Report Overview

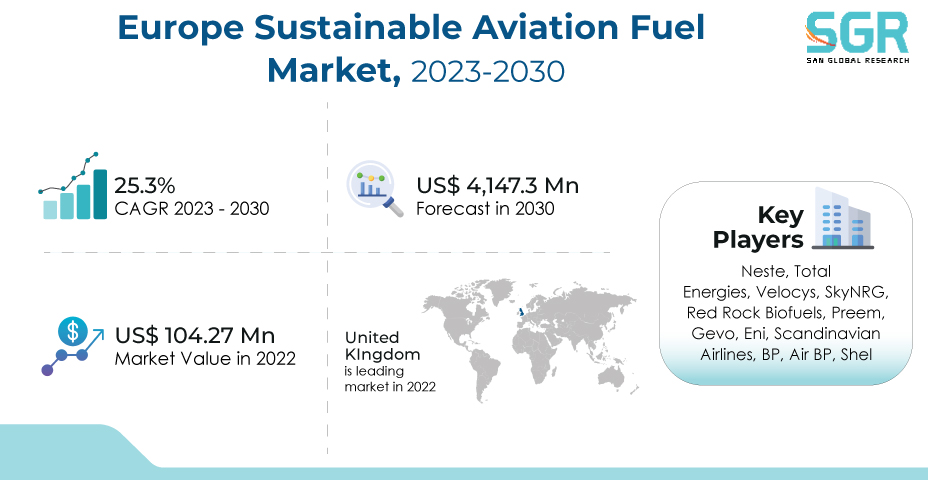

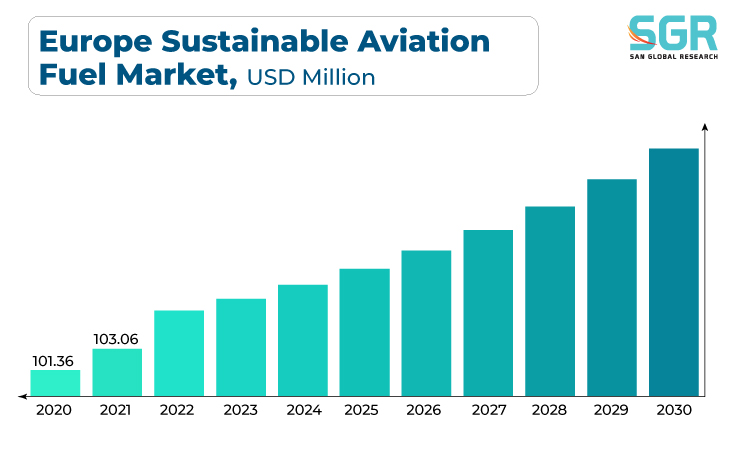

The Europe Sustainable Aviation Fuel Market was valued at 104.27 million in 2022 and expected to grow at CAGR of 25.3% over forecast period.

The Europe Sustainable Aviation Fuel (SAF) Market is primarily driven by the aviation industry's growing emphasis on reducing carbon emissions and transitioning to more sustainable and environmentally friendly fuel alternatives. Regulatory pressures and commitments to achieve net-zero carbon emissions are driving the use of SAF, which has a lower carbon footprint than traditional aviation fuels.

Government incentives, R&D funding, and a growing awareness of the environmental impact of air travel are driving investments and innovations in SAF production. As airlines and airports strive to meet sustainability goals, demand for SAF in Europe continues to rise, making it a key driver of market growth.

Fuel Type Outlook

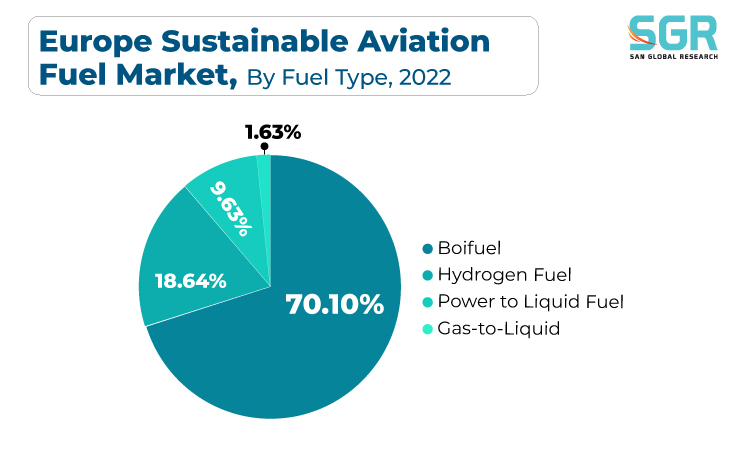

Based on Fuel Type, the Europe Sustainable Aviation Fuel Market is segmented Biofuel, Hydrogen Fuel, Power to Liquid Fuel, Gas-to-Liquid. Biofuel segment accounted for largest share in 2022. The growing commitment of the aviation industry to reducing carbon emissions and environmental impact is driving the Europe Biofuel Sustainable Aviation Fuel (SAF) Market. Biofuels derived from sustainable feedstocks such as waste oils, agricultural residues, and algae are a greener alternative to conventional aviation fuels that meet stringent emission reduction targets. The adoption of biofuel SAF has been accelerated further by the European Union's Renewable Energy Directive (RED II) and the International Air Transport Association's (IATA) initiatives to promote SAF. Government incentives, renewable energy policies, and growing consumer awareness of the importance of sustainable air travel are catalyzing investments and advancements in biofuel SAF production, positioning it as a critical driver of market growth in Europe.

Hydrogen SAF, made from renewable hydrogen, has the potential to significantly reduce carbon emissions from aviation. The European Union's strategies and regulations promoting hydrogen-based sustainable aviation fuels, as well as investments in hydrogen infrastructure and technology development, are easing adoption. In the context of climate change goals and the need for sustainable air travel, hydrogen SAF is a key driver for market growth in Europe, with the potential to revolutionize the aviation sector by providing a zero-emission energy source for aircraft.

Aircraft Type Outlook

Based on Aircraft Type, Europe Sustainable Aviation Fuel Market is segmented into Fixed Wings

, Rotorcraft, and others. Fixed Wings accounted for largest share in 2022. The aviation industry's collaborative efforts to reduce carbon emissions and transition to more sustainable fuel sources. SAF is gaining prominence as an immediate solution to reduce the carbon footprint of fixed-wing aircraft as part of the European Green Deal and the push for net-zero emissions. Government policies, environmental regulations, and financial incentives to encourage SAF adoption, as well as airline and manufacturer commitments to environmentally friendly aviation, are driving investments in SAF manufacturing facilities and research into advanced biofuels and synthetic fuels. With a strong emphasis on environmental responsibility and reducing the environmental impact of air travel, SAF is a key driver of the European sustainable aviation fuel market, particularly for fixed-wing aircraft.

The growing commitment of the rotorcraft aviation sector to environmental sustainability and the need to reduce carbon emissions. Rotorcraft, which include helicopters and vertical take-off and landing (VTOL) aircraft, have special operational requirements and are frequently used in medical services, search and rescue, and urban air mobility. As regulatory pressure to reduce emissions grows, SAF provides a viable solution for reducing the carbon footprint of rotorcraft operations.

Application Outlook

Based on Application, Europe Sustainable Aviation Fuel Market is segmented into Commercial, Transportation, Military, Unmanned Aerial Vehicles. The aviation industry's response to stringent emissions reduction targets and the imperative to transition towards more sustainable and eco-friendly aviation practices. Commercial aviation is under increasing pressure to reduce its carbon footprint, and SAF, which is made from renewable feedstocks, is a key solution. The Green Deal of the European Union, as well as various national and regional regulations encouraging SAF use, are driving SAF adoption. Airlines, airports, and industry stakeholders are investing in SAF infrastructure and research in order to reduce emissions and meet environmental sustainability goals. With a growing awareness of the environmental impact of air travel and a strong push for cleaner alternatives, SAF is a key driver of the European commercial aviation fuel market.The European defense sector, including NATO member countries, is investing in advanced military aircraft while also remaining prepared to respond to security threats. Given the importance of military aviation in national defense and peacekeeping missions, ensuring a consistent supply of high-quality aviation fuel is critical. Furthermore, efforts to improve

military aviation's environmental performance are encouraging the use of more sustainable aviation fuels (SAF) in military operations. Regulations and international agreements aimed at reducing emissions contribute to the growing interest in SAF.

Country Outlook

UK has emerged as leading market for Europe Sustainable Aviation Fuel Market in 2022. The UK government's environmental targets. SAF is gaining prominence as an important component of the UK's aviation sector, with a strong emphasis on achieving net-zero emissions and sustainable air travel. Regulatory pressures, environmental regulations, and financial incentives to encourage SAF adoption are encouraging investments in SAF manufacturing facilities as well as the development of advanced biofuels and synthetic fuels.

The German aviation industry's commitment to reducing carbon emissions and the country's strong focus on environmental sustainability. As a significant contributor to greenhouse gas emissions, the aviation sector in Germany is under pressure to adopt cleaner and more sustainable fuels. Government regulations and incentives, including the National Aviation Strategy 2030, are promoting the use of SAF.

Recent Key Developments in Europe Sustainable Aviation Fuel Market

- In September 2023, EU approved the RefuelEU aviation rules are part of the “Fit for 55 package”. Under which it is targeted to achieve 70% of jet fuels at EU airports to be green by 2050

- In September 2023, DHL Group, Sasol Ltd. and HH2E AG partnered to produce sustainable aviation fuels in Germany. The partners has signed agreement to expand green hydrogen capacity by 2030

- In August 2023, HCS Group and Lufthansa Group announced collaboration to produce and supply Sustainable Aviation Fuel by 2026. The SAF will be manufactured at the HCS Group manufacturing site in Speyer, Germany, operated by Haltermann Carless, using waste biomass from the agricultural and forestry sectors. SAF is a critical component for more sustainable flying and, as a result, aviation decarbonisation.

Europe Sustainable Aviation Fuel Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 104.27 Million |

| Forecast in 2030 | USD 4,147.3 Million |

| CAGR | CAGR of 25.3% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

Segments Scope |

By Fuel Type, By Aircraft Type, By Platform |

| Countries Covered | Germany, United Kingdom, France, Italy, Russia, Spain, Netherlands, Switzerland, Sweden, Poland |

| Key Companies profiled | Neste, TotalEnergies, Velocys, SkyNRG, Red Rock Biofuels, Preem, Gevo, Eni, Scandinavian Airlines, BP, Air BP, Shell |

Europe Sustainable Aviation Fuel Market Segmentation

Fuel Type Outlook (Revenue, USD Million, 2018 - 2030)

- Biofuel

- Hydrogen Fuel

- Power to Liquid Fuel

- Gas-to-Liquid

Aircraft Type Outlook (Revenue, USD Million, 2018 - 2030)

- Fixed Wings

- Rotorcraft

- Others

Application Outlook (Revenue, USD Million, 2018 - 2030)

- Commercial

- Transportation

- Military

- Unmanned Aerial Vehicles

Europe Sustainable Aviation Fuel Market, By Country

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Netherlands

- Switzerland

- Sweden

- Poland

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355