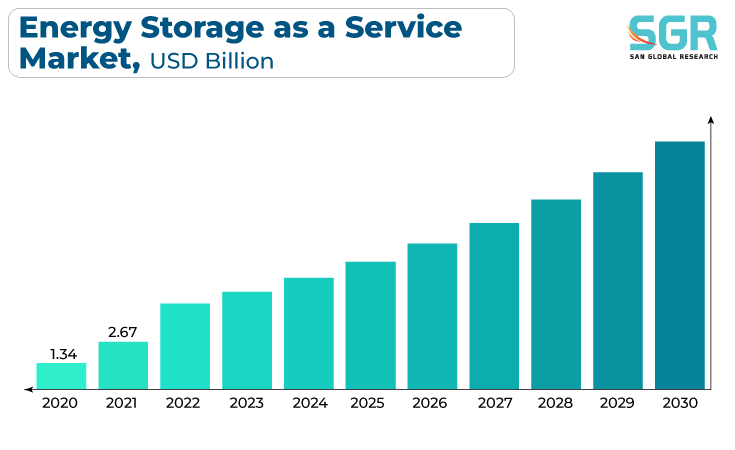

The Energy Storage as a Service Market was valued at 3.04 billion in 2023 and expected to grow at CAGR of 11.4% over forecast period. Several key drivers are propelling the Energy Storage as a Service (ESaaS) market, highlighting its growing importance in the energy landscape. For starters, the growing demand for dependable and resilient energy solutions, combined with the increasing integration of renewable energy sources, is driving the demand for efficient energy storage solutions. Furthermore, advances in battery technology and lower costs are increasing the economic feasibility of energy storage deployments. The push by governments and businesses to achieve decarbonization and sustainability goals highlights the importance of energy storage as a key enabler of a cleaner and more efficient energy system.

Furthermore, energy storage systems' flexibility and grid-supportive capabilities contribute to grid stability, making them critical in the face of changing energy consumption patterns and increasing penetration of intermittent renewable sources. Overall, these factors are driving the growth of the ESaaS market, positioning it as a key player in the ongoing energy transition.

Type Outlook

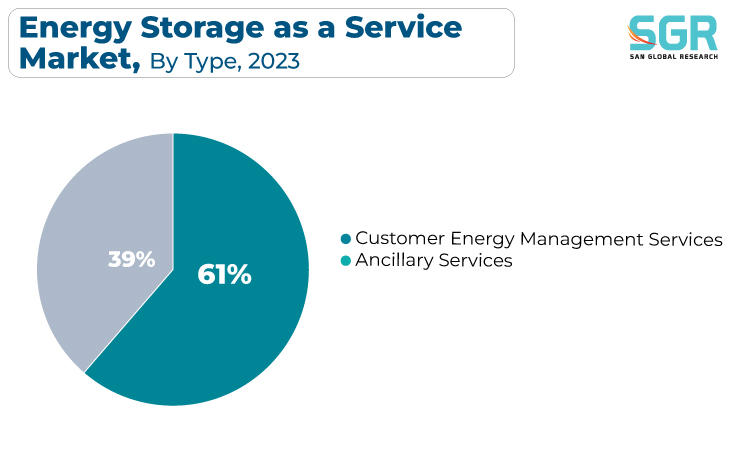

Based on Type, the Energy Storage as a Service Market is segmented Customer Energy Management Services, Ancillary Services. Customer Energy Management Services segment accounted for largest market share in 2023. Primarily, a rising awareness among consumers about the need for energy efficiency and cost savings is driving the demand for CEMS, which leverage energy storage solutions to optimize consumption patterns. As customers seek greater control over their energy usage, the flexibility offered by CEMS, coupled with the increasing affordability and advancements in energy storage technologies, becomes a compelling proposition. The integration of smart technologies, such as IoT-enabled devices and energy management platforms, further enhances the appeal of CEMS by providing real-time insights and control.

The growing use of renewable energy sources such as wind and solar has increased the need for grid stability, making ancillary services provided by energy storage systems essential. A primary driver is energy storage's ability to respond quickly to fluctuations in supply and demand, thereby improving grid reliability. Regulatory frameworks that require grid operators to ensure grid resilience and support ancillary services help to drive market growth.

End-Use Outlook

Based on End-User, Energy Storage as a Service Market is segmented into Residential, Commercial, Industrial, Utility. Commercial Industry accounted for largest share in 2023. With businesses facing fluctuating energy demands and rising electricity costs, the use of energy storage as a service becomes critical for optimizing energy consumption, lowering peak demand charges, and ensuring uninterrupted operations. Furthermore, the incorporation of renewable energy sources into commercial establishments, in conjunction with sustainability goals, increases demand for energy storage solutions to effectively manage intermittent power generation. The advancement of energy storage technologies, as well as the decline in battery costs, contribute to the economic viability of these services for commercial users.

Energy storage's grid-balancing capabilities, such as peak shaving, frequency regulation, and load management, have become critical to improving grid stability and reliability. Furthermore, as utilities work to modernize their infrastructure and transition to a more decentralized energy system, energy storage as a service provides the flexibility required to accommodate diverse energy sources and dynamic demand patterns. The pursuit of sustainability goals and regulatory mandates to reduce carbon emissions accelerates utility adoption of energy storage solutions, positioning the sector as a key driver in the transition to a more resilient, efficient, and environmentally friendly energy grid.

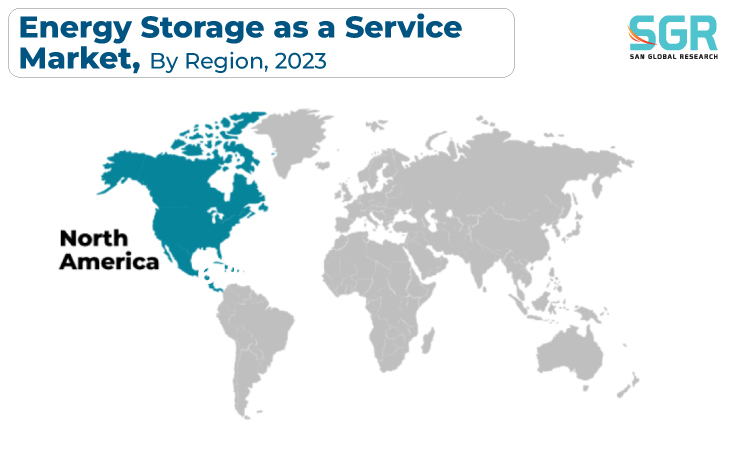

Regional Outlook

North America accounted for largest share in 2023. The growing use of intermittent renewable energy sources like wind and solar necessitates energy storage to reduce grid instability and support a reliable power supply. Aside from environmental considerations, declining battery costs, technological advancements, and a favorable policy landscape all contribute to the economic viability of energy storage as a service. The deployment of energy storage for applications such as grid balancing, peak demand management, and ancillary services also improves the resilience of the North American power grid. As the energy transition gains traction, the North American ESaaS market is poised to play a critical role in fostering a resilient and sustainable energy infrastructure across the continent.

A primary driver is the growing emphasis on renewable energy integration, which is supported by ambitious climate targets and supportive regulatory frameworks. Europe's efforts to improve energy security and grid reliability, particularly with the rise of intermittent renewables, fuel demand for energy storage solutions. The continent's focus on modernizing its energy infrastructure, combined with advancements in battery technologies and falling storage system costs, increases the economic feasibility of ESaaS deployments. Furthermore, the adoption of electric vehicles and the expansion of decentralized energy systems increase the demand for flexible energy storage services. As Europe continues to move toward a low-carbon energy landscape, the ESaaS market will be a critical enabler of energy efficiency, environmental sustainability, and grid resilience across the continent.

Recent Key Developments in Energy Storage as a Service Market

- In September 2023, Sunnova and FranklinWH Introduce a First-of-Its-Kind Solar Power Battery to Revolutionize Energy Storage in Multi-Family Homes. It is first-of-its-kind 208V battery. Sunnova New Homes is the sole provider of the FranklinWH 120/208V multi-family home battery.

- In July 2023, Ameresco Announces Groundbreaking Contract for Battery Energy Storage Assets with United Power. Over 78MW will be added to Energy Assets in Development under a 20-year agreement.

- In March 2023, Brenmiller Energy announced increase in production by fourth quarter of 2023; Brenmiller believes it is on track to become one of the first global thermal energy storage (TES) companies with an operational TES production facility, allowing it to meet the market's growing demand. Annually, bGen TES modules can generate up to 4,000 MWh of clean energy capacity.

Energy Storage as a Service Market Report Scope

| Report Attribute | Details |

| Market Value in 2023 | USD 3.04 Billion |

| Forecast in 2030 | USD 10.69 Billion |

| CAGR | CAGR of 11.4% from 2023 to 2030 |

| Base Year of forecast | 2023 |

| Historical | 2018-2022 |

| Units | Revenue in USD billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Type, By End-User |

Key Companies profiled |

Tesla, Inc.; ENGIE Storage; Fluence Energy; EON; NextEra Energy Resources; STEM, Inc.; Saft; Swisscom Energy Solutions; Convergent Energy and Power; Advanced Microgrid Solutions |

Energy Storage as a Service Market Segmentation

Type Outlook (Revenue, USD Billion, 2018 - 2030)

- Customer Energy Management Services

- Ancillary Services

End-User Industry Outlook (Revenue, USD Billion, 2018 - 2030)

- Residential

- Commercial

- Industrial

- Utility

Energy Storage as a Service Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355