Report Overview

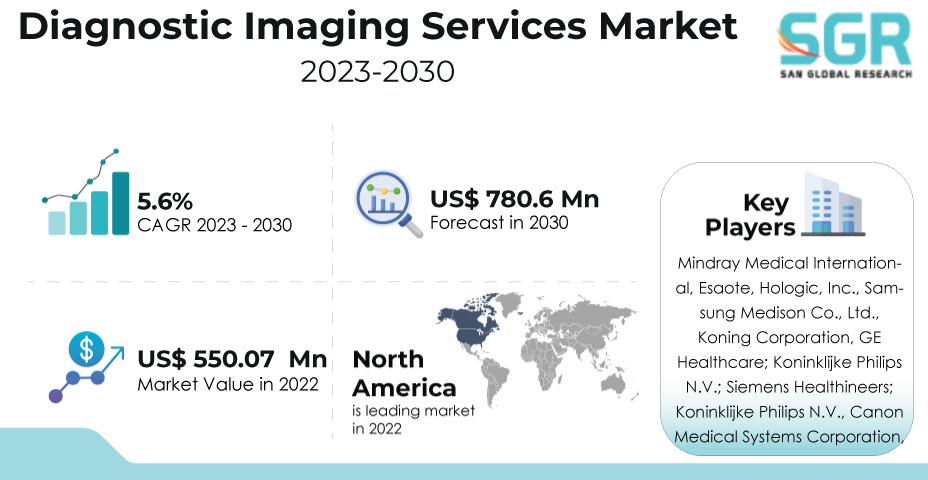

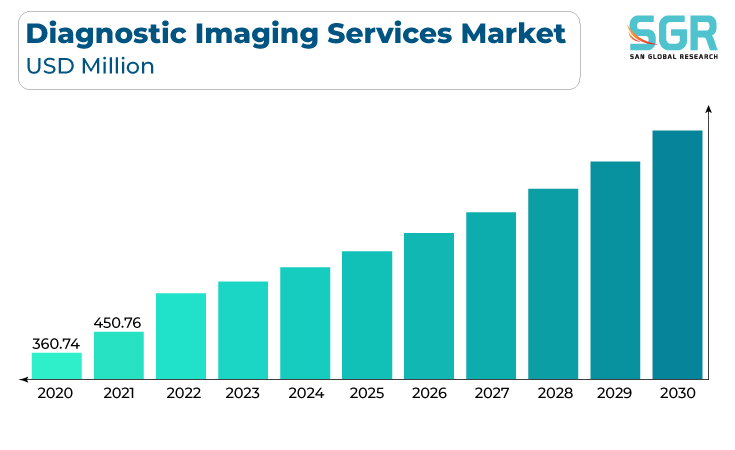

The Diagnostic Imaging Services Market was valued at 550.07 Billion in 2022 and expected to grow at CAGR of 5.1% over forecast period.

The rising prevalence of chronic diseases like cancer, cardiovascular disease, and neurological disorders necessitates accurate and timely diagnosis, fueling demand for diagnostic imaging services. The world's aging population is more vulnerable to various health issues that necessitate medical imaging for diagnosis and monitoring, resulting in increased demand for imaging services.

The Diagnostic Imaging Services Market Report focuses on a thriving and evolving industry that is influenced by a variety of factors. With the global prevalence of chronic diseases increasing, there is an increased demand for accurate and timely diagnosis, which is exacerbated by an aging population prone to health issues. The market thrives on ongoing technological advances that improve imaging quality and speed, allowing for more precise diagnostics. Patients seeking comprehensive care contribute to market growth as early detection becomes more important.

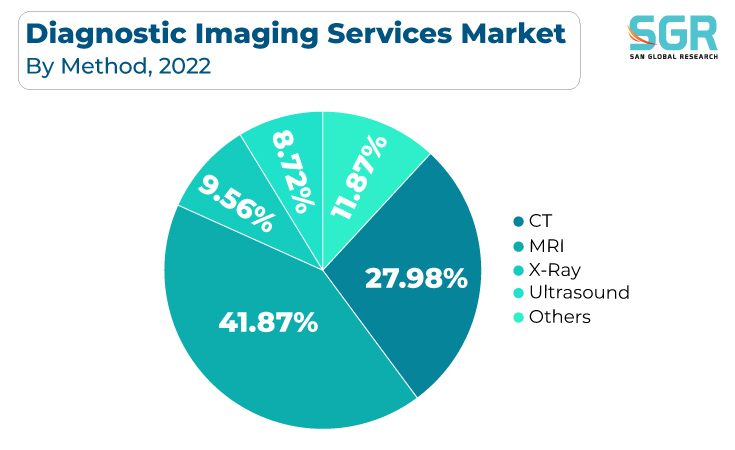

Method Outlook

Based on Method, the diagnostic imaging services market is segmented into CT, MRI, X-Ray, Ultrasound, and Others. X-Ray segment accounted for largest share in 2022.

X-ray imaging is a fundamental and widely used modality that is vital in medical diagnostics. It involves the use of electromagnetic radiation to create images of the body's internal structures. Here are some highlights from the X-ray segment. X-rays are versatile imaging tools that can show bones, lungs, teeth, and soft tissues. They are frequently used to diagnose fractures, infections, tumors, and other conditions.

Because of its wide range of applications, cost-effectiveness, and role in assisting rapid and accurate diagnoses across diverse medical scenarios, the X-ray segment remains an important component of the diagnostic imaging services market.

End-Use Outlook

Based on End-Use, Diagnostic Imaging Services Market is segmented into Cardiology, Neurology, Oncology, Orthopedics, Gynecology, and others. Cardiology accounted for largest share in 2022. The cardiology segment is crucial in the Diagnostic Imaging Services Market, encompassing a variety of imaging modalities and techniques aimed at assessing the cardiovascular system. The cardiology segment includes a variety of imaging modalities designed specifically to visualize the heart and blood vessels. Echocardiography, nuclear cardiology, cardiac MRI, and cardiac CT are examples of these modalities.

Within the diagnostic imaging services market, the cardiology segment addresses the specialized needs of patients with heart-related conditions, playing a critical role in diagnosing, monitoring, and treating a wide range of cardiovascular disorders.

Payor Outlook

Based on Deployment, Diagnostic Imaging Services Market is segmented into Public Health Insurance and Private Health Insurance/Out of Pocket. Private Health Insurance/Out of Pocket accounted for largest share in 2022. Health insurance reduces the financial burden of diagnostic imaging services by covering a portion of the costs, such as co-pays, deductibles, and gap fees. Some private health insurance policies include diagnostic imaging services as "extras" coverage. Individuals looking for all-inclusive healthcare coverage are drawn to these comprehensive policies.

Governments and policymakers demonstrate their commitment to healthcare by addressing a critical component of healthcare infrastructure by providing diagnostic imaging services through public insurance programs.

Establishments Outlook

Based on Establishments, Diagnostic Imaging Services Market is segmented into Hospitals, Imaging Centers, and Others. Imaging Centers accounted for largest in 2022.

Imaging centers hold a critical position in the Diagnostic Imaging Services market, thanks to a convergence of factors. These centers, which are outfitted with cutting-edge technology and specialized expertise, provide a variety of advanced diagnostic modalities under one roof, ensuring accurate and efficient diagnoses. They provide convenient access, reduced waiting times, and a comfortable environment by streamlining workflows and optimizing patient experiences. Imaging centers attract a high patient volume as cost-effective alternatives to hospital-based services, fostering referral relationships and community integration. Their emphasis on subspecialty expertise, outpatient care, and preventive services aids in disease detection and improves patient outcomes.

Hospitals are key drivers of the Diagnostic Imaging Services market, driven by a variety of factors. Hospitals, with their comprehensive healthcare facilities, offer a wide range of diagnostic imaging services to patients with a variety of medical needs.

Regional Outlook

North America is emerged as leading market for Diagnostic Imaging Services Market in 2022. A dynamic interplay of factors propels the North America Diagnostic Imaging Services market. Rapid technological advancements and a strong healthcare infrastructure encourage the use of cutting-edge imaging technologies, which improve diagnostic accuracy and patient outcomes. The region's aging population drives up demand for diagnostic imaging as a critical tool for diagnosing age-related health problems. Routine imaging is encouraged by private health insurance coverage and the high prevalence of chronic diseases, ensuring early detection and effective treatment. Collaborations between industry and research institutions encourage innovation and the development of new imaging techniques.

Asia Pacific is expected to be the second-most prominent area in terms of Diagnostic Imaging Services Market share. A convergence of influential factors is propelling the Asia Pacific Diagnostic Imaging Services market. Rapid economic growth and urbanization drive up healthcare spending, increasing access to advanced diagnostic imaging services. Demand for imaging procedures is driven by the region's large and diverse population, particularly as a means of early disease detection.

Diagnostic Imaging Services Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 550.07 Million |

| Forecast in 2030 | USD 780.6 Million |

| CAGR | CAGR of 5.6% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Method, By End-use, By Payor, and By Establishment |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies Profiled | Mindray Medical International, Esaote, Hologic, Inc., Samsung Medison Co., Ltd., Koning Corporation, GE Healthcare; Koninklijke Philips N.V.; Siemens Healthineers; Koninklijke Philips N.V., Canon Medical Systems Corporation |

Global Diagnostic Imaging Services Market, Report Segmentation

Diagnostic Imaging Services Market, By Establishment

- CT

- MRI

- X-Ray

- Ultrasound

- Others

Diagnostic Imaging Services Market, By Establishment

- Cardiology

- Neurology

- Oncology

- Ultrasound

- Orthopedics

Diagnostic Imaging Services Market, By Establishment

- Public Health Insurance

- Private Health Insurance/Out of Pocket

Diagnostic Imaging Services Market, By Establishment

- Hospitals

- Imaging Centers

- Others

Diagnostic Imaging Services Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355