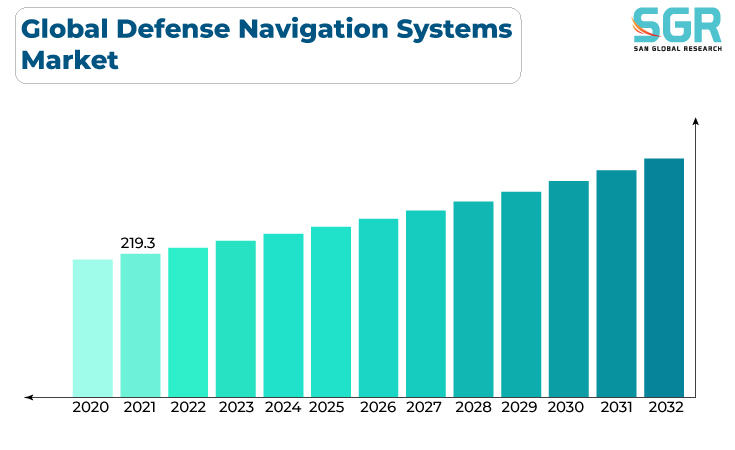

Global Defense Navigation Systems market is estimated to be worth USD 219.3 Billion in 2022 and is projected to grow at a CAGR of 15.6% between 2021 to 2032. The study has considered the base year as 2022, which estimates the market size of market and the forecast period is 2021 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Million), for the market. The report segments the market and forecasts it by type, by application, and region/country.

The global defense navigation systems market is a substantial segment of the broader defense industry. It encompasses a wide range of navigation technologies, including GPS, inertial navigation systems, radar, and other equipment. The market size and growth are influenced by defense budgets, technological advancements, and evolving security threats. Defense navigation systems are often exported to allied and friendly nations, contributing to the global market's dynamics. Export regulations and international agreements play a significant role in this. Investment in research and development is key to identifying emerging opportunities in navigation system technology and maintaining a competitive edge. The defense industry is increasingly focused on reducing the environmental impact of navigation equipment, including the development of energy-efficient and eco-friendly systems.

Region wise Comparison:

North America, particularly the United States, plays a significant role in the global defense navigation systems market. The U.S. is a major producer and exporter of navigation systems, including GPS technology, inertial navigation systems, and avionics. Several defense contractors, such as Lockheed Martin, Northrop Grumman, and Raytheon, are key players in the region.

Europe, as a whole, has a strong presence in the global defense navigation systems market. Leading European countries, including the United Kingdom, France, Germany, and Italy, have developed and supplied navigation systems for military applications. European defense contractors and technology companies are key players in this market.

Asia-Pacific is an emerging player in the global defense navigation systems market. Countries like China, India, South Korea, and Japan are investing in the development and production of navigation systems for military and aerospace applications. China, in particular, has made significant advancements in navigation technology.

The Middle East, especially the Gulf nations, has seen increased investments in defense navigation systems to bolster their military capabilities. The defense industry in this region is primarily driven by geopolitical concerns and regional conflicts.

Latin America has a smaller share of the global defense navigation systems market compared to other regions. However, countries like Brazil have their defense industries and contribute to navigation system production for their own military needs.

Oceania, represented by Australia and New Zealand, maintains relatively small defense industries compared to larger continents. They often procure navigation systems from allied nations and participate in international defense projects.

Segmentation:

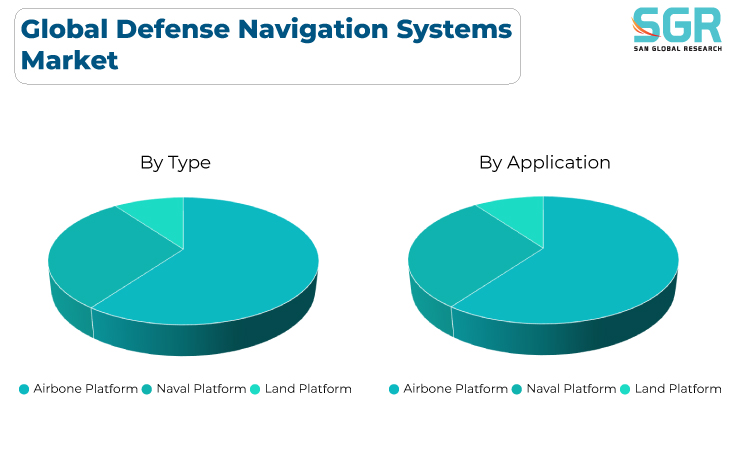

The Defense Navigation Systems market is segmented by type, by application, and region/country.

Based on the Type

- Marine Grade

- Navigation Grade

- Tactical Grade

Based on Application

- Airborne Platform

- Naval Platform

- Land Platform

On the basis of region

- North America

- Europe

- Asia Pacific

- South America and

- Middle East and Africa

In 2022, North America is anticipated to dominate the Defense Navigation Systems market with market revenue of XX USD Million with a registered CAGR of XX%.

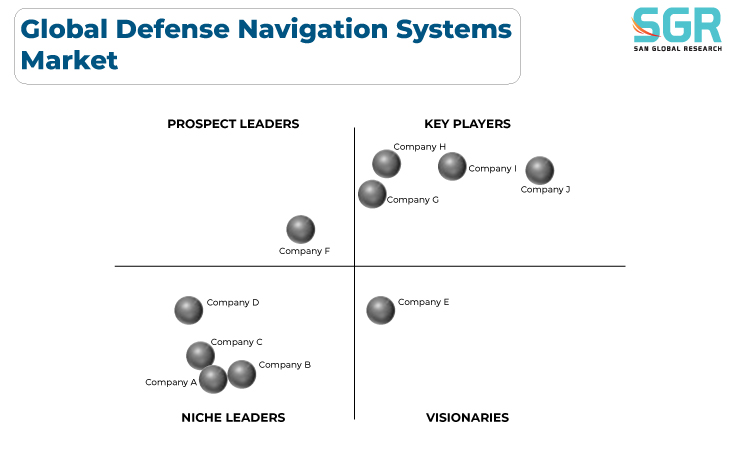

Key Players:

The key market players operating in the Defense Navigation Systems market include

- Northrop Grumman Corporation

- Honeywell Aerospace

- L3Harris

- Safran

- Thales Group

- Trimble Navigation

- LORD MicroStrain

- VectorNav Technologies

- EMCORE Corporation

- Collins Aerospace

- Advanced Navigation

Drivers:

Growing defense programs across global

The global defense navigation systems market is driven by various factors that influence the demand for advanced navigation technologies and equipment used in military and defense applications. Ongoing regional and international conflicts, as well as rising geopolitical tensions, drive the demand for advanced defense navigation systems as nations seek to enhance their military capabilities and situational awareness. Many countries are engaged in military modernization efforts, which include upgrading their navigation systems to meet evolving security needs and maintain a competitive edge in defense operations. The increasing reliance on GNSS, including GPS and other global navigation systems, drives the demand for more accurate, resilient, and secure navigation solutions for military applications.

Opportunity:

Technology Advancements

The global defense navigation systems market presents various opportunities for businesses, defense contractors, and technology providers. These opportunities arise from the growing demand for advanced navigation technologies and equipment in the defense sector. Opportunities exist for companies that can develop and provide innovative navigation technologies, such as more accurate and robust Global Navigation Satellite Systems (GNSS), advanced inertial navigation systems (INS), and integrated navigation solutions. The development and supply of navigation systems for autonomous military systems, including unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and autonomous underwater vehicles (AUVs), are emerging opportunities.

Description

Description

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355