Report Overview

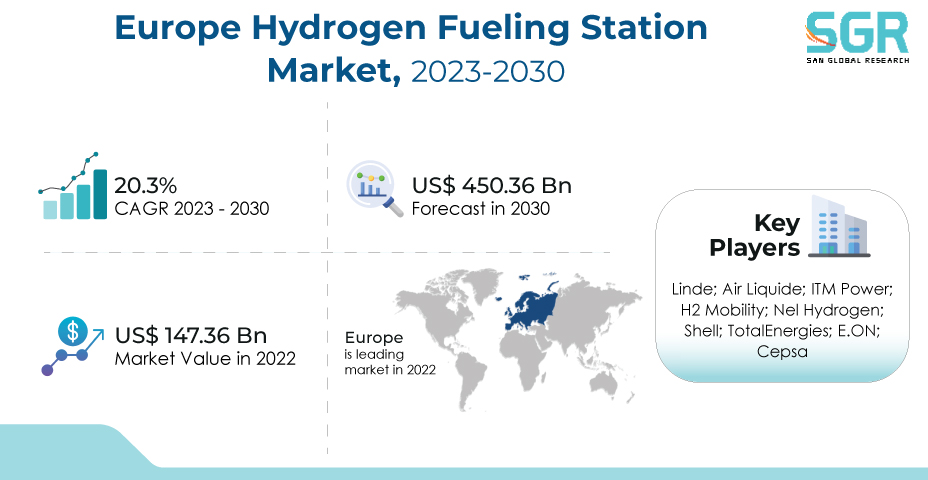

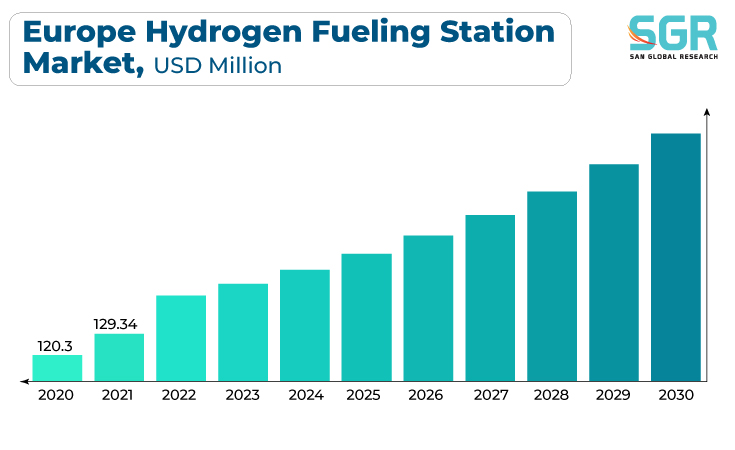

The Europe Hydrogen Fueling Station Market was valued at 147.36 million in 2022 and expected to grow at CAGR of 20.3% over forecast period. the increasing focus on decarbonizing the transportation sector and achieving sustainability goals.

Hydrogen fuel cell vehicles (FCVs) are an environmentally friendly and cost-effective alternative to traditional internal combustion engine vehicles, emitting only water vapor as a byproduct. As European countries commit to reducing greenhouse gas emissions and promoting renewable energy sources, there is a growing demand for hydrogen infrastructure, including fueling stations, to support the adoption of FCVs, creating a strong market incentive for the development and expansion of hydrogen refueling infrastructure throughout the region.

Another key driver for the Europe hydrogen fueling station market is government support and incentives. Many European governments have implemented policies, regulations, and financial incentives to promote the development and deployment of hydrogen fuel cell technology, including subsidies for hydrogen refueling infrastructure.

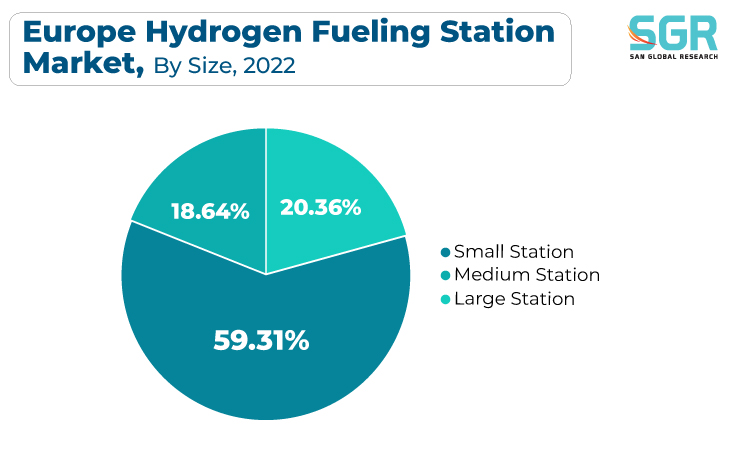

Size Outlook

Based on Size, the Europe Hydrogen Fueling Station Market is segmented in Small Station, Medium Station, and Large Station. Medium station segment accounted for largest share in 2022. Medium-sized hydrogen fueling stations are ideal for meeting the needs of industrial users because they can provide a dependable and cost-effective source of high-purity hydrogen for their operations. The availability of medium-sized hydrogen fueling stations facilitates the adoption of hydrogen as a versatile energy source, driving the growth of this market segment as European industries seek to decarbonize and reduce their environmental footprint.

As European cities and municipalities intensify their efforts to reduce air pollution and greenhouse gas emissions, there is a growing need for compact, easily deployable hydrogen refueling infrastructure to support FCEVs. Small-sized hydrogen fueling stations often referred to as "micro-stations," offer a cost-effective and space-efficient solution for these urban environments, enabling convenient access to clean hydrogen fuel.

Type Outlook

Based on Type, Europe Hydrogen Fueling Station Market is segmented into On-site, Off-site. On-site accounted for largest share in 2022. On-site hydrogen production and refueling stations have the advantage of producing hydrogen directly at the point of use, eliminating the need for hydrogen transportation and distribution from centralized facilities. This not only lowers the costs of hydrogen supply chain logistics, but it also improves the reliability and security of hydrogen availability, especially in remote or industrial settings.

Off-site hydrogen stations are strategically placed at key transportation hubs, urban centers, and along major highways to provide FCEV users with easy access to hydrogen fuel. This market is being boosted by European countries' growing commitment to reduce greenhouse gas emissions and promote sustainable transportation options. Off-site hydrogen stations help to expand FCEV fleets by providing a dependable and extensive network, assuring consumers and businesses of the viability of FCEVs as a clean and practical alternative to traditional internal combustion engine vehicles.

Mobility Outlook

Based on Mobility, Europe Hydrogen Fueling Station Market is segmented into fixed station and mobile stations. Fixed station accounted for largest share in 2022. The need for a stable and established infrastructure to support the rapid growth of hydrogen-powered vehicles and the broader hydrogen economy is driving the Europe fixed hydrogen fueling station market. Fixed hydrogen refueling stations provide a consistent and reliable source of hydrogen, making them an essential component for the long-term adoption of fuel cell electric vehicles (FCEVs) and industrial hydrogen applications.

Mobile stations provide a temporary and versatile solution for accelerating the growth of fuel cell electric vehicles (FCEVs) and various industrial hydrogen applications, especially in areas with fluctuating demand or limited access to fixed infrastructure. This market is also fueled by the dynamic nature of hydrogen adoption, which allows for rapid deployment in response to changing consumer and industrial demands.

Application Outlook

Based on Application, Europe Hydrogen Fueling Station Market is segmented into marine, railway, commercial vehicle, and aviation. Commercial Vehicle accounted for largest share in 2022. The commercial vehicle hydrogen fueling station market in Europe is primarily driven by the need to reduce emissions and meet stringent environmental regulations in the commercial transportation sector. As fleet operators seek to transition from traditional diesel or gasoline-powered fleets to cleaner alternatives, hydrogen fuel cell technology offers an appealing solution. Commercial hydrogen fueling stations, such as trucks and buses, are critical for enabling the adoption of fuel cell electric vehicles (FCEVs) in this sector.

Hydrogen fuel cells are emerging as a promising alternative for ship propulsion because they emit no emissions and have long cruising ranges. The development of hydrogen refueling infrastructure, specifically for marine applications, is critical to promoting the use of hydrogen-powered vessels. Furthermore, European initiatives to decarbonize the shipping industry, as well as stringent emissions regulations in many European coastal areas and ports, provide a compelling incentive for the development of marine hydrogen fueling stations. As the maritime industry seeks to align with sustainability goals and reduce its environmental impact, the region's demand for dedicated hydrogen refueling infrastructure for ships grows.

Country Outlook

Germany has emerged as leading market for Europe Hydrogen Fueling Station Market in 2022.Germany's hydrogen fueling station market is being driven by the country's strong commitment to decarbonizing its transportation sector and meeting ambitious sustainability targets. Germany has emerged as a pioneer in the promotion of hydrogen as a clean energy carrier, actively supporting the development of a comprehensive hydrogen infrastructure, including fueling stations. Government initiatives, significant funding, and favorable regulations have created an environment conducive to investment in hydrogen refueling infrastructure.

The United Kingdom has set aggressive targets for reducing greenhouse gas emissions, and hydrogen is critical to the transition to cleaner transportation and industrial sectors. Government incentives, grants, and favorable policies encourage the development of hydrogen refueling infrastructure, thereby creating a strong market incentive.

Recent Key Developments in Europe Hydrogen Fueling Station Market

- In March 2023, EU launched Alternative Fuels Infrastructure Regulation (AFIR) and FuelEU have been published in the Official Journal of the European Union. Hundreds of hydrogen filling stations to be installed across Europe, and shipping forced to cut emissions, after EU plans become law

- In June 2023, Air Liquide and Iveco Group announced launch of its first high-pressure hydrogen station for long-haul trucks in Europe

- In February 2023, Air Liquide and Total Energies collaborated to develop 100 hydrogen stations for heavy duty vehicles in Europe

Europe Hydrogen Fueling Station Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 147.36 Million |

| Forecast in 2030 | USD 450.36 Million |

| CAGR | CAGR of 20.3% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Size, By Type, By Mobility, By Application |

| Countries Covered | Germany, United Kingdom, France, Italy, Russia, Spain, Netherlands, Switzerland, Sweden, Poland |

| Key Companies profiled | Linde; Air Liquide; ITM Power; H2 Mobility; Nel Hydrogen; Shell; TotalEnergies; E.ON; Cepsa |

Europe Hydrogen Fueling Station Market Segmentation

Size Outlook (Revenue, USD Million, 2018 - 2030)

- Small Station

- Medium Station

- Large Station

Type Outlook (Revenue, USD Million, 2018 - 2030)

- On-site

- Off-site

Mobility Outlook (Revenue, USD Million, 2018 - 2030)

- Fixed Station

- Mobile stations

Application Outlook (Revenue, USD Million, 2018 - 2030)

- Marine

- Railway

- Commercial vehicle

- Aviation

Europe Hydrogen Fueling Station Market, By Country

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Netherlands

- Switzerland

- Sweden

- Poland

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355