Report Overview

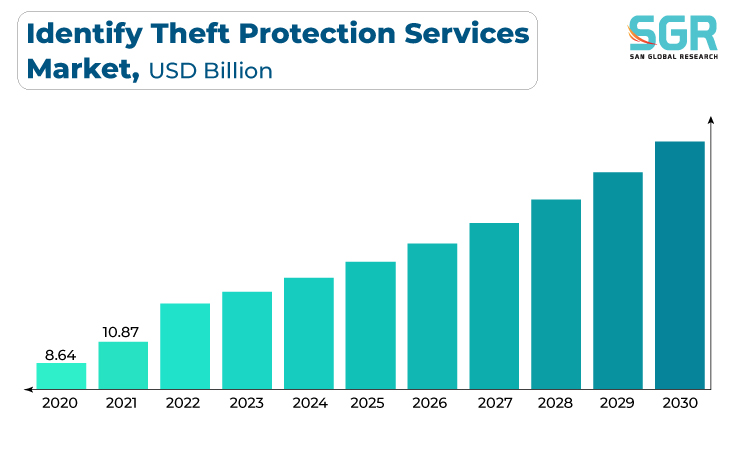

The Identity Theft Protection Services was valued at 4.12 billion in 2022 and expected to grow at CAGR of 5.6% over forecast period.

The growing prevalence of cybercrime and data breaches, rising consumer awareness of the risks associated with identity Identity Theft , and the growing reliance on digital platforms for personal and financial transactions are driving the Identity Identity Theft Protection Services market. As the risk of identity Identity Theft increases for individuals and businesses, there is a greater demand for comprehensive protection services that can safeguard personal information, monitor for suspicious activity, and provide timely alerts and assistance in the event of a breach.

Evolving data security and privacy regulations and compliance requirements, such as GDPR and CCPA, are compelling organizations to invest in identity Identity Theft protection solutions in order to meet legal obligations and maintain customer trust. The ongoing digitization of financial and personal information contributes to the growth of this market by emphasizing the need for robust identity Theft prevention and resolution services.

Type Outlook

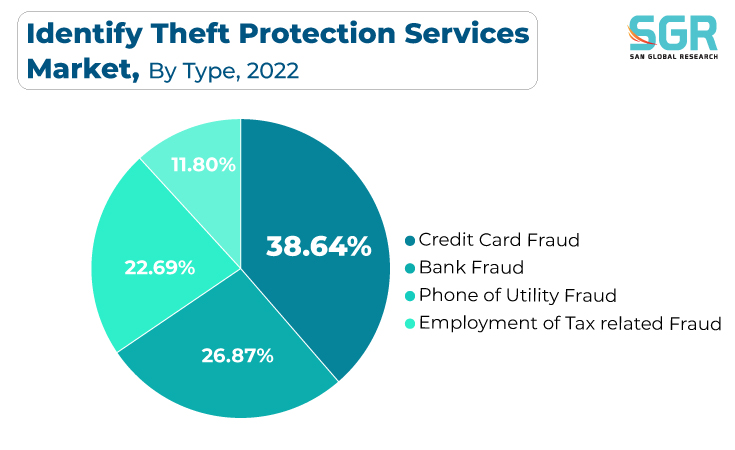

Based on Type, the Identity Theft Protection Services is segmented Credit Card Fraud, Bank Fraud, Phone or Utility Fraud, and Employment or Tax-related Fraud. Credit Card Fraud segment accounted for largest share in 2022. The growing prevalence of credit card fraud and identity Theft cases, fueled by the increasing digitization of financial transactions and personal information, is driving individuals and businesses to seek robust security solutions. Second, stringent regulatory requirements and compliance mandates, such as GDPR and PCI DSS, force organizations to invest in advanced fraud prevention and detection services in order to avoid hefty fines and reputational damage.

Key factors drive the Phone and Utility Fraud Identity Theft Protection Services market. For starters, the growing prevalence of identity Theft and fraud involving phone and utility accounts is compelling individuals and businesses to seek comprehensive protection services. The digitization of billing and account management processes in the telecommunications and utilities sectors has introduced new risks that must be addressed. Regulatory mandates and requirements, such as GDPR and industry-specific regulations, are compelling service providers to invest in robust fraud prevention and detection measures to protect customers.

Application Outlook

Based on Application, the Identity Theft Protection Services is segmented Consumer and Enterprise. High-profile data breaches and the increasing sophistication of cybercriminals have increased consumer awareness of the importance of protecting their personal information. This increased concern, combined with an increasing number of regulations and compliance standards, such as GDPR and CCPA, is compelling individuals and businesses to invest in strong identity Theft protection solutions. Furthermore, the rapid adoption of online and mobile financial transactions, e-commerce, and digital banking has increased the attack surface for cybercriminals, necessitating the implementation of comprehensive identity protection services that provide real-time monitoring and proactive threat mitigation. Furthermore, the COVID-19 pandemic has accelerated the digital transformation, emphasizing the importance of trustworthy identity Theft protection services in an increasingly interconnected world.

Several key factors drive the Enterprise Identity Theft Protection Services market. To begin with, the increasing frequency and sophistication of cyberattacks, such as data breaches and identity Theft attempts, has made it critical for businesses to invest in comprehensive identity protection solutions to protect sensitive corporate data and customer information. Second, an increasingly complex regulatory landscape, including stringent data protection regulations such as GDPR and evolving industry-specific compliance standards, is compelling enterprises to implement robust identity Theft protection services in order to ensure compliance and avoid costly fines.

Regional Outlook

North America is emerged as leading market for Identity Theft Protection Services in 2022. Region's significant digital economy and widespread use of online services, the region's high incidence of data breaches and identity Theft cases has raised individual and business awareness of the need for robust identity protection solutions. Second, evolving data protection regulations such as the CCPA, as well as the continued enforcement of GDPR for companies doing business with European customers, have made it critical for organizations to invest in comprehensive identity Theft protection services to ensure compliance and mitigate legal and financial risks.

The increasing frequency of cyber-attacks and data breaches across the region, which frequently target both individuals and businesses, has raised awareness about the need for strong identity Theft protection services. Second, the implementation and enforcement of stringent data protection regulations, such as GDPR, have compelled organizations to invest in comprehensive identity protection solutions in order to ensure compliance and safeguard European citizens' personal data. Furthermore, the rapid digitization of financial services, e-commerce, and government interactions has increased the attack surface for cybercriminals, necessitating the implementation of advanced identity Theft protection measures to mitigate risks.

Identity Theft Protection Services Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 4.12 Billion |

| Forecast in 2030 | USD 5.69 Billion |

| CAGR | CAGR of 5.6% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Product, By Application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Trans-Chemco, Inc.; Kemira Oyj; Air Products and Chemicals, Inc.; Bluestar Silicones International; Evonik Industries AG; BASF SE; KCC Basildon; Clariant AG |

Global Identity Theft Protection Services Market, Report Segmentation

Identity Theft Protection Services Market, By Component

- Credit Card Fraud

- Bank Fraud

- Phone or Utility Fraud

- Employment or Tax-related Fraud

Identity Theft Protection Services Market, By Application

- Consumer

- Enterprise

Identity Theft Protection Services Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355