Report Overview

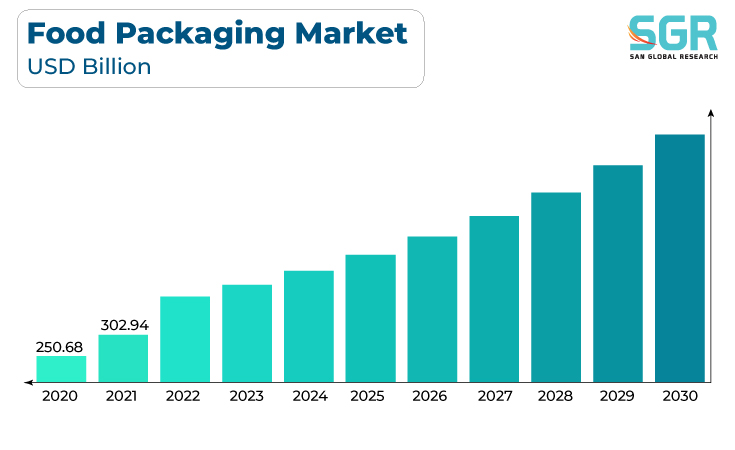

The Food Packaging Market was valued at 378.69 billion in 2022 and expected to grow at CAGR of 6.12% over forecast period. Changing demographics, such as an increase in single-person households and on-the-go consumption patterns, are driving increased demand for convenient and portion-controlled packaging solutions. Furthermore, as consumers seek more environmentally friendly and recyclable packaging options, innovation in sustainable packaging materials is increasing.

Stringent food safety regulations and the need for extended shelf-life preservation further drive innovation in packaging technologies like modified atmosphere packaging and intelligent packaging solutions. Consequently, the Food Packaging Market is characterized by dynamic growth and innovation in response to these multifaceted drivers.

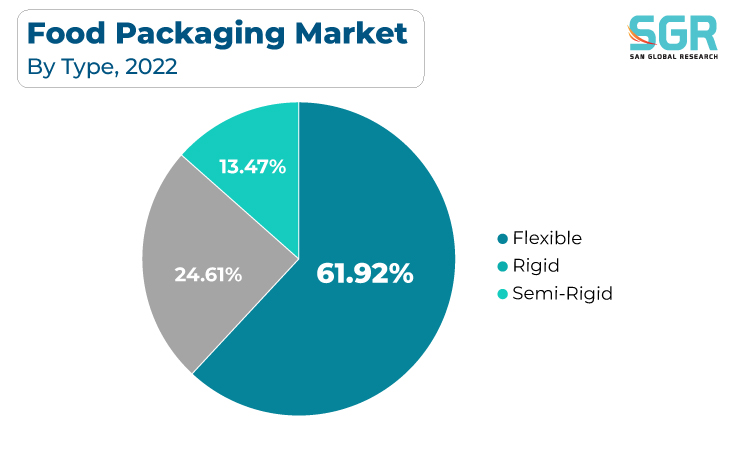

Type Outlook

Based on Type, the Food Packaging Market is segmented Rigid, Semi-rigid, and Flexible. Flexible segment accounted for largest share in 2022. Several key factors are driving the Flexible Food Packaging Market, including changing consumer preferences and lifestyles that favor convenience, on-the-go consumption, and portion control. Environmental concerns, as well as a growing demand for sustainable packaging solutions, are driving manufacturers to invest in eco-friendly materials and technologies, such as recyclable and biodegradable packaging options.

The Rigid Food Packaging Market is primarily driven by several key factors, including changing consumer preferences for premium and visually appealing packaging, which improves product visibility and branding. Manufacturers are investing in durable and protective rigid packaging solutions as consumer awareness of food safety and quality assurance grows, fueled by stringent regulations. Concerns about sustainability are also influencing the market, with an increase in demand for recyclable, reusable, or biodegradable materials in rigid packaging options.

Material Outlook

Based on Material, Food Packaging Market is segmented into Paper, Plastic. Plastic accounted for largest share in 2022. The cost-effectiveness, adaptability, and light weight of plastic food packaging are some of the main factors driving the market, making it a desirable option for manufacturers looking for effective packaging solutions. Plastic packaging also has excellent barrier properties, which help to keep food fresh and extend shelf life. Furthermore, the convenience factor corresponds to changing consumer lifestyles, emphasizing on-the-go consumption and portion control. While sustainability concerns are a challenge, advances in recyclable and biodegradable plastics, as well as regulatory measures to reduce single-use plastics, are shaping the market toward more environmentally friendly options. Despite ongoing sustainability concerns, the ever-expanding global food industry and rising demand for pre-packaged and processed foods drive the growth of plastic food packaging.

Consumer preferences are shifting towards more sustainable choices, driving demand for paper-based packaging due to its biodegradability, recyclability, and renewable nature. Stringent regulations and initiatives to reduce single-use plastics also contribute to this shift. Furthermore, innovations in paper-based packaging technology have improved its barrier properties, making it suitable for a wider range of food products while maintaining food safety standards. The trend towards artisanal and premium food products also favors paper packaging, as it conveys a sense of naturalness and authenticity.

Application Outlook

Based on Application, Food Packaging Market is segmented into Bakery & Confectionary, Dairy Products, Fruits & Vegetables, Meat, Poultry, & Seafood, Sauces & Dressings, and Others.

Bakery & Confectionary accounted for largest share in 2022. The Bakery & Confectionery Food Packaging Market is primarily driven by several key drivers, including evolving consumer preferences for convenient, single-serving, and visually appealing packaging to accommodate on-the-go lifestyles and impulse purchases. Furthermore, the expansion of the bakery and confectionery sectors is closely linked to the industry's growth, with new product launches and innovations driving demand for suitable packaging solutions. Concerns about food safety and shelf-life preservation are also important factors driving the adoption of packaging technologies such as modified atmosphere packaging and barrier films. With a growing demand for eco-friendly, recyclable, and biodegradable packaging materials to address environmental concerns, sustainability has become increasingly important in this market.

Consumer health and nutrition awareness is influencing packaging trends, necessitating the need for portion-controlled and convenient packaging options. Concerns about sustainability are also prominent, driving manufacturers to use eco-friendly materials and recyclable packaging solutions. The expansion of dairy product distribution channels, such as online sales and convenience stores, fuels demand for packaging that meets the needs of a wide range of consumers. In essence, the Dairy Products Food Packaging Market is shaped by the interaction of dairy industry growth, changing consumer preferences, food safety, sustainability, and distribution channel diversification.

Regional Outlook

Asia Pacific is emerged as leading market for Food Packaging Market in 2022. Rapid urbanization and an expanding middle-class population have resulted in changing lifestyles and dietary habits, as well as an increase in demand for convenience foods and single-serving packaging solutions. Furthermore, the region's thriving food and beverage industry, which features a diverse range of cuisines and products, necessitates a diverse range of packaging options to meet consumer preferences. Environmental concerns are prompting the adoption of eco-friendly packaging materials and recycling initiatives, which align with regulatory measures aimed at reducing plastic waste.

A complex interplay of factors drives the Europe Food Packaging Market, reflecting the region's distinct economic, social, and regulatory landscape. Packaging designs and formats are being influenced by consumer preferences for convenience, portion control, and on-the-go consumption. To extend shelf life and ensure product freshness, strict food safety regulations and a focus on quality assurance are driving the adoption of advanced packaging technologies such as modified atmosphere packaging and active packaging solutions. Concerns about sustainability are especially prevalent in Europe, resulting in a high demand for eco-friendly and recyclable packaging materials, driven by both consumer preferences and regulatory mandates.

Food Packaging Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 378.69 Billion |

| Forecast in 2030 | USD 572.14 Billion |

| CAGR | CAGR of 6.12% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By Material, By Application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Alpha Packaging; CuBE Packaging; Cheer Pack North America; Evanesce Packaging Solutions Inc; Pacmoore Products Inc.; Innovative Fiber; Emmerson Packaging; PakTech; Tradepak; ProAmpac; |

Global Food Packaging Market, Report Segmentation

Food Packaging Market, By Type

- Rigid

- Semi-rigid

- Flexible

Food Packaging Market, By Material

- Paper & Paper-based Material

- Plastics

- Metal

- Glass

- Others

Food Packaging Market, By Application

- Bakery & Confectionary

- Dairy Products

- Fruits & Vegetables

- Meat, Poultry, & Seafood

- Sauces & Dressings

- Others

Food Packaging Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355