Report Overview

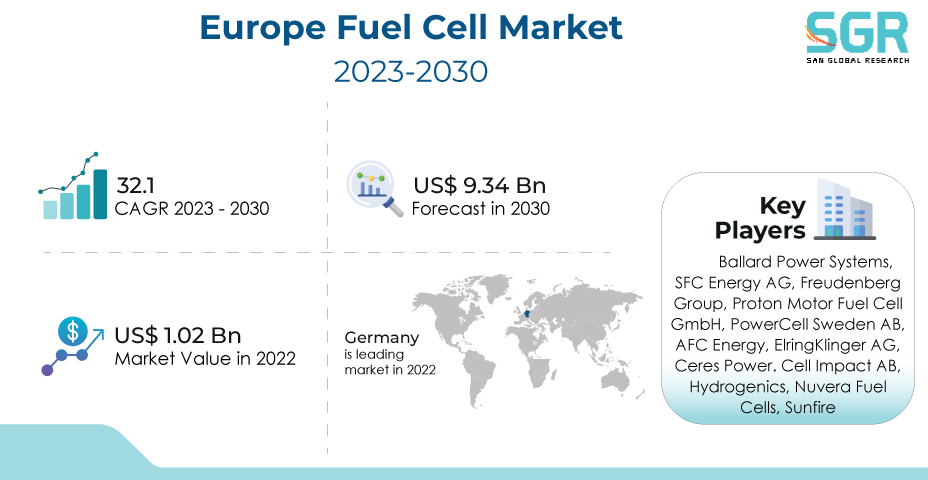

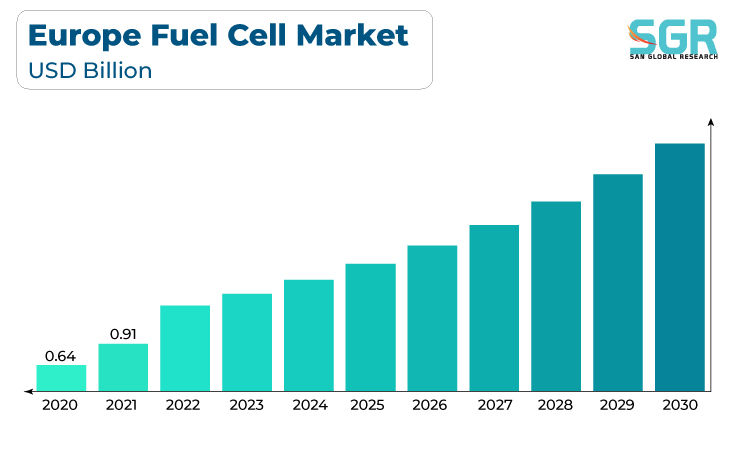

The Europe Fuel Cell Market was valued at 1.02 billion in 2022 and expected to grow at CAGR of 32.1% over forecast period.

Fuel cells provide a highly efficient and environmentally friendly alternative to traditional combustion-based power generation, making them essential for lowering carbon emissions and meeting climate goals. The growing emphasis on green hydrogen production, as well as the expansion of hydrogen infrastructure, drive up demand for fuel cells as a means of storing and converting hydrogen into electricity.

Furthermore, fuel cells play an important role in a variety of applications, including transportation, stationary power, and portable devices, helping to diversify energy and reduce reliance on fossil fuels. Fuel cells are a key driver in Europe's clean energy transition and efforts to build a sustainable and resilient energy ecosystem, thanks to government incentives and policies that encourage fuel cell adoption, as well as a growing focus on energy security and resilience.

Product Outlook

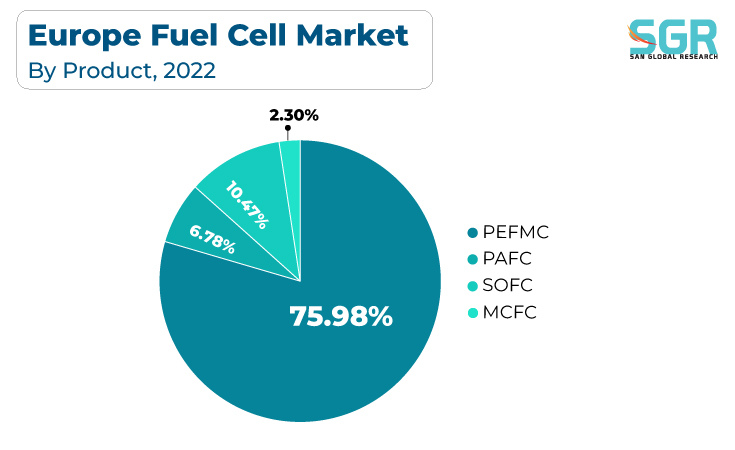

Based on Product, the Europe Fuel Cell Market is segmented PEMFC, PAFC, SOFC, MCFC and Others. PEMFC segment accounted for largest share in 2022. PEMFCs are a valuable technology for clean energy and reducing greenhouse gas emissions because of their high efficiency, low emissions, and quick start-up capabilities. The emphasis on hydrogen as a clean energy carrier, as well as the expansion of hydrogen infrastructure, drive up demand for PEMFCs, which are critical in converting hydrogen into electricity for fuel cell vehicles and backup power systems. PEMFCs play a critical role in decarbonizing transportation and improving the sustainability and resilience of power supply as Europe strives to meet stringent emissions targets and advance clean energy technologies, positioning them as key drivers in the European clean energy landscape.

SOFCs are highly efficient, environmentally friendly, and adaptable, and their high-temperature operation allows for waste heat recovery and utilization. The advantages of SOFCs are aligned with Europe's focus on energy efficiency, sustainable power generation, and greenhouse gas emissions reduction. Furthermore, the increased use of hydrogen as an energy carrier and the development of clean hydrogen production pathways boost demand for SOFCs, positioning them as critical drivers in the region's clean energy transition, grid resilience, and pursuit of innovative distributed power solutions.

Application Outlook

Based on Application, the Europe Fuel Cell Market is segmented Stationary, Transportation, Portable. Stationary segment accounted for largest share in 2022. The growing need for dependable, clean, and distributed power generation in a variety of sectors, including commercial and industrial applications, residential use, and critical infrastructure. With their high efficiency and low emissions, fuel cells provide a reliable source of electricity, especially for off-grid or grid-interactive systems. Their ability to run on a variety of fuels, including natural gas and hydrogen, increases their adaptability. Furthermore, as concerns about energy security, resilience, and environmental sustainability grow, stationary fuel cells play an important role in providing backup power during outages while also lowering carbon emissions.

Fuel cells, particularly hydrogen fuel cells, are becoming increasingly popular in a variety of modes of transportation, including passenger cars, buses, trucks, and even trains. When compared to electric batteries, they have longer driving ranges and shorter refueling times, making them suitable for both light and heavy-duty vehicles. The development of a hydrogen infrastructure, government incentives and regulations supporting fuel cell vehicles, and automakers' commitment to developing hydrogen-powered transportation all contribute to fuel cell demand. Furthermore, as Europe strives to decarbonize its transportation sector and improve energy security, transportation fuel cells play a critical role in achieving these objectives and fostering sustainable and efficient mobility solutions.

Country Outlook

Germany has emerged as leading market for Europe Fuel Cell Market in 2022. Fuel cells, particularly hydrogen fuel cells, are critical to the decarbonization of a variety of sectors, including transportation, stationary power generation, and industrial processes. Germany has been at the forefront of fuel cell development and adoption, with significant investments in fuel cell research, development, and infrastructure. The country's robust automotive industry, which includes world-class brands such as Mercedes-Benz and BMW, has fueled the development of hydrogen fuel cell vehicles.

The UK government's emphasis on environmental sustainability, including aggressive targets to achieve net-zero emissions, has resulted in a number of initiatives promoting fuel cell technology, particularly in the transportation sector. The expansion of hydrogen infrastructure, investments in hydrogen production, and the development of hydrogen-powered buses and commercial vehicles all contribute to increased demand for fuel cells. Furthermore, the UK's energy security concerns and the need for resilient power solutions drive fuel cell adoption, positioning them as key drivers in the country's transition to a low-carbon, sustainable energy landscape.

Recent Key Developments in Europe Fuel Cell Market

- In October 2023, Ballard Power Systems announced accomplishment of bulk order of fuel cells. The order consists of 170 hydrogen fuel cell engines to power Solaris buses in Europe. Furthermore orders and deliveries are expected in 2024 and 2026

- In July 2023, Hyundai announced launch of its XCIENT fuel cells in Europe. Hyundai Motor is shipping the first ten XCIENT Fuel Cell trucks to Switzerland, making it the world's first fuel cell heavy-duty truck.

- In May 2023, Ford announced test of a small fleet of fuel cell E-Transit vans in the United Kingdom. Ford will lead a consortium in a three-year project that will put fuel cell vans to the test for its customers.

Europe Fuel Cell Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 1.02 Billion |

| Forecast in 2030 | USD 9.34 Billion |

| CAGR | CAGR of 32.1% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Product, By Application |

| Countries Covered | Germany, United Kingdom, France, Italy, Russia, Spain, Netherlands, Switzerland, Sweden, Poland |

| Key Companies profiled | Ballard Power Systems, SFC Energy AG, Freudenberg Group, Proton Motor Fuel Cell GmbH, PowerCell Sweden AB, AFC Energy, ElringKlinger AG, Ceres Power. Cell Impact AB, Hydrogenics, Nuvera Fuel Cells, Sunfire |

Europe Fuel Cell Market Segmentation

Product Outlook (Revenue, USD Billion, 2018 - 2030)

- PEMFC

- PAFC

- SOFC

- MCFC

- Others

Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Stationary

- Transportation

- Portable

Europe Fuel Cell Market, By Country

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Netherlands

- Switzerland

- Sweden

- Poland

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355