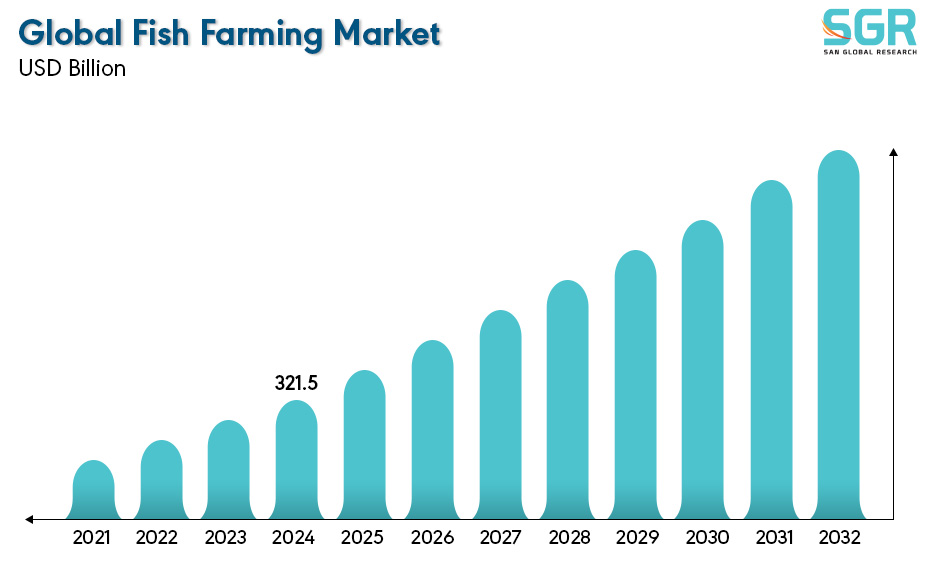

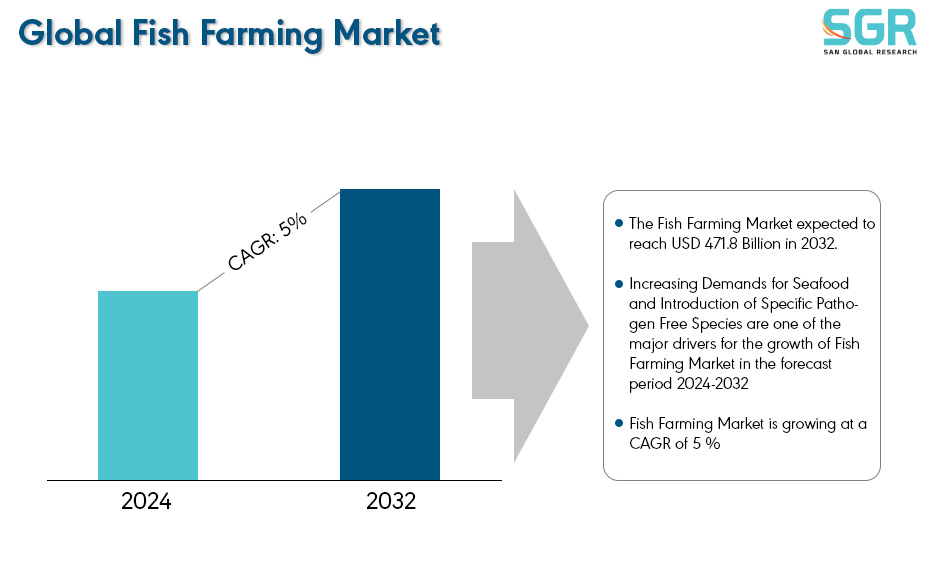

Fish Farming Market is estimated to be worth USD 321.5 Billion in 2024 and is projected to grow at a CAGR of 5 % between 2024 to 2032. The study has considered the base year as 2023, which estimates the market size of market and the forecast period is 2024 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Environment, by Fish Type and by region/country.

Fish farming is the cultivation of aquatic organisms, with human interference within the breeding process to increase the fish population artificially. The main operations included in the systems are storage, reproduction, feeding and protection from other predators. The farming systems are very diverse, encompassing various cultural methods, practices, facilities, and integration with other agricultural activities. Land ponds remain the most common facility type for freshwater aquaculture. However, recent years have witnessed significant advancements in integrated freshwater aquaculture systems, which are increasingly combined with agricultural practices.

These advancements have resulted not only in higher productivity and better resource efficiency, but also in environmental impacts. The world aquaculture is significantly gaining the attention due to increasingly diversified and intensive due to the use of new technologies. It has grown significantly in recent decades, contributing substantially to improving food security and reducing poverty worldwide. As fish farming remains a promising activity for producing protein with high nutritional value, large aquaculture companies, recognizing the potential of this important modality, have invested in research and production across various productive segments and the cultivation of the diverse fish species.

After reviewing the data shown below, it can be determined that the Asia Pacific region dominates the Fish Farming Market for the following reasons.

The fish consumed in Asia in terms of volume accounts for almost two-thirds of global consumption at a rate of 20.7 kg per capita which the largest than any other region. This is because for centuries, populations within Asia have been eating fish-based proteins due to the vast costal line within the region. For example, in 2013, Asian countries accounted for 70% of the global increase in fish consumption for food. Looking ahead, per capita fish consumption is expected to rise primarily in high-income East Asian countries. Due to which the Asia pacific region is dominating the Fish Farming market.

Aquaculture, the fastest-growing sector in our food system, is a key source of sustainable food in Europe. The EU-funded ECOFISH project is developing a model and guide to encourage and help conventional fish farms transition to organic aquaculture. Sustainable aquaculture farms prioritize measures that protect the environment, natural resources, and landscapes throughout production. This emphasis on sustainability contributes to the steady growth of the Fish Farming market.

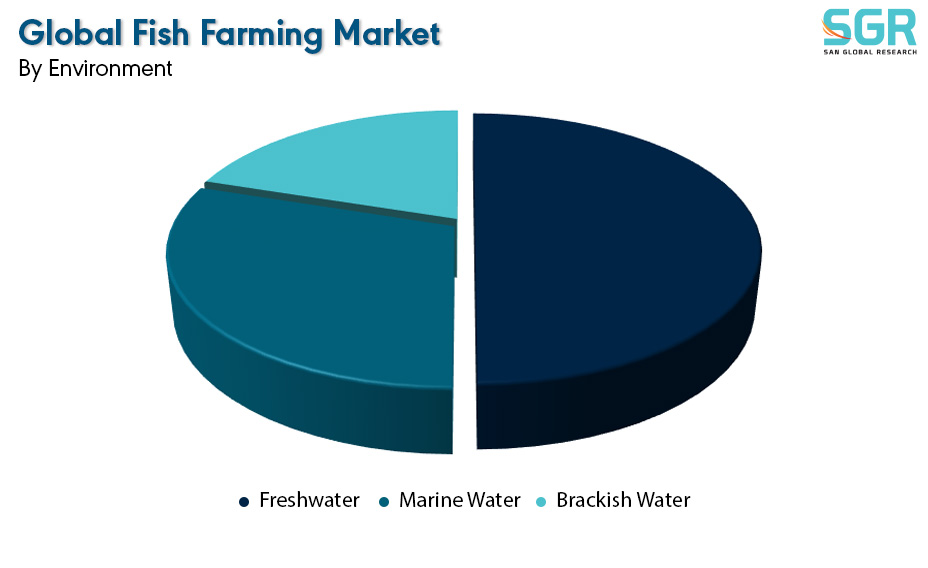

By Environment

Based on the Environment, the Fish Farming Market is bifurcated into Freshwater, Marine Water and Brackish Water – where Fresh Water is dominating and ahead in terms of share. The fishes harvested from the fresh water are rich in protein which meets the growing demand of protein globally, where the ocean resources are limited. Also compared to marine water fish farming the fresh water fish farming requires land due to which the Fresh Water farming is dominating the Fish Farming market.

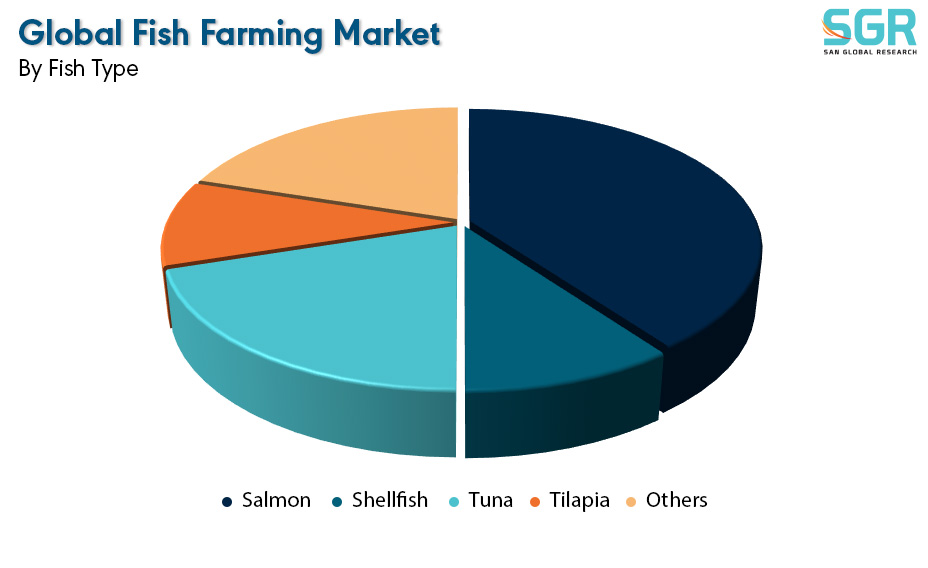

By Fish Type

Based on the Fish Type, the Fish Farming Market is bifurcated into Salmon, Shellfish, Tuna, Tilapia and Others – where Salmon is dominating and ahead in terms of share. Salmon is a highly demanded fish species due to its taste and health benefits, particularly its richness in omega-3 fatty acids. Additionally, salmon boasts a high feed conversion ratio, meaning it efficiently converts food into flesh. These factors contribute significantly to the dominance of the salmon segment within the fin fish type segment of the Fish Farming market.

Key Players

• Alpha Group

• Mowi ASA

• Blue Ridge Aquaculture

• Tassal Group

• Nireus Aquaculture S.A.

Drivers

Increasing Demand of Seafood

Fish offers a promising solution to the challenge of feeding a growing global population. The population is expected to grow about 9 billion people in the world by 2050 due to which the experts are seeking a solution actively. Currently, fish already provides 16% of the world's animal protein consumption. This number is likely to rise as aquaculture expands to meet rising demand, particularly for higher-value seafood sought by consumers with increasing disposable incomes. Fish can thus play a significant role in ensuring food security for both the world's growing middle class and its most vulnerable populations.

Opportunity

Introduction of Specific Pathogen Free Species

Aquaculture's expansion in recent decades offers a realistic solution to supplement wild-caught fish and meet global protein needs as seafood demand continues to rise. However, the sector faces challenges like environmental concerns and disease outbreaks that can cause significant financial losses. One promising solution to these problems is the development of specific pathogen-free (SPF) seeds of fish and shellfish stocks, as exemplified by the success story of Litopenaeus vannamei. SPF fish and shellfish stocks are intentionally bred to eliminate detrimental pathogens, reducing disease risks and promoting the sustainability and productivity of aquaculture operations.

| Report Attribute | Details |

| Market Value in 2023 | 312.5 Billion |

| Forecast in 2032 | 471.8 Billion |

| CAGR | CAGR of 5% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Million and CAGR from 2024 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, Competitive Landscape, Growth Factors, and Trends |

| Segments Scope | By Environment, By Fish Type |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | • Alpha Group • Mowi ASA • Blue Ridge Aquaculture • Tassal Group • Nireus Aquaculture S.A. |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355