Report Overview

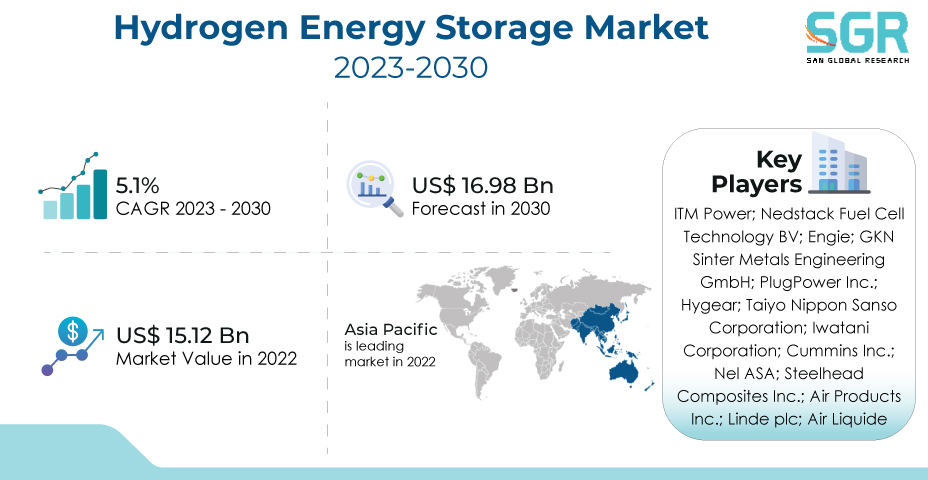

The Hydrogen Energy Storage Market was valued at 15.12 Billion in 2022 and expected to grow at CAGR of 5.1% over forecast period.

A dynamic interplay of factors drives the Hydrogen Energy Storage market, emphasizing its critical role in enabling renewable energy integration, grid stabilization, and sustainable energy solutions. Demand for hydrogen storage as a versatile energy carrier is being driven by the global shift toward decarbonization and the need to address energy intermittency. Hydrogen production, storage, and utilization technologies have advanced, increasing its appeal for energy storage applications. Government incentives, policies encouraging the use of renewable energy, and emissions reduction targets all help to accelerate market growth by encouraging the development of hydrogen-based energy storage systems. The need to improve grid resilience, store excess renewable energy, and provide clean fuel for a variety of industries drives the adoption of hydrogen energy storage solutions.

The imperative to enhance grid resilience, store excess renewable energy, and provide clean fuel for various sectors fuels the adoption of hydrogen energy storage solutions. Collaborations between energy companies, research institutions, and regulatory bodies stimulate innovation, refining hydrogen storage technologies, optimizing efficiency, and contributing to a more sustainable and reliable energy future through the integration of hydrogen as a key component of the global energy transition.

Technology Outlook

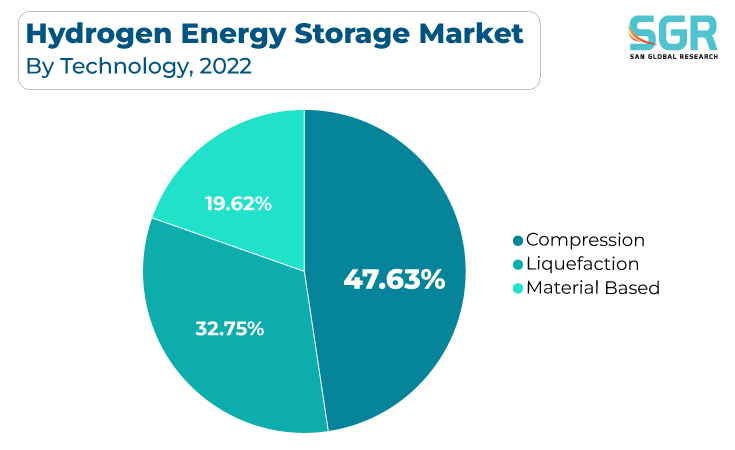

Based on Technology, the Hydrogen Energy Storage Market is segmented into Compression, Liquefaction, and Material Based. Compression segment accounted for largest share in 2022. Compression technology adoption in the Hydrogen Energy Storage market is being driven by a dynamic interplay of factors that highlight its critical role in enabling efficient, scalable, and reliable hydrogen storage solutions. The intermittent nature of renewables necessitates energy storage technologies such as hydrogen as the global energy landscape shifts toward renewable sources. Compression technology is critical in converting hydrogen gas into a denser form for storage, increasing its practicality and allowing it to be used in a variety of applications.

Higher compression ratios and improved efficiency, as well as technological advancements in compression techniques, increase the appeal of this storage method. The need to address energy intermittency, support grid stability, and provide a clean fuel source for industries such as transportation and industry is driving the adoption of compression-based hydrogen storage solutions. Collaborations among energy companies, technology developers, and regulatory bodies foster innovation by refining compression technology for hydrogen storage, optimizing its efficiency, and contributing to a more sustainable energy future through the integration of efficient and versatile hydrogen storage solutions.

Physical State Outlook

Based on Physical State, Hydrogen Energy Storage Market is segmented into Solid, Liquid, Gas. Solid accounted for largest share in 2022. A dynamic convergence of factors is driving the solid-state hydrogen energy storage market, emphasizing its critical role in advancing energy storage capabilities, improving safety, and promoting sustainable hydrogen utilization. Solid-state storage has the potential to store hydrogen in a compact, stable, and transportable form, overcoming the limitations of gaseous or liquid storage. Solid-state material advancements, such as metal hydrides and chemical compounds, improve hydrogen storage density and enable safe storage and release.

Liquid hydrogen has a high energy density and is easily transportable, it is an appealing option for applications such as fueling stations and industrial processes. Liquid-state storage is becoming more practical and safe as technology advances in liquefaction and storage techniques. The push for decarbonization, support for renewable energy integration, and the need to address energy insecurity all contribute to the rapid adoption of liquid hydrogen storage solutions.

Application Outlook

Based on Application, Hydrogen Energy Storage Market is segmented into Residential, Commercial and Industrial. Industrial accounted for largest share in 2022. Hydrogen storage, with its capacity for large-scale and long-term storage, provides a solution to industrial energy needs. Hydrogen storage and conversion technologies are improving their applicability for industrial processes such as hydrogen-based heating, power generation, and chemical synthesis. The need to improve energy efficiency, reduce carbon emissions, and comply with environmental regulations has accelerated the adoption of industrial hydrogen storage solutions.

Businesses are looking for cost-effective energy storage solutions to help manage peak demand, reduce electricity costs, and promote clean energy integration. Hydrogen storage has the potential to be scalable and flexible, aligning with commercial energy needs. Hydrogen storage and fuel cell advancements increase the appeal of hydrogen-based energy solutions for commercial applications such as backup power, microgrids, and load leveling.

Regional Outlook

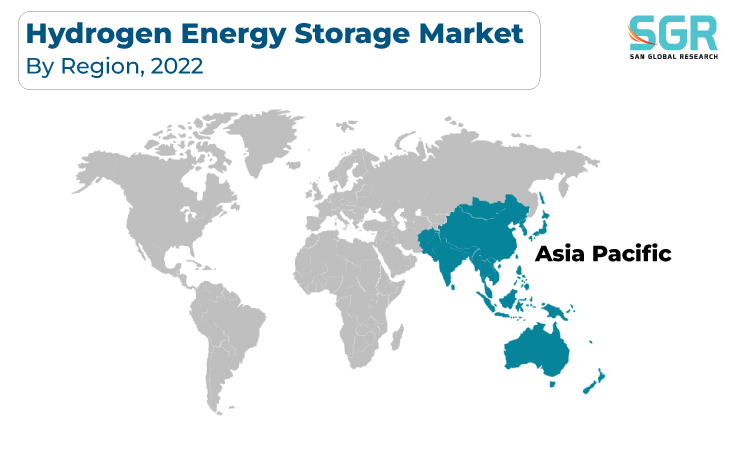

Asia Pacific is emerged as leading market for Hydrogen Energy Storage Market in 2022. Rapid economic growth, urbanization, and rising energy demand necessitate the development of effective energy storage solutions to support evolving power grids and industries. Government policies that encourage the use of clean energy, combined with a focus on lowering carbon emissions, accelerate market growth by promoting hydrogen's role in the energy transition. Advances in hydrogen storage and utilization technologies are consistent with the region's commitment to innovation and sustainability.

Europe is expected to be the second-most prominent area in terms of Hydrogen Energy Storage Market share. Stringent emissions targets, combined with a strong commitment to renewable energy, are driving the adoption of hydrogen as an energy carrier and storage solution. Government incentives, green hydrogen production policies, and sector coupling all help to accelerate market growth by promoting hydrogen's integration across industries. Hydrogen production, storage, and utilization technological advancements are in line with Europe's drive for innovation and sustainability.

Hydrogen Energy Storage Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 15.12 Billion |

| Forecast in 2030 | USD 16.98 Billion |

| CAGR | CAGR of 5.1% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Technology, By Physical state, By Application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | ITM Power; Nedstack Fuel Cell Technology BV; Engie; GKN Sinter Metals Engineering GmbH; PlugPower Inc.; Hygear; Taiyo Nippon Sanso Corporation; Iwatani Corporation; Cummins Inc.; Nel ASA; Steelhead Composites Inc.; Air Products Inc.; Linde plc; Air Liquide |

Global Hydrogen Energy Storage Market, Report Segmentation

Hydrogen Energy Storage Market, By Technology

- Compression

- Liquefaction

- Material Based

Hydrogen Energy Storage Market, By Physical State

- Solid

- Liquid

- Gas

Hydrogen Energy Storage Market, By Application

- Residential

- Commercial

- Industrial

Hydrogen Energy Storage Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355