Report Overview

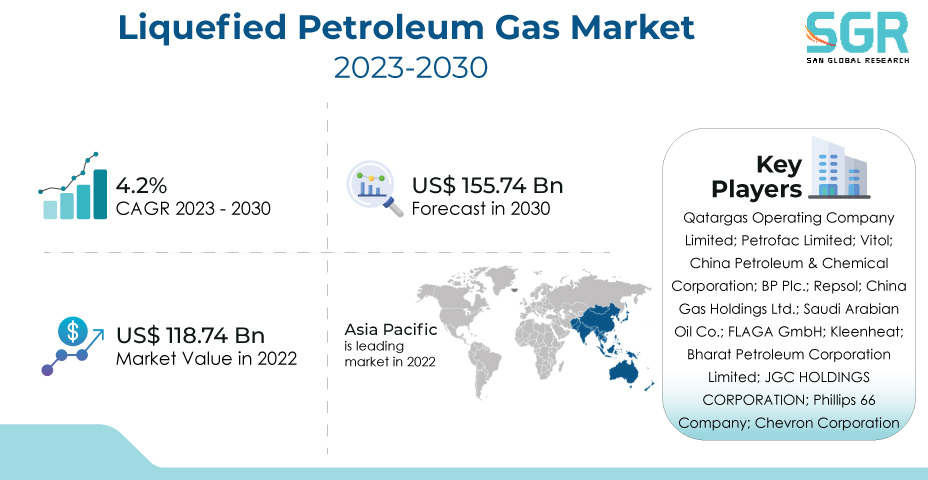

The Liquefied Petroleum Gas Market was valued at 118.74 Billion in 2022 and expected to grow at CAGR of 4.2% over forecast period.

The global shift toward cleaner-burning fuels and energy sources is a significant driver in the Liquefied Petroleum Gas (LPG) market. LPG, which is made up of propane and butane, emits fewer greenhouse gases and emits fewer pollutants into the atmosphere than traditional fossil fuels such as coal and oil. This cleaner profile, combined with its versatility and broad range of applications in the residential, commercial, industrial, and automotive sectors, has increased LPG adoption for heating, cooking, transportation, and industrial processes.

As governments and industries around the world prioritize emissions reduction and energy diversification, demand for LPG as an accessible and efficient energy solution grows, propelling market expansion and prompting investment in LPG infrastructure and distribution networks.

Source Outlook

Based on Source, the Liquefied Petroleum Gas Market is segmented Associated Gas. Associated Gas segment accounted for largest share in 2022. Associated gas, which is frequently released as a byproduct of crude oil production, contains propane and butane, which can be processed into LPG. The growing emphasis on reducing flaring and maximizing the value of extracted resources has resulted in the development of technologies and infrastructure for capturing, processing, and converting associated gas into LPG, transforming it into a valuable energy source.

This contributes to overall LPG supply, which is in line with the growing demand for cleaner-burning fuels and versatile energy solutions in the residential, commercial, industrial, and automotive sectors, driving the associated gas-derived LPG market.

Application Outlook

Based on Application, Liquefied Petroleum Gas Market is segmented into Chemical, Industrial, Autogas. Chemical accounted for largest share in 2022. LPG is a valuable raw material for the production of ethylene and propylene, which are essential building blocks for a wide range of petrochemical products such as plastics, synthetic rubber, solvents, and fibers. The growing global demand for these petrochemical derivatives, driven by industries such as packaging, automotive, construction, and consumer goods, exacerbates the need for a reliable and accessible supply of LPG. As industries look to diversify their feedstock sources and optimize production processes, LPG stands out as a versatile and efficient option, propelling the chemical LPG market and influencing investment in LPG extraction, transportation, and processing infrastructure.

LPG's versatility, low emissions profile, and ease of use make it a preferred choice for a range of industrial processes such as heating, cogeneration, and as a fuel source for forklifts and industrial vehicles. Industries across manufacturing, agriculture, construction, and hospitality sectors are increasingly adopting LPG as a reliable energy source that helps reduce both operational costs and greenhouse gas emissions.

Regional Outlook

Asia Pacific is emerged as leading market for Liquefied Petroleum Gas Market in 2022. The Asia Pacific industrial liquefied petroleum gas (LPG) market is being driven by the region's rapid industrialization and economic growth, which is increasing demand for energy sources to power industrial processes. As industries such as manufacturing, construction, and agriculture expand, the need for efficient and versatile energy solutions becomes critical. LPG, which is known for its clean combustion characteristics and wide range of industrial applications such as heating, forklift operations, and industrial vehicles, fits in well with the growing emphasis on environmental sustainability and emission reduction.

Europe is expected to be the second-most prominent area in terms of Liquefied Petroleum Gas Market share. As European industries strive to comply with strict environmental regulations and reduce carbon emissions, LPG emerges as a viable option due to its lower emissions profile and versatility. Manufacturing, agriculture, hospitality, and construction industries are increasingly using LPG for applications such as heating, cogeneration, and as a fuel for industrial vehicles, driven by both economic and environmental concerns. The well-established LPG infrastructure, combined with government incentives to promote cleaner fuels, has accelerated LPG adoption in industrial settings throughout Europe, fostering market growth and encouraging investments in LPG infrastructure and technologies.

Liquefied Petroleum Gas Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 118.74 Billion |

| Forecast in 2030 | USD 155.74 Billion |

| CAGR | CAGR of 4.2% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Source, By Application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Qatargas Operating Company Limited; Petrofac Limited; Vitol; China Petroleum & Chemical Corporation; BP Plc.; Repsol; China Gas Holdings Ltd.; Saudi Arabian Oil Co.; FLAGA GmbH; Kleenheat; Bharat Petroleum Corporation Limited; JGC HOLDINGS CORPORATION; Phillips 66 Company; Chevron Corporation |

Global Liquefied Petroleum Gas Market, Report Segmentation

Liquefied Petroleum Gas Market, By Source

- Chemical

- Industrial

- Autogas

Liquefied Petroleum Gas Market, By Application

- Ethyl Alcohol

- Hydrogen

- Ethylene Oxide

Liquefied Petroleum Gas Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355