Report Overview

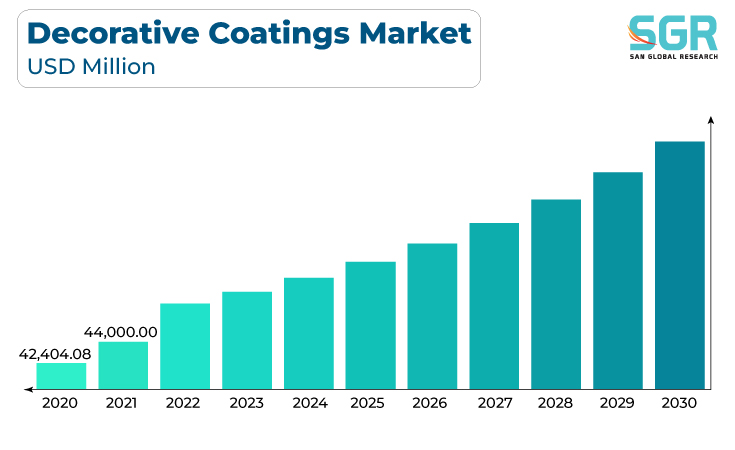

The Decorative coatings Market was valued at 45,653.87 million in 2022 and expected to grow at CAGR of 4.5% over forecast period.

The global trend of urbanization, particularly in emerging economies, leads to increased construction activities, driving the demand for decorative coatings in residential and commercial spaces. Changing architectural and design preferences, along with a growing emphasis on aesthetics and visual appeal, drive the demand for innovative and decorative coatings in construction and interior design.

In addition, Stringent environmental regulations and a shift towards sustainable practices encourage the use of eco-friendly and low-VOC decorative coatings, aligning with global environmental concerns. Moreover, growing real estate activities, including residential, commercial, and industrial construction projects, create a substantial demand for decorative coatings as developers seek visually appealing and durable solutions.

The global construction industry's growth contributes significantly to the demand for building materials, including decorative coatings. As urbanization and infrastructure development continue, the need for durable and reliable decorative coating materials rises.

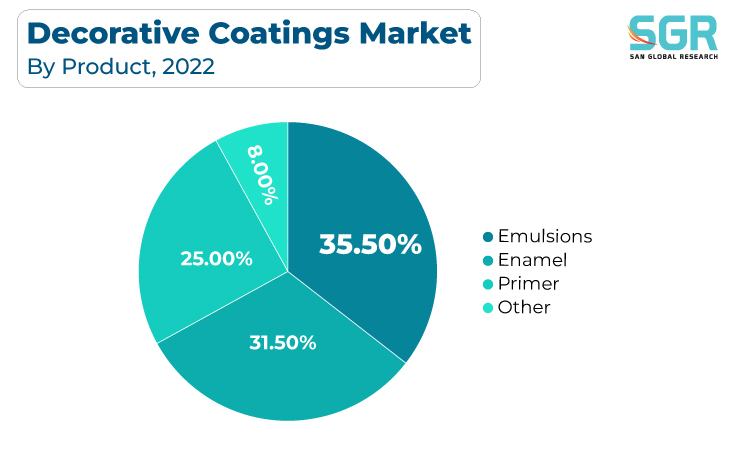

Product Outlook

Based on Product, the decorative coatings market is segmented into emulsions, enamel, primer and others. Emulsion segment accounted for largest share in 2022. Water-based emulsion paints are known for their low volatile organic compound (VOC) content compared to solvent-based alternatives. Growing environmental consciousness and regulatory pressures have led consumers and industries to prefer eco-friendly and sustainable coatings, making emulsions an attractive choice.

Moreover, Emulsion paints have a low odor compared to solvent-based paints, providing a healthier and more comfortable environment for occupants. This characteristic is particularly important in residential and indoor spaces, contributing to the increasing preference for emulsion coatings.

Thus, the growth of the decorative coatings market is significantly driven by the widespread adoption of emulsion paints, driven by their environmentally friendly nature, low odor, ease of application, versatility, durability, regulatory support, affordability, and continuous technological advancements. As consumer preferences and environmental considerations continue to shape the market, emulsion paints are likely to maintain their strong position in the decorative coatings industry.

Regional Outlook

Asia-Pacific has emerged as leading market for decorative coatings market in 2022. Several key factors are driving the Asia-Pacific Decorative coatings Market such as the Asia-Pacific has experienced robust economic growth, leading to an increase in construction activities, both residential and commercial. Also, Rapid urbanization has resulted in a surge in infrastructure development, including residential and commercial buildings, which boosts the demand for decorative coatings.

In addition, ongoing real estate development, particularly in emerging economies within the Asia-Pacific region, has led to a surge in demand for decorative coatings. Both residential and commercial real estate projects contribute to the growth of the market as developers seek high-quality coatings for their projects.

Some countries in the Asia-Pacific region have introduced policies and initiatives to promote sustainable and energy-efficient construction practices. This has led to an increased demand for coatings that offer not only aesthetic appeal but also contribute to energy efficiency and sustainability.

Decorative Coatings Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 45,653.87 Million |

| Forecast in 2030 | USD 64,564.10 Million |

| CAGR | CAGR of 4.5% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Resin Type, By Product, By Technology, By Coating Type, By Application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies Profiled | AkzoNobel, PPG Industries, Sherwin-Williams, Valspar, Benjamin Moore, Asian Paints, Nippon Paint, Jotun, Berger Paints among Others |

Global Decorative Coatings Market, Report Segmentation

Decorative Coatings Market, By Resin Type

- Acrylic

- Polyurethane

- Alkyd

- Vinyl

- Other

Decorative Coatings Market, By Product

- Enamel

- Primer

- Emulsions

- Others

Decorative Coatings Market, By Technology

- Waterborne Coatings

- Solventborne Coatings

- Powder Coatings

Decorative Coatings Market, By By Coating Type

- Interior

- Exterior

Decorative Coatings Market, By Application

- Residential

- Non-Residential

Decorative Coatings Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355