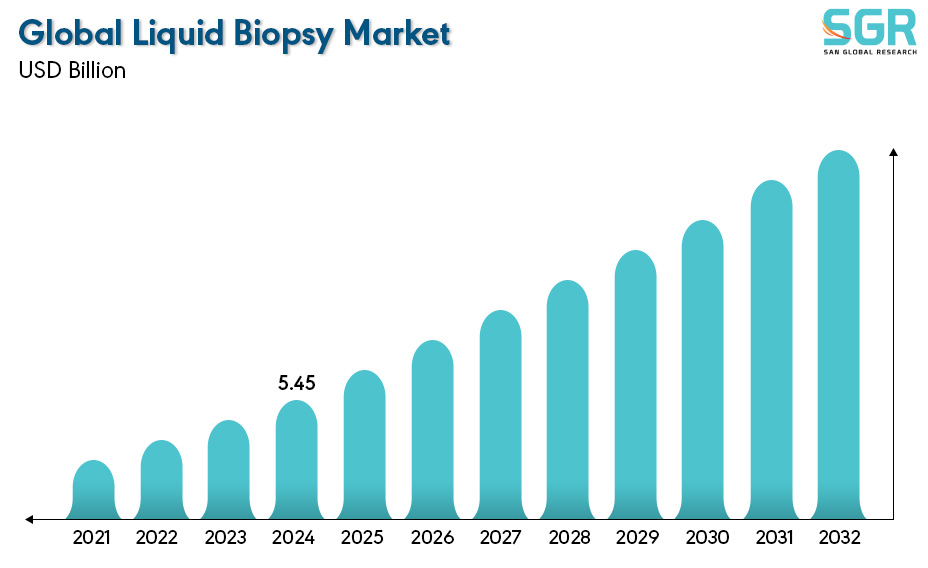

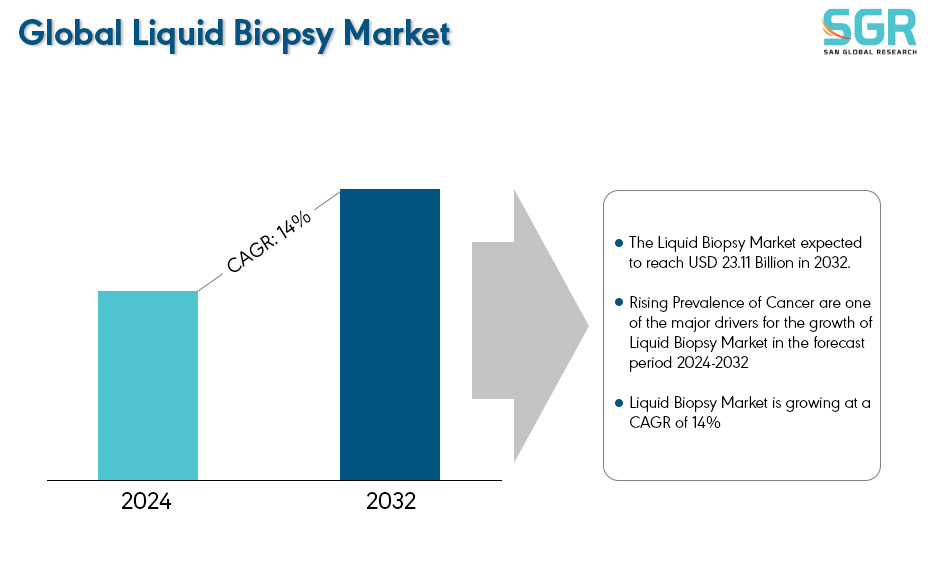

Liquid Biopsy Market is estimated to be worth USD 7.94 Billion in 2024 and is projected to grow at a CAGR of 14% between 2024 to 2032.

The study has considered the base year as 2023, which estimates the market size of the market, and the forecast period is 2024 to 2032. The report analyses and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it By Product and Services, By Biomarkers, By Application, By End User and by region/country.

Liquid biopsy technology, analysing molecules in liquid samples (primarily blood), has seen remarkable progress. This has not only enabled its use in everyday cancer care but also fuelled research into the very foundation of malignant growth.

These minimally invasive procedures offer a way to glean tumour information from bodily fluids, with blood being the most common source. Two key targets are circulating cell-free DNA (cfDNA) and circulating tumour DNA (ctDNA). CfDNA is freely floating DNA in the blood, potentially originating from tumours or healthy cells. ctDNA, on the other hand, is specifically derived from tumours. Additionally, circulating tumour cells (CTCs) can be isolated. These are shed by tumours into the bloodstream and typically only survive for 1-2.5 hours before being eliminated by the immune system. However, a small number can persist and establish distant metastases.

After reviewing the data shown below, it can be determined that the North American region dominates the Liquid Biopsy Market for the following reasons.

North America region is experiencing significant domination within the Liquid Biopsy market. For instance, according to the data published by the National Library of Medicine on January 2023, in 2023, projections estimated that the United States would experience roughly 1.96 million new cancer diagnoses and 609,820 deaths attributed to the disease. North America has a significant burden of cancer, with a high number of new cases diagnosed each year. This fuels the demand for effective diagnostic tools, and minimally invasive options like liquid biopsies become increasingly attractive.

Segmentations

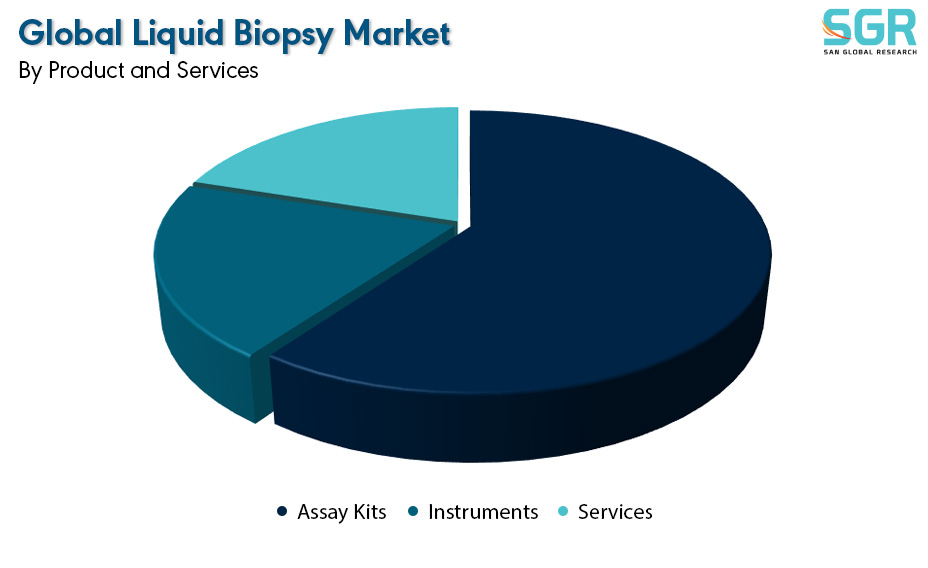

By Product and Services

Based on Product and Services, the Liquid Biopsy Market is bifurcated into Assay Kits, Instruments and Services– where Assay Kits segment is dominating and ahead in terms of share. Liquid biopsy assay kits play a vital role in detecting cancer by analysing tumour cells or DNA in bodily fluids. These minimally invasive and cost-effective kits offer significant advantages. They allow for continuous patient monitoring throughout and after treatment, as well as for cancer screening. The liquid biopsy assay kit market is further fuelled by the growing availability of diverse reagents and kits, easier access to a wider range of assays, and the alarming rise in cancer cases globally.

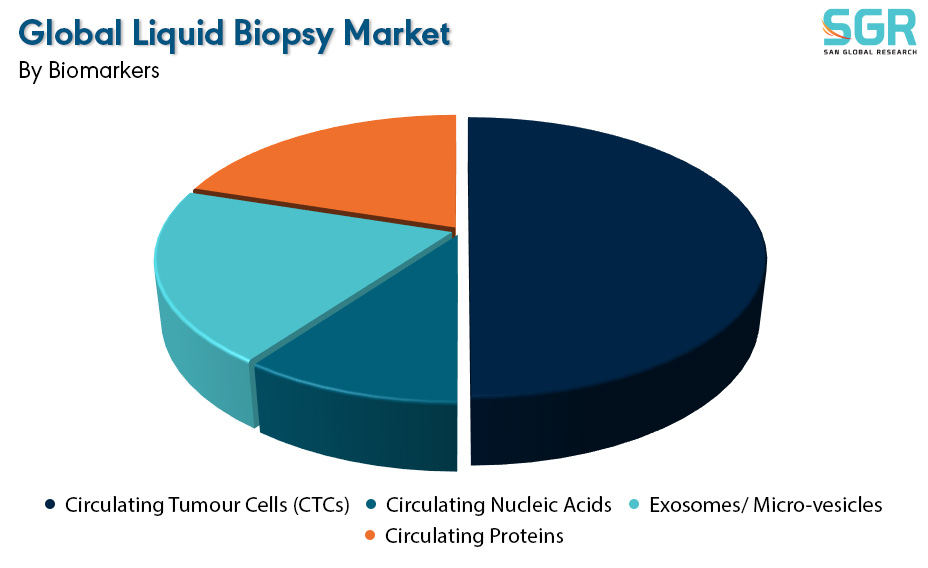

By Biomarkers

Based on Biomarkers, the Liquid Biopsy Market is bifurcated into Circulating Tumour Cells (CTCs), Circulating Nucleic Acids, Exosomes/ Micro-vesicles and Circulating Proteins– where Circulating Tumour Cells (CTCs) segment is dominating and ahead in terms of share.

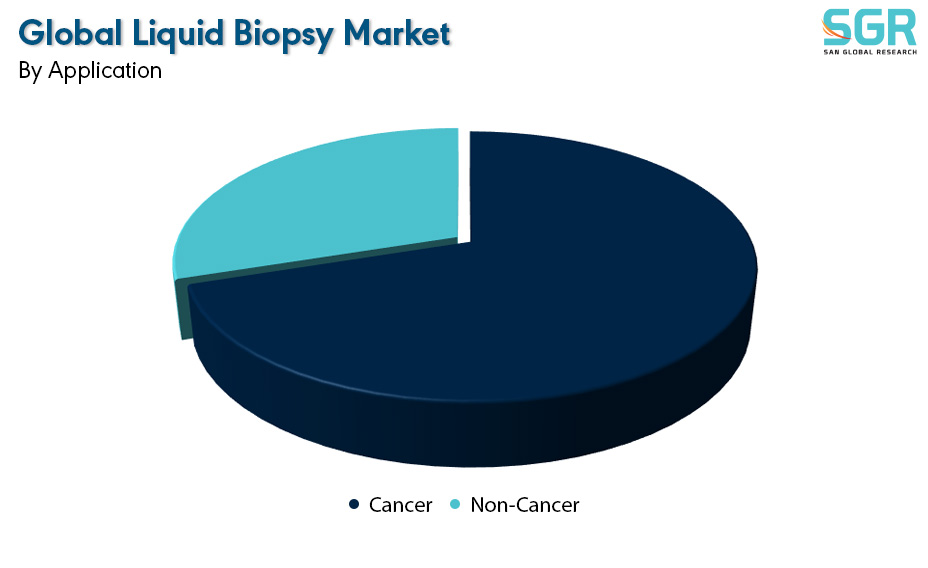

By Application

Based on Application, the Liquid Biopsy Market is bifurcated into Cancer and Non-Cancer– where Cancer segment is dominating and ahead in terms of share.

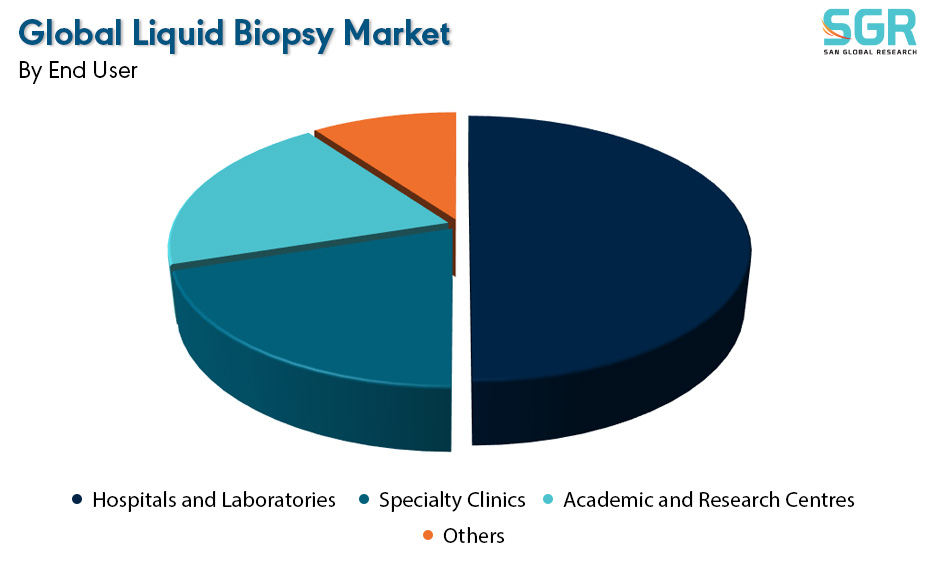

By End User

Based on End User, the Liquid Biopsy Market is bifurcated into Hospitals and Laboratories, Specialty Clinics, Academic and Research Centres and Others– where Hospitals and Laboratories segment is dominating and ahead in terms of share.

Key Players

• ANGLE plc

• Oncimmune Holdings PLC

• Guardant Health

• Myriad Genetics, Inc.

• Biocept, Inc.

Drivers

Rising Prevalence of Cancer

An aging population with accumulated cellular mutations is a major contributor to rising cancer rates. Modern lifestyles add to the risk with factors like smoking, unhealthy diets, and lack of exercise. Environmental toxins and improved detection methods also play a role. While early detection is positive, it inflates prevalence statistics. Additionally, specific cancers like colorectal cancer are seeing unexplained increases. For instance, globally an alarming 20 million new cancer diagnoses were estimated in 2022, tragically leading to 9.7 million deaths. Lung and breast cancer emerged as the most prevalent types. As the global cancer burden grows, minimally invasive liquid biopsies become more crucial for effective diagnosis and management.

Opportunity

Technological Advancements

Fuelled by continuous innovation, technologies like next-generation sequencing (NGS) and digital PCR are driving the development of increasingly sensitive and specific liquid biopsy assays. This translates to more accurate and reliable liquid biopsy tests, significantly enhancing their value in clinical applications. Beyond established biomarkers like ctDNA, CTCs, and exosomes, research on tumour-educated platelets (TEPs) is pushing the boundaries of liquid biopsy technology. TEPs hold immense promise for revolutionizing cancer diagnosis, screening, and therapy monitoring through minimally invasive liquid biopsies.

| Report Attribute | Details |

| Market Value in 2024 | 7.94 Billion |

| Forecast in 2032 | 23.11 Billion |

| CAGR | CAGR of 14% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2024 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, Competitive Landscape, Growth Factors, and Trends |

| Segments Scope | By Product and Services, By Biomarkers, By Application, By End User |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • ANGLE plc • Oncimmune Holdings PLC • Guardant Health • Myriad Genetics, Inc. • Biocept, Inc. |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355