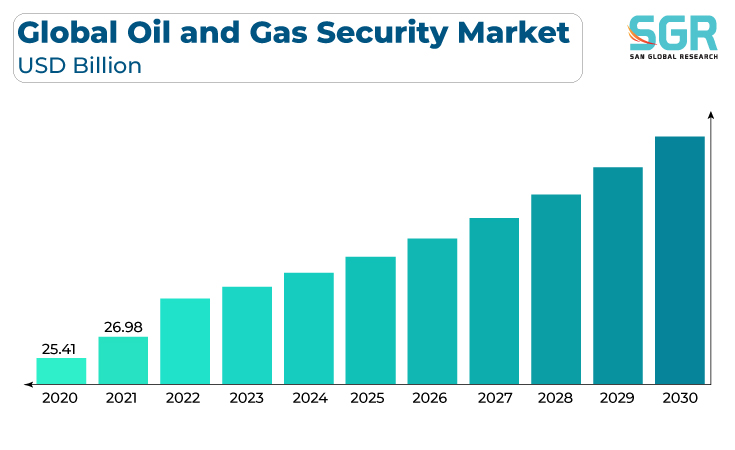

The Oil and Gas Security Market was valued at USD 27.63 billion in 2022 and expected to grow at CAGR of 5.1% over forecast period.

The global Oil and Gas Security market is primarily driven by a combination of factors, including an increase in the frequency of security breaches, terrorist threats, and geopolitical tensions in oil-producing regions, all of which have increased the need for robust security measures to protect critical infrastructure. Moreover, the growing adoption of advanced technologies such as surveillance systems, access control, cybersecurity solutions, and drones, in addition to stringent government regulations and compliance requirements, are motivating oil and gas companies to invest in comprehensive security solutions to protect their assets, operations, and data from potential threats, ultimately stimulating market growth.

In addition to these factors, the oil and gas industry's ongoing expansion into remote and challenging environments, such as deep-sea drilling and unconventional shale operations, has further intensified the demand for security solutions to mitigate risks associated with operational vulnerabilities. The evolving

nature of cyber threats, including ransomware attacks and data breaches, has made cybersecurity a paramount concern for the industry, spurring investments in cutting-edge technologies to protect sensitive information and infrastructure.

Component Outlook

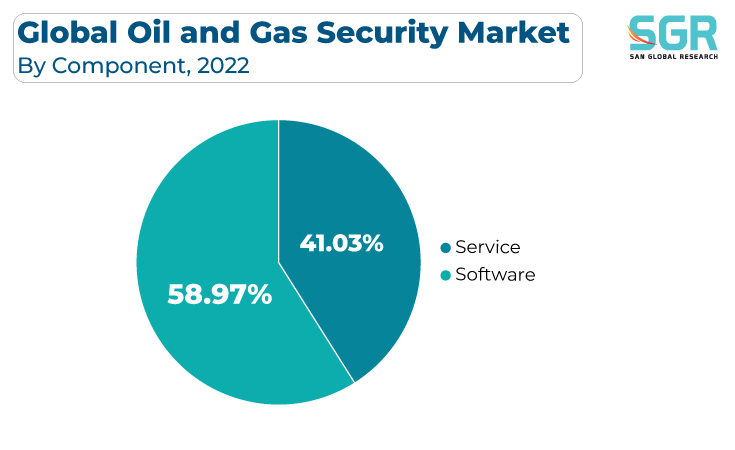

Based on Component, the Oil and Gas Security Market is segmented into Software, Services. Services segment accounted for largest share in 2022. Several key drivers are propelling the growth of services in the Oil and Gas Security market. To begin, the ever-changing nature of security threats, such as cyberattacks and physical breaches, is compelling businesses to seek out specialized security service providers for real-time threat detection, incident response, and proactive risk management. Second, the need for cost-effective solutions is driving a shift toward outsourcing security services, which provides access to expert personnel, advanced technologies, and scalable solutions while reducing capital expenditures.

The increasing reliance on digital technologies and the adoption of Industrial Internet of Things (IIoT) in the oil and gas sector have led to a greater need for advanced software tools to monitor and secure critical infrastructure and data. Secondly, the rising sophistication of cyber threats, including ransomware attacks and data breaches, has heightened the demand for cybersecurity software to safeguard sensitive information and operational systems.

Application Outlook

Based on Application, Oil and Gas Security Market is segmented into Exploring and Drilling, Transportation, Pipelines, Distribution and Retail Services. Pipelines accounted for largest share in 2022. The need to ensure uninterrupted energy supply, the expansion of global energy infrastructure, including pipeline networks, necessitates enhanced security measures to protect against physical attacks, theft, and sabotage. Second, growing concerns about environmental and safety risks have increased demand for security solutions capable of mitigating accidents, leaks, and other hazards in pipeline operations, thereby encouraging investment in safety and surveillance technologies. Third, as the importance of cybersecurity in protecting critical energy infrastructure against digital threats such as cyberattacks and data breaches grows, pipeline operators are investing in advanced software and network security solutions.

The Exploration and Drilling segment of the Oil and Gas Security Market is propelled by several key drivers. Firstly, the industry's expansion into increasingly challenging and remote environments, such as deep-sea drilling and unconventional shale exploration, has amplified the need for security measures to mitigate operational vulnerabilities and protect valuable assets. Second, the heightened awareness of environmental and safety risks associated with oil and gas exploration necessitates investments in security solutions as part of sustainability and regulatory compliance efforts.

Regional Outlook

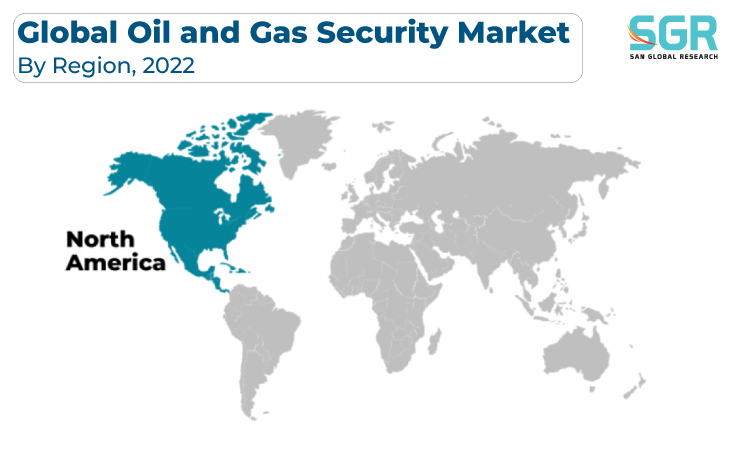

North America is emerged as leading market for Oil and Gas Security Market in 2022. The North America Oil and Gas Security Market is driven by several pivotal factors. Firstly, the region's substantial energy infrastructure, including pipelines, refineries, and drilling operations, is highly vulnerable to a range of security threats, including physical attacks, environmental risks, and cyber threats, motivating investments in robust security solutions. Secondly, the increase in energy production, driven by shale oil and gas development, has created a heightened need for security measures to protect valuable assets and ensure a stable energy supply.

The Europe Oil and Gas Security Market is shaped by several key drivers. Firstly, the region's heavy reliance on imported energy resources, combined with ongoing geopolitical tensions and terrorist threats, underscores the need for robust security measures to protect critical infrastructure, ensuring a stable energy supply and safeguarding against disruptions. Secondly, the growing emphasis on environmental and safety regulations, including the European Union's stringent standards, is pushing oil and gas companies to invest in security solutions to meet compliance requirements, mitigate operational risks, and protect against accidents and incidents.

Oil and Gas Security Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 27.63 Billion |

| Forecast in 2030 | USD 40.26 Billion |

| CAGR | CAGR of 5.1% from 2023 to 2030 |

| Base Year of forecast | 2022 |

Historical |

2018-2021 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Component, By Application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Honeywell International, Siemens AG, Schlumberger Limited, Johnson Controls, G4S plc, ABB Group, BoozAllen Hamilton, Axis Communications, Black & Veatch |

Oil and Gas Security Market Segmentation

Component Outlook (Revenue, USD Billion, 2018 - 2030)

- Software

- Service

Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Exploring and Drilling

- Transportation

- Pipelines

- Distribution and Retail Services

Oil and Gas Security Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355