Report Overview

The Hydrogen Generation Market was valued at 150.76 Billion in 2022 and expected to grow at CAGR of 9.6% over forecast period.

Rapid global efforts to reduce carbon emissions and combat climate change are propelling the adoption of hydrogen generation technologies as a versatile, low-emission energy carrier. The need for decarbonization in industries such as transportation, manufacturing, and power generation is driving interest in green hydrogen production from renewable sources. Technological advances and research investments improve the efficiency of hydrogen generation methods like electrolysis and natural gas reforming, making them more economically viable.

Government policies, incentives, and international agreements that promote hydrogen as a clean energy solution help to accelerate market growth. Collaborations among energy companies, governments, and research institutions drive innovation by refining hydrogen generation technologies and infrastructure in order to meet the growing global demand for sustainable energy solutions.

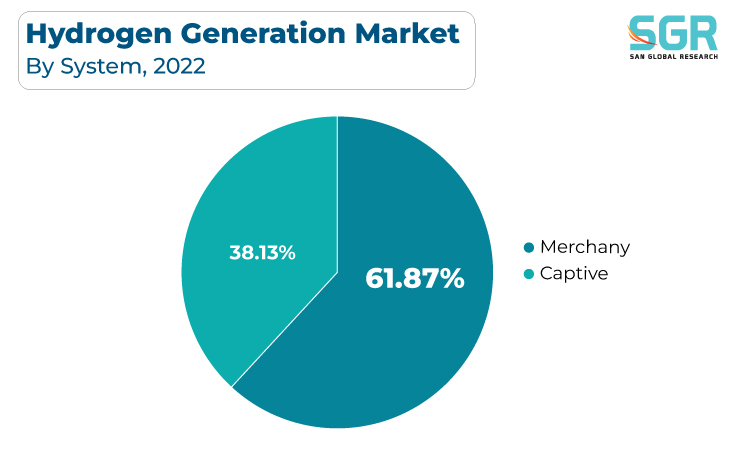

System Outlook

Based on System, the Hydrogen Generation Market is segmented into Merchant and Captive. Merchant segment accounted for largest share in 2022. Hydrogen is emerging as a critical component in decarbonizing sectors such as transportation, manufacturing, and energy production as industries seek cleaner alternatives. The growing demand for merchant hydrogen generation solutions is being driven by the rise of green hydrogen production using renewable sources. Technological advancements and economies of scale improve the efficiency and cost-effectiveness of hydrogen production methods, promoting merchant hydrogen generation's commercial viability.

The adoption of captive hydrogen generation systems is driven by the need for reliable and independent hydrogen sources for a variety of applications such as refining, chemicals, and power generation. By producing hydrogen on-site, industries seek to improve operational efficiency, reduce emissions, and ensure a secure hydrogen supply. Advances in technology in steam methane reforming, electrolysis, and other hydrogen generation methods improve system efficiency and cost-effectiveness, making captive hydrogen generation a viable option.

Technology Outlook

Based on End-Use, Hydrogen Generation Market is segmented into Steam Methane Reforming, Coal Gasification. Steam Methane Reforming accounted for largest share in 2022. In the Hydrogen Generation market, steam methane reforming (SMR) is driven by a dynamic nexus of factors that highlight its pivotal role in producing hydrogen as a versatile energy carrier. Natural gas's abundant availability and low cost make SMR a dominant method for hydrogen production, meeting rising demand from industries seeking cleaner alternatives.

The abundance of coal reserves, combined with the possibility of cleaner energy conversion, fuels interest in coal gasification for hydrogen production. Technological advancements improve the efficiency of coal gasification processes, making them more economically and environmentally viable.

Source Outlook

Based on Establishments, Hydrogen Generation Market is segmented into Natural Gas, Coal, Biomass and Water. Natural Gas accounted for largest in 2022. The natural gas Hydrogen Generation market is being driven by a dynamic confluence of factors that highlight its importance in supplying hydrogen as a versatile and cleaner energy source. Natural gas's widespread availability and lower cost make it an appealing feedstock for hydrogen production, meeting the demands of industries seeking to reduce carbon emissions.

A dynamic interplay of influential factors drives water-based hydrogen generation, emphasizing its critical role in providing a sustainable and clean energy carrier. The main method for producing hydrogen is water electrolysis, which splits water molecules into hydrogen and oxygen using renewable electricity. The need to reduce greenhouse gas emissions and transition to carbon-neutral energy solutions drives the adoption of water-based hydrogen generation, which produces hydrogen without emitting any emissions when powered by renewable sources.

Regional Outlook

Asia Pacific is emerged as leading market for Hydrogen Generation Market in 2022. Rapid economic growth, combined with the need to address air quality and emissions issues, drives demand for hydrogen as a cleaner energy carrier and feedstock. The region's abundant renewable energy resources, as well as the region's growing emphasis on sustainability, are driving interest in green hydrogen production via electrolysis. Government pledges to reduce carbon emissions, combined with supportive policies and investments, hasten the adoption of hydrogen generation technologies. The push to decarbonize industries such as transportation and manufacturing drives up demand for hydrogen even more. Collaborations between energy companies, governments, and technology innovators foster innovation, improving hydrogen generation methods and infrastructure to meet the Asia Pacific region's diverse energy and industrial needs, positioning hydrogen as a key driver of sustainable economic growth and energy transformation.

Hydrogen Generation Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 150.76 Billion |

| Forecast in 2030 | USD 341.82 Million |

| CAGR | CAGR of 9.6% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By System, By Technology and By Source |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Taiyo Nippon Sanso Corporation; Teledyne Technologies Incorporated; Hygear; Claind; Advanced Specialty Gases Inc.; Linde Plc; Messer; Air Products and Chemicals, Inc; Air Liquide International S.A; INOX Air Products Ltd.; Matheson Tri-Gas, Inc.; SOL Group; Iwatani Corporation; |

Global Hydrogen Generation Market, Report Segmentation

Hydrogen Generation Market, By System

- Merchant

- Captive

Hydrogen Generation Market, By Technology

- Steam Methane Reforming

- Coal Gasification

Hydrogen Generation Market, By Source

- Natural gas

- Coal

- Biomass

- Water

Hydrogen Generation Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355