Report Overview

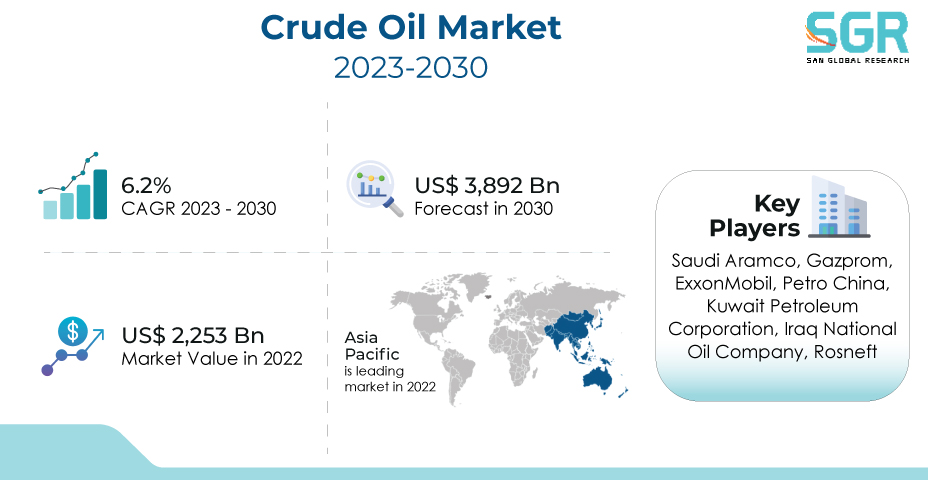

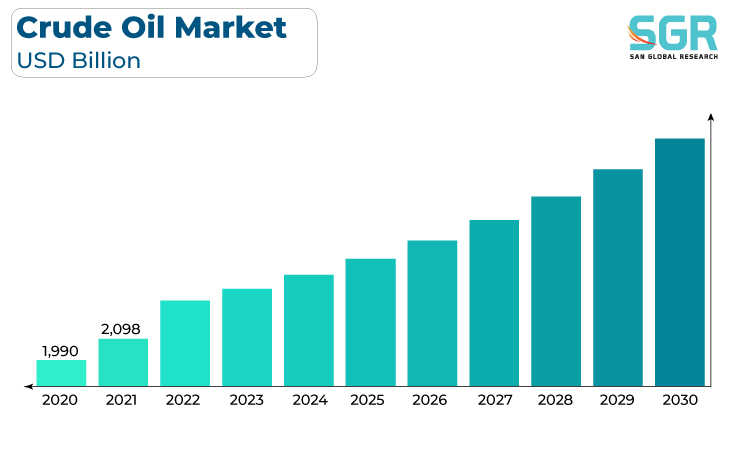

The Crude Oil Market was valued at USD 2,253 billion in 2022 and expected to grow at CAGR of 6.2% over forecast period.

A complex interplay of global factors influences the crude oil market, including supply and demand dynamics, geopolitical tensions, economic growth, and environmental policies. Crude oil price fluctuations are caused by changes in production, which are frequently influenced by OPEC+ decisions and geopolitical events affecting major oil-producing regions. Furthermore, economic growth, industrial activity, and transportation demand all have an impact on oil consumption.

Government policies such as production quotas, renewable energy incentives, and environmental regulations, as well as efforts to transition to cleaner energy sources and reduce carbon emissions, are increasingly shaping the market. As a result, the Crude Oil market is highly sensitive to a wide range of factors, making it vulnerable to both short-term volatility and long-term structural changes in the energy landscape.

Category Outlook

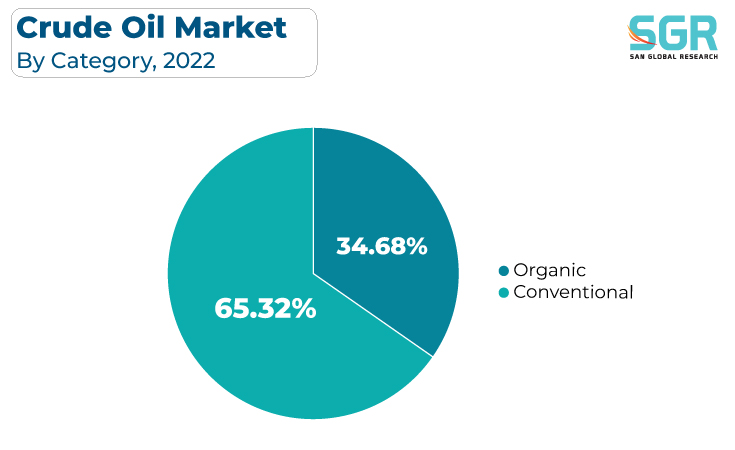

Based on Category, the Crude Oil Market is segmented into Organic, Conventional. Conventional segment accounted for largest share in 2022. The Conventional Crude Oil market is primarily driven by factors that influence global energy supply and demand dynamics, including geopolitical tensions, production decisions by major oil-producing nations and organizations like OPEC+, economic growth, and transportation demand. Additionally, energy security, infrastructure development, technological advancements in exploration and extraction, and investment in the oil sector play crucial roles in shaping the market

Market drivers are frequently interconnected, and their effects on crude oil prices are significant, making the sector vulnerable to geopolitical events and changes in economic conditions, as well as shifts in energy policy, environmental regulations, and sustainability considerations, given the increasing global focus on reducing carbon emissions.

Derivatives Outlook

Based on Derivatives, Crude Oil Market is segmented into Praffin, Napthene, Aromatic, Asphaltic. Paraffin accounted for largest share in 2022.In the context of crude oil, paraffin compounds typically refer to a group of saturated hydrocarbons that are not the same as the paraffin wax used in the manufacture of candles and other products. Paraffin wax, a solid hydrocarbon derived from crude oil, is used to make candles, wax paper, and some coatings. Because of its properties as an insulator, lubricant, and water repellent, paraffin wax is also used in industries such as packaging and cosmetics.

Naphthenic compounds are primarily found in crude oil as a type of hydrocarbon, and their specific applications are typically in the petrochemical industry for various chemical processes such as the production of specific chemicals, solvents, and additives. Lubricants and motor oils are typically made from base oils that have been specially refined and processed to meet the application's specifications.

Aromatic hydrocarbons, such as benzene, toluene, and xylene (BTX), are widely used in the petrochemical industry for a variety of purposes. These compounds are critical building blocks in the production of plastics, synthetic fibers, and a variety of industrial products. Benzene, in particular, is an important raw material in the manufacture of chemicals such as styrene, which is used in the production of polystyrene, and phenol, which is used in the production of resins, adhesives, and a variety of other chemical products. These aromatic compounds are useful feedstocks for a wide range of chemical processes.

Regional Outlook

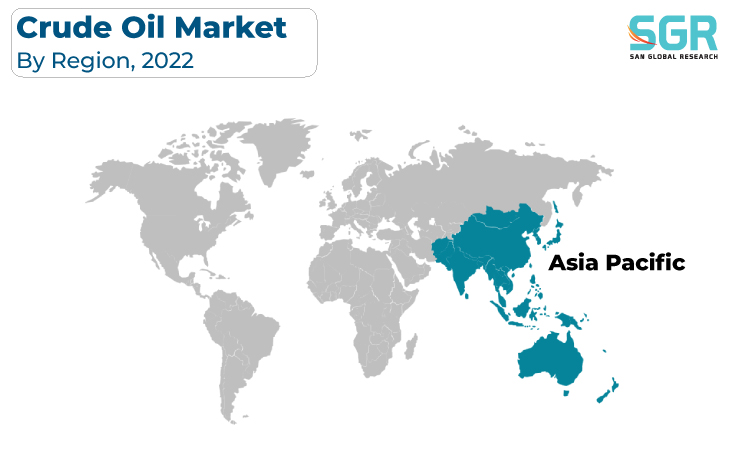

Asia pacific is emerged as leading market for Crude Oil Market in 2022. The Asia Pacific Crude Oil market is heavily influenced by a number of factors, including the region's strong economic growth, rising energy demand, and industrial expansion, all of which drive crude oil consumption for transportation and manufacturing. Because the region is home to both major oil-consuming and key oil-producing countries, geopolitical tensions, global supply fluctuations, and regional production decisions all play a role in shaping the market.

Europe’s strong emphasis on environmental sustainability and the transition to cleaner energy sources drives the Europe Crude Oil market. Policies and regulations promoting renewable energy and energy efficiency have a significant impact on crude oil demand as Europe actively works to reduce carbon emissions. Geopolitical events, such as supply disruptions and global production decisions, also have an impact on the market. Europe's commitment to energy security and efforts to diversify its energy sources shape crude oil demand even more.

Crude Oil Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 2,253 Billion |

| Forecast in 2030 | USD 3,892 Billion |

| CAGR | CAGR of 6.2% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Category, By Derivatives |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Saudi Aramco, Gazprom, ExxonMobil, PetroChina, Kuwait Petroleum Corporation, Iraq National Oil Company, Rosneft |

Crude Oil Market, Report Segmentation

Category Outlook (Revenue, USD Billion, 2018 - 2030)

- Organic

- Conventiona

Derivatives Outlook (Revenue, USD Billion, 2018 - 2030)

- Praffin

- Napthene

- Aromatic

- Asphaltic

Crude Oil Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355