Report Overview

The Customer Data Platform market was valued at 790.68 million in 2022 and expected to grow at CAGR of 28.96% over forecast period.

The growing importance of data-driven decision-making in business is driving the Customer Data Platform (CDP) market. In order to gain a competitive advantage and improve customer experiences, organizations recognize the need for a unified and comprehensive view of customer data, which CDPs provide by aggregating data from multiple sources.

Furthermore, growing concerns about data privacy and regulatory compliance are compelling businesses to invest in CDPs that can assist them in better managing and protecting customer data. The rise of omnichannel marketing strategies and the demand for personalized customer experiences drive the CDP market even further, as these platforms enable businesses to deliver targeted and relevant content across multiple touchpoints, ultimately improving customer engagement and loyalty.

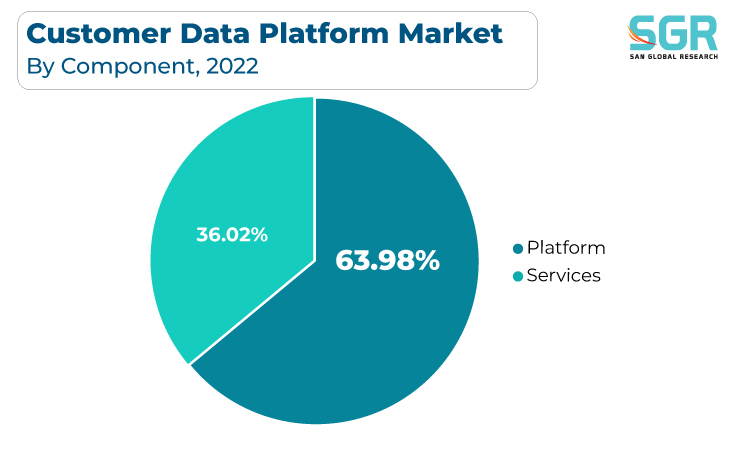

Component Outlook

Based on Component, the Customer Data Platform is segmented Platform and Services. Platform segment accounted for largest share in 2022. Platform CDPs provide a solution by seamlessly integrating with other marketing and analytics tools as businesses prioritize a holistic view of customer data and seek to break down data silos. This integration capability is critical for businesses that want to run sophisticated marketing campaigns, optimize customer journeys, and increase ROI.

Furthermore, the demand for real-time data access and analysis, combined with the need to adapt to rapidly changing customer behaviors, drives Platform CDP adoption. Businesses are recognizing the strategic importance of these platforms in gaining actionable insights and remaining competitive in a data-centric era.

Deployment Outlook

Based on Deployment, Customer Data Platform is segmented into Cloud and On-premises. On premises accounted for largest share in 2022. A number of factors are driving the On-Premises Customer Data Platform (CDP) market, including increased concerns about data privacy and security, regulatory compliance requirements such as GDPR and CCPA, and the need for businesses to have greater control over their customer data. On-premises CDP solutions enable businesses to keep sensitive customer data within their own secure infrastructure, lowering the risks of data breaches and ensuring compliance with data protection regulations.

Businesses are turning to cloud CDPs to streamline data management, reduce infrastructure overhead, and take advantage of cloud platforms' agility and global accessibility. Furthermore, the growing importance of data-driven marketing and personalized customer engagement strategies, as well as the need for quick adaptability to changing market conditions, is driving cloud CDP adoption, allowing organizations to harness actionable customer insights efficiently and at scale.

Type Outlook

Based on Type, Customer Data Platform is segmented into Access, Analytics, and Campaign. On premises accounted for largest share in 2022. Several critical factors are driving the Access Customer Data Platform (CDP) market, including the growing need for seamless and unified access to customer data across various touch points and channels, the rising demand for personalized and data-driven marketing strategies, and the growing importance of compliance with data privacy regulations such as GDPR and CCPA.

Businesses are realizing that having quick and easy access to comprehensive customer data is critical for improving customer experiences and making informed decisions. Access CDPs provide a centralized data repository, enabling organizations to break down data silos, gain a 360-degree view of their customers, and provide more personalized and timely interactions. Furthermore, the growing emphasis on data security and privacy

Industry Outlook

Based on Industry, Customer Data Platform is segmented into Banking, Financial Services and Insurance (BFSI), Retail and E-commerce, Information Technology (IT) and Telecom, Media and Entertainment, Travel and Hospitality, Healthcare, and Others. Retail and E-commerce accounted for largest share in 2022. A number of factors are driving the Retail and E-commerce Customer Data Platform (CDP) market, including increased competition in the online retail landscape, increased customer expectations for personalized shopping experiences, and the need for data-driven decision-making to optimize marketing efforts and inventory management.

CDPs are increasingly being used by healthcare organizations to consolidate fragmented patient data from various sources, allowing for a comprehensive view of patient history, treatments, and preferences. This consolidated data allows healthcare providers to provide more personalized care, optimize resource allocation, and streamline administrative processes. Furthermore, the need to comply with stringent healthcare data regulations such as HIPAA, as well as the desire to improve cybersecurity measures to protect sensitive patient information, are driving the adoption of CDPs in the healthcare industry, ensuring both data security and regulatory compliance.

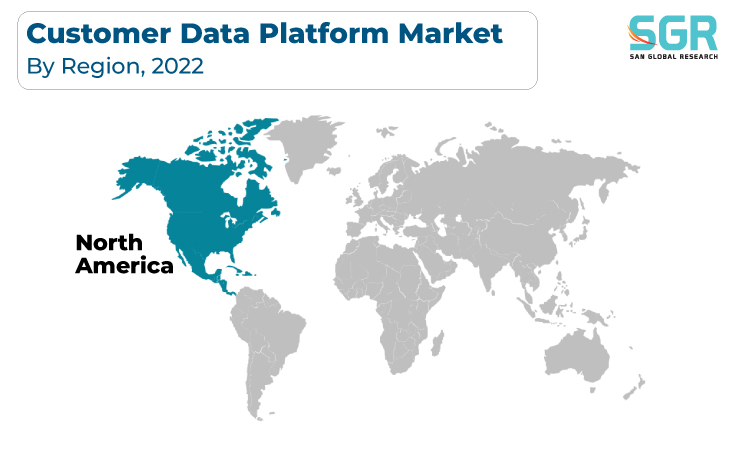

Regional Outlook

North America is emerged as leading market for Customer Data Platform in 2022. Several key factors are driving the North American Customer Data Platform (CDP) market. For starters, the growing emphasis on data-driven marketing strategies, as well as the need for businesses to gain deeper insights into customer behavior and preferences, are driving demand for CDPs. Second, rising awareness of data privacy and compliance regulations such as GDPR and CCPA is driving organizations to invest in CDPs that can help them manage and protect customer data more effectively.

CDPs are being used by European organizations to ensure compliance with data privacy regulations, as these platforms provide tools for handling customer data responsibly. Furthermore, the European market's diversity necessitates sophisticated data management and segmentation capabilities provided by CDPs, allowing companies to deliver personalized experiences across multiple languages and cultural contexts. As companies seek to deepen customer relationships and optimize marketing spend, the use of CDPs in Europe is increasing in order to capture customer insights and foster brand loyalty while maintaining data privacy and compliance.

Customer Data Platform Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 790.68 Million |

| Forecast in 2030 | USD 10.03 Billion |

| CAGR | CAGR of 28.96% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Component, By Deployment, By Type, By Industry |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | mParticle, Inc.; Oracle; SAP SE; Adobe; Tealium; Leadspace; Kabbage Inc.; Salesforce.com; AgileOne |

Global Customer Data Platform Market, Report Segmentation

Customer Data Platform Market, By Component

- Platform

- Services

Customer Data Platform Market, By Deployment

- Cloud

- On-premises

Customer Data Platform Market, By Type

- Access

- Analytics

Customer Data Platform Market, By Industry

- Banking

- Financial Services and Insurance (BFSI)

- Retail and E-commerce

- Information Technology (IT) and Telecom

- Media and Entertainment

- Travel and Hospitality

- Healthcare

- Others

Customer Data Platform Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355