Report Overview

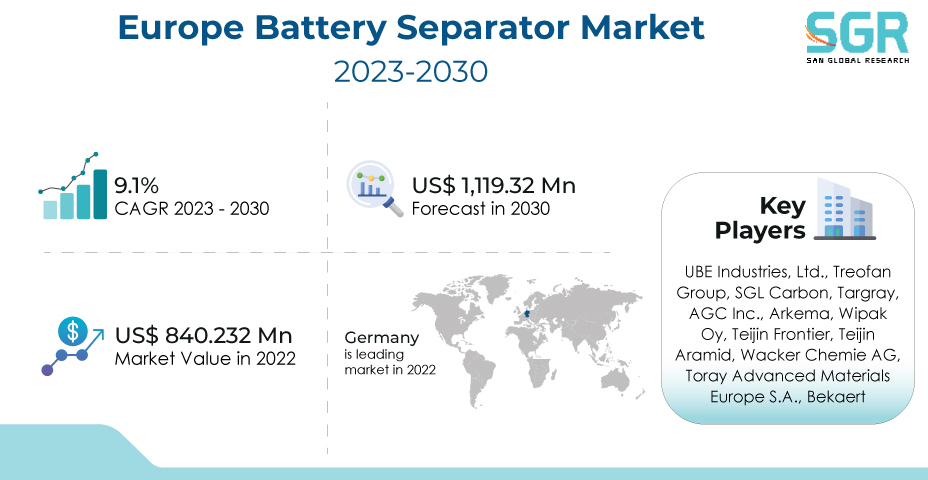

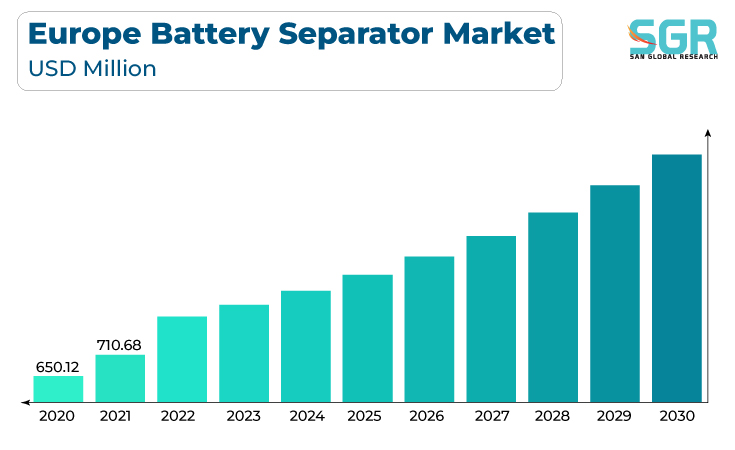

The Europe Battery Separator Market was valued at 840.23 million in 2022 and expected to grow at CAGR of 9.1% over forecast period.

The increasing adoption of electric vehicles (EVs) and the growing demand for energy storage solutions in the region are driving the Europe Battery Separator Market. The demand for advanced battery technologies has increased as the automotive industry shifts toward electrification and renewable energy sources gain prominence. Battery separators are essential components in EVs and energy storage systems because they improve the performance and safety of lithium-ion batteries.

Furthermore, government incentives and regulations promoting clean energy solutions are driving market growth for battery separators in Europe. In addition to the rising demand for electric vehicles and energy storage systems, the Europe Battery Separator Market is also being propelled by advancements in battery technology, leading to the development of high-performance and long-lasting batteries.

Battery Type Outlook

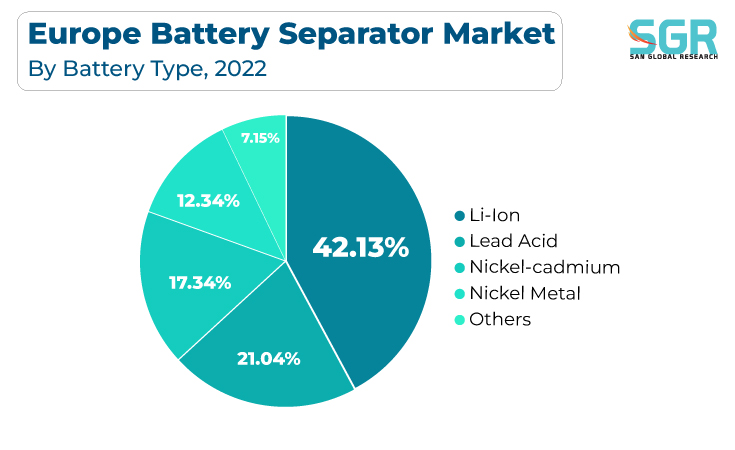

Based on Battery Type, the Europe Battery Separator Market is segmented Li-Ion, Lead Acid, Nickel-cadmium, Nickel Metal and Others. Li-Ion segment accounted for largest share in 2022. The rapidly growing demand for lithium-ion batteries across various industries, such as consumer electronics, electric vehicles, and renewable energy storage systems, is driving the Li-Ion Battery Separator Market. The need for portable and efficient power sources in our increasingly digital and electrified world is driving this surge in demand.

Furthermore, the growing demand for uninterruptible power supply systems, particularly in data centers and critical infrastructure, is driving up the demand for lead-acid batteries and separators. Furthermore, advancements in lead-acid battery technology, such as improvements in design and materials, are improving battery performance and extending battery life, contributing to market growth.

Type Outlook

Based on Type, Europe Battery Separator Market is segmented into Coated, Non-coated. Coated accounted for largest share in 2022. The growing demand for high-performance lithium-ion batteries in a variety of applications, including electric vehicles, consumer electronics, and renewable energy storage, is driving the Coated Battery Separator Market. Coated battery separators provide improved thermal stability, reduced short-circuiting risk, and increased battery life, making them an essential component in advanced battery technologies.

The cost-effectiveness and efficiency of non-coated battery separators in various battery applications drive the market. Non-coated separators, typically made of polyethylene and polypropylene, provide a simple and cost-effective solution for separating battery electrodes while maintaining mechanical strength. They are widely used in consumer electronics, automotive batteries, and industrial batteries. Because of their affordability and reliability, non-coated battery separators play an important role in meeting the growing demand for portable electronic devices, electric vehicles, and renewable energy storage, driving market expansion.

Material Outlook

Based on Material, Europe Battery Separator Market is segmented into Nylon, Polyethylene, Polypropylene, Ceramic and others. Nylon accounted for largest share in 2022. Nylon separators are increasingly being used in lithium-ion and other advanced battery technologies due to their exceptional thermal and chemical stability, mechanical strength, and puncture resistance. As electric vehicles, consumer electronics, and renewable energy storage solutions become more common, so does the demand for dependable and long-lasting battery components like nylon separators.

Innovative materials, such as ceramic, polymer, and nanocomposite separators, must be developed to improve battery efficiency, safety, and overall performance. As the use of electric vehicles, renewable energy storage, and consumer electronics grows, so does the need for more durable and heat-resistant separator materials to meet the rigorous demands of these industries. Furthermore, environmental concerns and sustainability efforts are encouraging the development of eco-friendly and recyclable separator materials, propelling the market forward.

Technology Outlook

Based on Technology, Europe Battery Separator Market is segmented into dry and wet battery separator. Dry accounted for largest share in 2022. The growing demand for advanced dry battery technologies, such as alkaline and zinc-carbon batteries, in various applications, including consumer electronics, remote controls, toys, and industrial devices. Dry battery separators, which provide electrical insulation and prevent internal short circuits, are essential in improving the safety and performance of these batteries. The market for dry battery separators benefits from the ongoing development of cost-effective and high-quality separator materials, which contributes to market growth as demand for portable and reliable power sources rises.

The demand for traditional lead-acid batteries in a variety of applications, including automotive, industrial, and standby power systems. Wet battery separators, which are frequently made of materials such as microporous polyethylene, are critical components in lead-acid batteries because they provide electrolyte separation and promote efficient chemical reactions. The market for wet battery separators is thriving as the demand for dependable, cost-effective energy storage solutions remains high, particularly in the automotive sector.

End-Use Outlook

Based on End-Use, Europe Battery Separator Market is segmented into automotive, consumer electronics, energy storage, industrial, medical devices and others. Automotive accounted for largest share in 2022. The rapid expansion of electric mobility, including electric vehicles (EVs) and hybrid electric vehicles (HEVs), both of which rely heavily on advanced lithium-ion batteries. The growing global emphasis on lowering emissions and transitioning to clean transportation has increased demand for high-performance automotive batteries. Battery separators, an essential component of these batteries, improve safety, thermal stability, and overall battery efficiency. Government incentives, stringent emissions regulations, and environmental awareness are driving the automotive battery separator market forward, encouraging innovation and investment in the sector.

Battery separators are critical components that ensure the safe and efficient operation of consumer batteries, whether they are alkaline, zinc-carbon, or lithium-ion. Consumer batteries battery separator market is being driven by the constant evolution and adoption of new consumer technologies and devices, as well as the desire for longer-lasting and safer batteries. Furthermore, environmental concerns and the push for sustainable battery technologies are driving innovations in separator materials to meet both performance and eco-friendly requirements, fueling market growth even further.

Country Outlook

Germany has emerged as leading market for Europe Battery Separator Market in 2022. Germany's commitment to lowering carbon emissions has resulted in significant investments in electric vehicles (EVs) and renewable energy solutions, both of which rely heavily on advanced battery technology. Battery separators are an essential component in these applications because they play an important role in improving battery efficiency and safety. Government incentives, robust R&D efforts, and a strong manufacturing base all contribute to the growth of the battery separator market in Germany.

The growing use of electric vehicles (EVs) and the development of renewable energy projects are driving the demand for advanced battery technologies. Battery separators are in high demand for these applications because they are critical components for improving battery safety and performance. Furthermore, government incentives, environmental regulations, and increased consumer awareness of sustainable energy solutions are propelling the battery separator market in the UK forward. As the country works to reduce carbon emissions and transition to more environmentally friendly technologies, the demand for innovative separator materials and technologies rises, promoting market growth.

Recent Key Developments in Europe Battery Separator Market

- In June 2023, SKIET announced investment of USD 1.7 billion to expand its footprint in Europe battery separator market. By the end of next year, three new production lines will be built. The second is set to go into mass production later this year.

- In November 2022, Celgard and Morrow have signed an exclusive joint development agreement for high-voltage battery separator technology for LNMO battery cell production at the European Gigafactory. Celgard will collaborate with Morrow to develop, test, and commercialize next-generation dry-process battery separators for Morrow high-voltage battery cells containing lithium nickel manganese oxide (LNMO) cathode material for electric vehicle (EV) and energy storage system (ESS) applications.

Europe Battery Separator Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 840.23 Million |

| Forecast in 2030 | USD 1,119.32 Million |

| CAGR | CAGR of 9.1% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Battery Type ,By Material, By Technology, By End-use |

| Countries Covered | Germany, United Kingdom, France, Italy, Russia, Spain, Netherlands, Switzerland, Sweden, Poland |

| Key Companies profiled | UBE Industries, Ltd., Treofan Group, SGL Carbon, Targray, AGC Inc., Arkema, Wipak Oy, Teijin Frontier, Teijin Aramid, Wacker Chemie AG, Toray Advanced Materials Europe S.A., Bekaert |

Europe Battery Separator Market Segmentation

Battery Type Outlook (Revenue, USD Million, 2018 - 2030)

- Li-Ion

- Lead Acid

- Nickel-cadmium

- Nickel Metal

- Others

Material Outlook (Revenue, USD Million, 2018 - 2030)

- Coated

- Non-coated

Technology Outlook (Revenue, USD Million, 2018 - 2030)

- Wet

- Dry

End-use Outlook (Revenue, USD Million, 2018 - 2030)

- Automotive

- Consumer electronics

- Energy storage

- Industrial

- Medical devices

- Others

Europe Battery Separator Market, By Country

- Germany

- United Kingdom

- France

- Italy

- Russia

- Spain

- Netherlands

- Switzerland

- Sweden

- Poland

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355