Report Overview

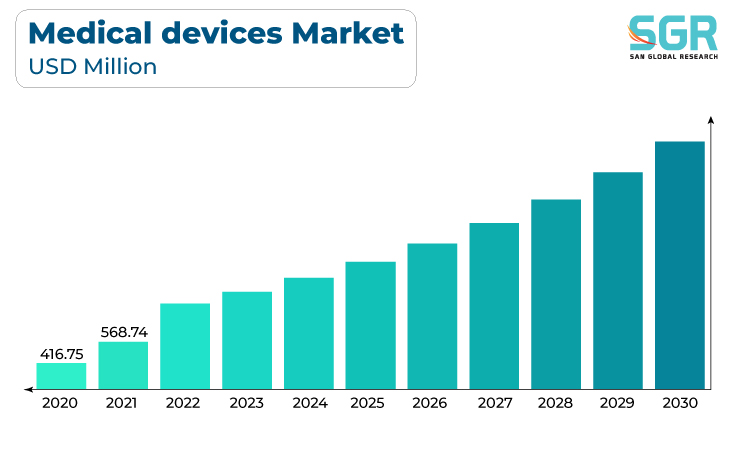

The Medical devices Market was valued at 601.78 billion in 2022 and expected to grow at CAGR of 8.01% over forecast period.

.jpg)

Medical technology advancements, such as innovations in diagnostic, therapeutic, and monitoring devices, are broadening healthcare providers' capabilities and improving patient outcomes. The rising prevalence of chronic diseases, an aging population, and a growing demand for personalized medicine drive the demand for advanced medical devices capable of providing accurate diagnosis, effective treatment, and continuous patient monitoring.

Furthermore, the emphasis on cost-effective healthcare solutions, as well as the desire to reduce hospitalization and recovery times, is driving the development of portable and home-based medical devices. Furthermore, regulatory changes, such as streamlined approvals and standards, are facilitating market growth and fostering innovation in the medical device industry, transforming it into a dynamic and evolving sector of healthcare.

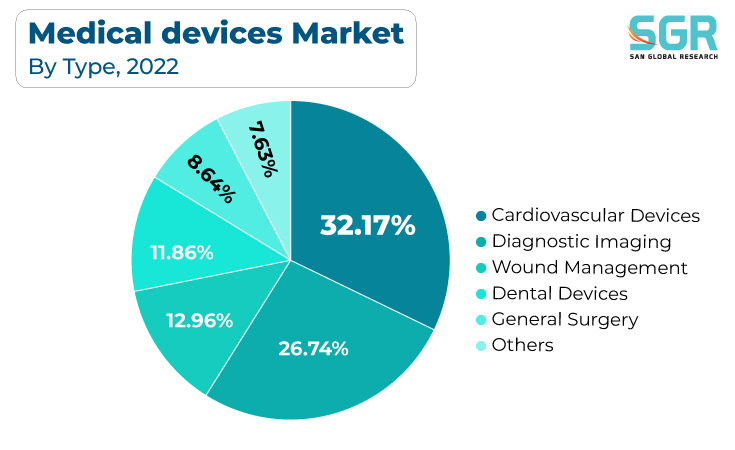

Type Outlook

Based on Type, the Medical devices Market is segmented into Orthopedic Devices, Cardiovascular Devices, Diagnostic Imaging, Wound Management, Dental Devices, General Surgery and Others. Orthopedic Devices segment accounted for largest share in 2022.

A rapidly aging global population, combined with an increase in the prevalence of musculoskeletal disorders, fractures, and orthopedic conditions, drives demand for orthopedic devices like joint replacements, spinal implants, and orthobiologics. Material, implant, and surgical technique advancements are improving the durability and efficacy of these devices, resulting in better patient outcomes and reduced pain. Because they result in shorter hospital stays and faster recovery times, minimally invasive surgical approaches are increasing the adoption of orthopedic devices.

General surgery is a critical component of healthcare, and the growing number of surgical procedures around the world drives up demand for specialized medical devices. The growing global population, combined with the prevalence of chronic diseases and the need for trauma and emergency surgery, highlights the significance of advanced surgical tools and equipment.

Application Outlook

Based on Application, the Medical devices Market is segmented into Hospitals, and others. Hospitals segment accounted for largest share in 2022. Hospitals are at the forefront of healthcare delivery, and their constant need to provide high-quality patient care, improve efficiency, and reduce costs fuels the demand for advanced medical devices and technology. To meet the needs of their growing patient population, hospitals must invest in a wide range of diagnostic, therapeutic, and monitoring devices. Furthermore, ongoing technological advancements, such as the incorporation of artificial intelligence and data analytics into medical devices, improve patient care, streamline workflows, and optimize resource allocation in hospitals.

Clinics play an important role in providing primary care, specialized services, and outpatient treatments, and as such, they require a diverse range of medical devices to diagnose and treat patients. The market is being influenced by rising demand for point-of-care testing devices, telemedicine solutions, and portable diagnostic equipment, which allow clinics to provide efficient and convenient healthcare services.

Regional Outlook

North America is emerged as leading market for Medical devices Market in 2022. The robust healthcare infrastructure in this region, combined with a well-established regulatory framework, promotes innovation and the rapid adoption of advanced medical technologies. The aging population, combined with the prevalence of chronic diseases, drives demand for medical devices such as diagnostic, therapeutic, and monitoring equipment. Furthermore, a strong emphasis on healthcare quality, patient safety, and personalized medicine increases the demand for cutting-edge devices that provide precise diagnostics and targeted treatments.

Asia Pacific accounted for second largest share in the market in 2022. Rapid economic growth, a growing middle class, and rising healthcare spending in the region are driving demand for advanced medical technologies in a variety of medical specialties. The increasing prevalence of chronic diseases, an aging population, and the need for improved healthcare access are driving the adoption of medical devices such as diagnostic, therapeutic, and monitoring equipment.

Medical Devices Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 601.78 Billion |

| Forecast in 2030 | USD 864.12 Billion |

| CAGR | CAGR of 6.2% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By Application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Koninklijke Philips N.V.; Medtronic; F. Hoffmann-La Roche Ltd; and Nox Medical; General Electric Company; OMRON Corporation; VYAIRE; Samsung |

Global Medical Devices Market, Report Segmentation

Medical Devices Market, By Type

- Orthopedic Devices

- Cardiovascular Devices

- Diagnostic Imaging

- Wound Management

- Dental Devices

- General Surgery

- Others

Medical Devices Market, By Application

- Hospitals

- Clinics

- Others

Medical Devices Market, Regional Outlook

- North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355