Report Overview

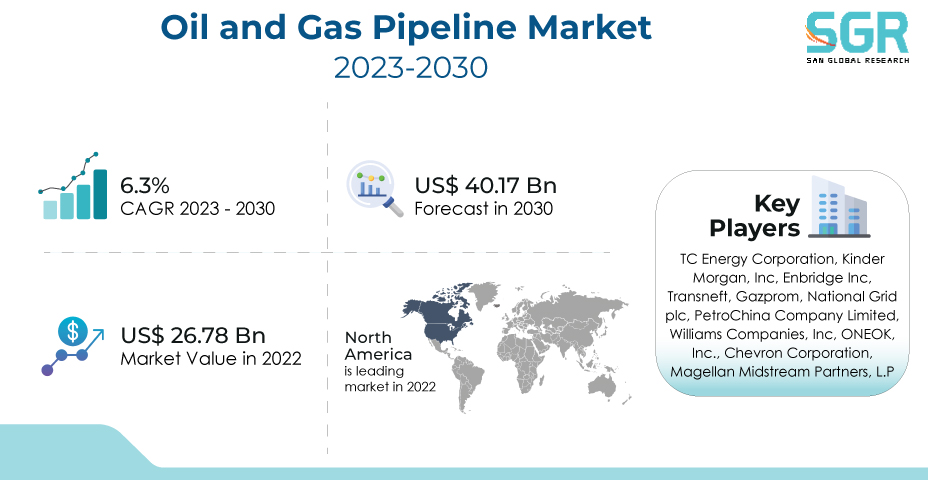

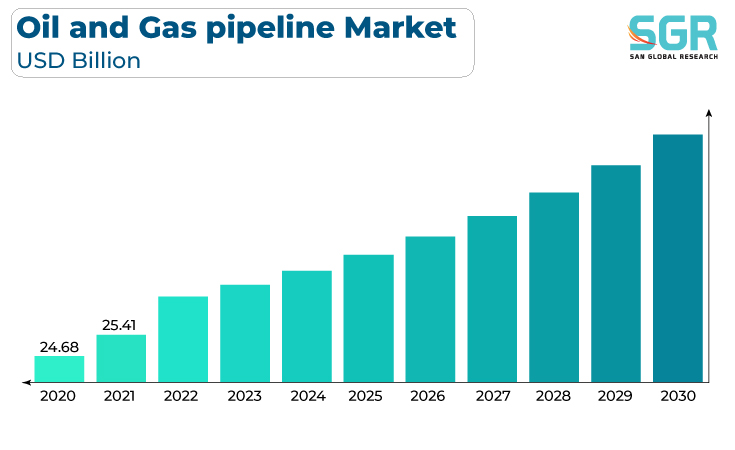

The Oil and Gas pipeline was valued at USD 26.78 billion in 2022 and expected to grow at CAGR of 6.3% over forecast period.

A combination of factors, including rising energy demand, the need to transport hydrocarbons from production sites to consumption centers, and the expansion of unconventional oil and gas sources, is driving the global oil and gas pipeline market. Furthermore, geopolitical factors and energy security concerns influence pipeline infrastructure development, as countries seek to diversify their energy sources and reduce reliance on unstable regions.

Furthermore, advancements in pipeline technology, such as automation and monitoring systems, are enhancing efficiency and safety in the industry, while environmental regulations and sustainability goals are promoting the adoption of cleaner energy sources, including natural gas, thereby driving investment in gas pipeline projects as a bridge to a low-carbon energy future.

Type Outlook

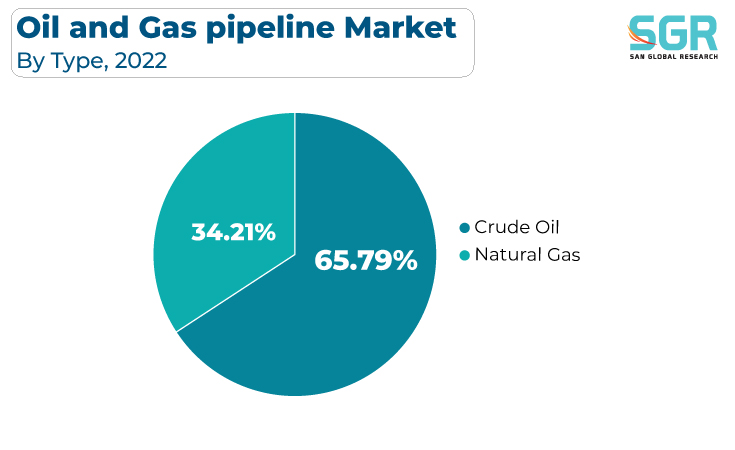

Based on Type, the Oil and Gas pipeline is segmented into Crude oil and Natural gas. Crude oil segment accounted for largest share in 2022. The crude oil and gas pipeline market is primarily driven by the ongoing global demand for energy, particularly in developing economies, which necessitates the development of efficient and cost-effective means of transporting crude oil and natural gas. The increased production of unconventional oil and gas, such as shale and oil sands, increases the demand for pipeline infrastructure to connect production areas to refining and distribution centers.

The natural gas pipeline market is primarily steered by the increasing global demand for clean energy sources, driven by environmental concerns and the transition towards lower carbon emissions. The development of new natural gas reserves, particularly in shale formations, has led to a surge in supply, necessitating the expansion of pipeline infrastructure to transport gas from production sites to consumers and export markets.

Application Outlook

Based on Application, Oil and Gas pipeline is segmented into Onshore and Offshore. Offshore accounted for largest share in 2022. The offshore oil and gas pipeline market is primarily driven by the growing global demand for hydrocarbons, which requires the development of infrastructure to extract and transport oil and gas from offshore reserves. Offshore drilling in deepwater and ultra-deepwater regions, as well as the exploration of subsea reserves, has expanded the need for subsea pipelines to connect extraction facilities to onshore processing and distribution points. Geopolitical factors and the quest for energy security play a significant role, with countries looking to diversify energy sources and reduce dependence on unstable regions.

The onshore oil and gas pipeline market is primarily propelled by the sustained global demand for hydrocarbons, necessitating the construction of infrastructure to transport oil and gas from production regions to refining and distribution centers. The growth in unconventional oil and gas sources, such as shale and oil sands, further fuels the need for pipelines to connect production sites to consumers, while geopolitical factors and energy security concerns influence investment in onshore pipeline projects to reduce reliance on volatile regions.

Sector Outlook

Based on Sector, Oil and Gas pipeline is segmented into Upstream, Mid-Stream, Downstream. Upstream accounted for largest share in 2022. Geopolitical factors, energy security concerns, and the desire for diversification in energy supply contribute to the development of upstream pipelines as countries aim to reduce their reliance on unstable regions and enhance energy self-sufficiency. Advancements in pipeline technology, including automation, monitoring, and safety measures, also play a pivotal role in driving market growth, improving efficiency and reducing environmental risks in the upstream sector.

Global demand for refined products and natural gas necessitates efficient transportation of these products from refineries, processing plants, and import terminals to end-users and distribution points. The rising demand for petrochemicals, liquefied natural gas (LNG), and other downstream products drives the expansion of pipeline infrastructure to serve a wider range of markets. As countries seek to secure their energy supplies and reduce reliance on uncertain regions, geopolitical factors and energy security concerns play an important role.

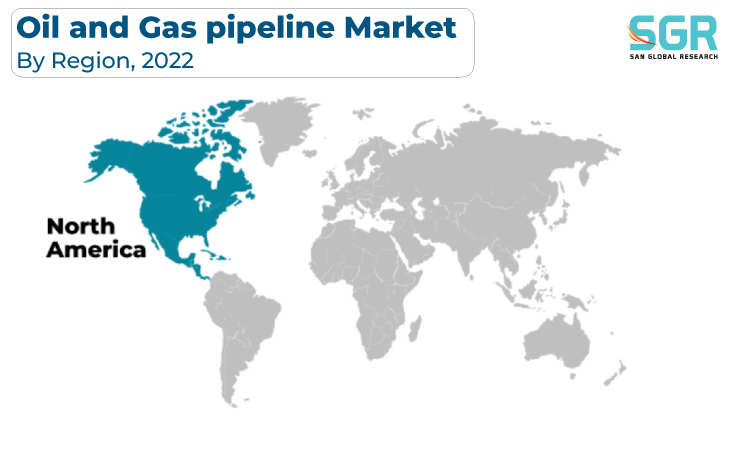

Regional Outlook

North America is emerged as leading market for Oil and Gas pipeline in 2022. The abundant shale oil and natural gas resources, which have triggered a surge in production and necessitated the development of extensive pipeline networks to transport these hydrocarbons to refining and distribution hubs, are driving the North American oil and gas pipeline market. As North American countries strive to reduce their reliance on foreign energy sources, geopolitical factors and energy security concerns contribute to market growth. Automation, monitoring, and leak detection systems, as well as other technological advancements in pipeline infrastructure, improve operational efficiency and safety.

The European oil and gas pipeline market is primarily driven by the need for energy security and the diversification of energy sources, as countries aim to reduce reliance on imports from geopolitically volatile regions. The development of renewable energy sources and the transition to cleaner energy systems further push for investment in gas pipelines to serve as a flexible and reliable energy source during this transition.

Oil and Gas Pipeline Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 26.78 Billion |

| Forecast in 2030 | USD 40.17 Billion |

| CAGR | CAGR of 6.3% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By Application, By Sector |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | TC Energy Corporation, Kinder Morgan, Inc, Enbridge Inc, Transneft, Gazprom, National Grid plc, PetroChina Company Limited, Williams Companies, Inc, ONEOK, Inc., Chevron Corporation, Magellan Midstream Partners, L.P |

Oil and Gas Pipeline, Report Segmentation

Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Crude Oil

- Natural Gas

Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Onshore

- Offshore

Sector Outlook (Revenue, USD Billion, 2018 - 2030)

- Upstream

- Mid-Stream

- Downstream

Oil and Gas Pipeline Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355