Report Overview

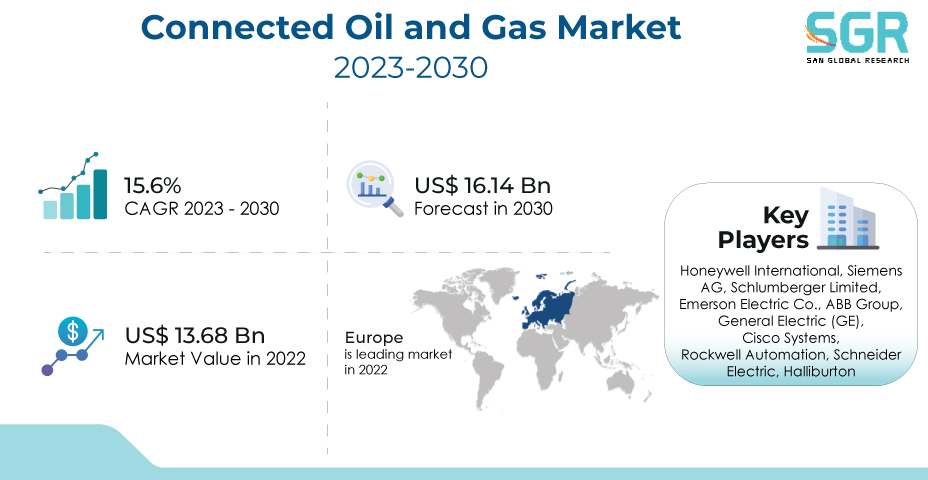

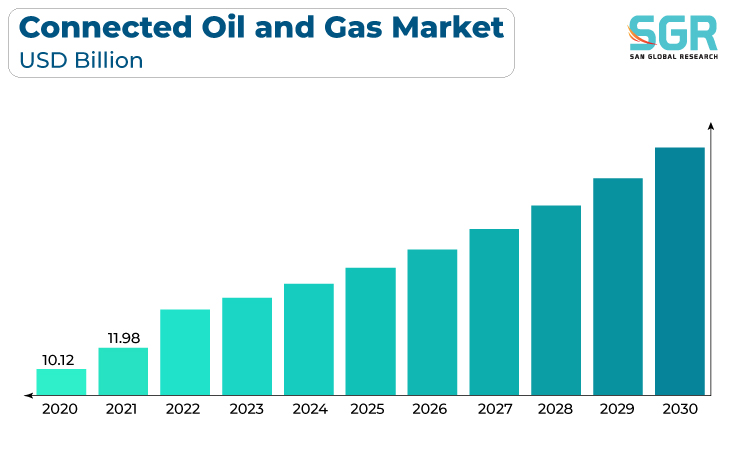

The Connected Oil and Gas Market was valued at USD 13.68 billion in 2022 and expected to grow at CAGR of 15.3% over forecast period.

A combination of factors, including rising energy demand, the need to transport hydrocarbons from production sites to consumption centers, and the expansion of unconventional oil and gas sources, is driving the global Connected Oil and Gas Market. Furthermore, geopolitical factors and energy security concerns influence pipeline infrastructure development, as countries seek to diversify their energy sources and reduce reliance on unstable regions.

The increasing global energy demand and the need for reliable, uninterrupted supply are pushing oil and gas companies to adopt connected technologies to maximize production and distribution efficiency. Overall, the Connected Oil and Gas Market is being driven by a convergence of technology, regulatory, environmental, and market factors that are reshaping the industry and enabling it to meet the challenges of the future.

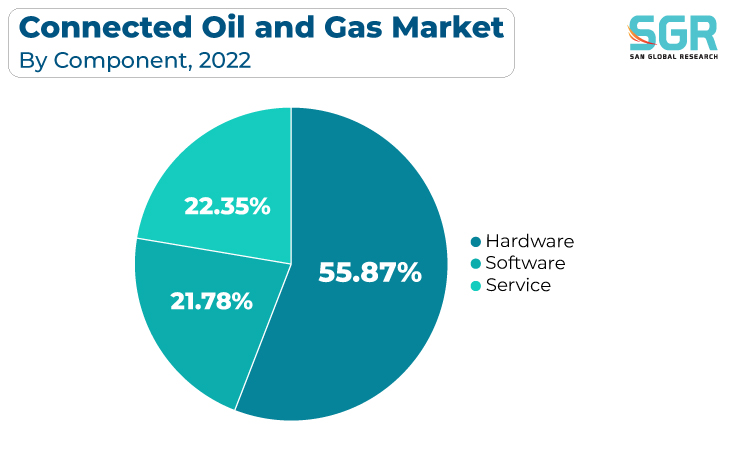

Component Outlook

Based on Component, the Connected Oil and Gas Market are segmented into Hardware, Software, and Services. Hardware segment accounted for largest share in 2022. The Hardware segment in the Connected Oil and Gas Market is primarily driven by the industry's pursuit of operational efficiency, safety enhancement, and cost reduction through the deployment of advanced sensor technologies, IoT devices, and ruggedized hardware solutions. The need to monitor and control critical infrastructure, equipment, and assets in remote and challenging environments, such as offshore platforms and drilling sites, is compelling oil and gas companies to invest in robust hardware components.

Moreover, the rise in cybersecurity threats, regulatory requirements, and the industry's expansion into remote and challenging environments is driving investment in software that ensures the integrity, security, and resilience of connected systems, ultimately reshaping the future of the oil and gas sector.

Application Outlook

Based on Application, Connected Oil and Gas Market is segmented into Asset Tracking & Monitoring, Predictive & Preventive Maintenance, Supply Chain Management, Leak Detection, Fleet Management. Asset Tracking & Monitoring accounted for largest share in 2022. Asset tracking and monitoring solutions in the Connected Oil and Gas Market are primarily driven by the need to enhance operational efficiency and safety, minimize downtime, and optimize resource utilization. These solutions enable real-time visibility into the location, status, and condition of valuable assets and equipment, making it possible to prevent asset loss, streamline maintenance processes, and improve overall productivity.

The industry's expansion into remote and challenging locations, coupled with the need for just-in-time inventory management and increased regulatory scrutiny, has amplified the importance of robust supply chain management. Moreover, the global energy transition and evolving market dynamics require oil and gas companies to be more agile and responsive, making connected supply chain solutions an essential driver for adapting to change and maintaining competitiveness in the sector.

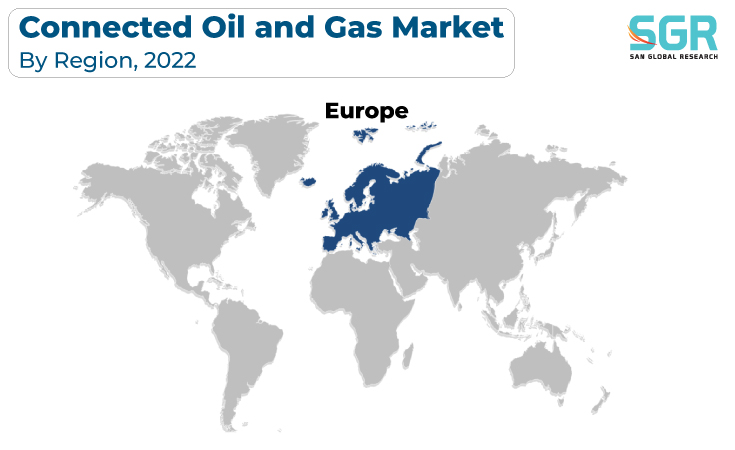

Regional Outlook

Europe is emerged as leading market for Connected Oil and Gas Market in 2022. The Europe Connected Oil and Gas Market is being driven primarily by a combination of factors, including stringent environmental regulations and a growing emphasis on sustainability, which are compelling energy companies to adopt connected technologies in order to optimize operations, reduce emissions, and ensure compliance. Furthermore, the growth of renewable energy sources, as well as the need to integrate them into existing energy infrastructure, is driving the adoption of connected systems for efficient grid management and energy distribution.

The rising demand for clean energy and the push for diversification, coupled with the geopolitical importance of energy security, are further motivating Middle Eastern oil and gas companies to invest in advanced connected solutions, which enable real-time monitoring, predictive maintenance, and operational resilience, ultimately reinforcing their position as global energy leaders.

Connected Oil and Gas Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 13.68 Billion |

| Forecast in 2030 | USD 16.14 Billion |

| CAGR | CAGR of 15.6% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD billion and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Component, By Application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled |

Honeywell International, Siemens AG, Schlumberger Limited, Emerson Electric Co., ABB Group, General Electric (GE), Cisco Systems, Rockwell Automation, Schneider Electric, Halliburton |

Connected Oil and Gas Market, Report Segmentation

Component Outlook (Revenue, USD Billion, 2018 - 2030)

- Hardware

- Software

- Servicesection

Application Outlook (Revenue, USD Billion, 2018 - 2030)

- Asset Tracking & Monitoring

- Predictive & Preventive Maintenance

- Supply Chain Management

- Leak Det

- Fleet Management

Connected Oil and Gas Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355