Report Overview

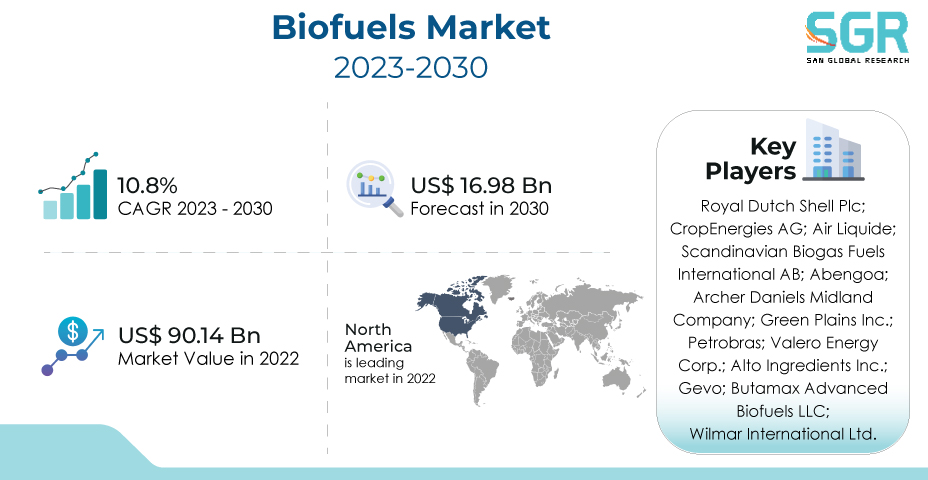

The Biofuels Market was valued at 90.14 Billion in 2022 and expected to grow at CAGR of 10.8% over forecast period.

The growing global demand for sustainable and environmentally friendly alternatives to fossil fuels is driving the biofuels market. Concerns about climate change and the depletion of finite fossil fuel reserves have heightened interest in biofuels, which are derived from renewable sources like agricultural crops, waste materials, and algae. Government regulations and policies encouraging the use of biofuels, combined with technological advancements that improve their production efficiency, have fueled market growth even further.

Furthermore, the desire to achieve energy security by reducing reliance on imported oil, as well as the potential for rural development and job creation through biofuel production, all contribute to market growth.

Feedstock Outlook

Based on Feedstock, the Biofuels Market is segmented into Corn, Sugarcane. Sugarcane segment accounted for largest share in 2022.

Several factors influence the sugarcane market, including its widespread use as a key raw material for sugar production, ethanol biofuel, and a variety of other industrial applications. Because of its high sucrose content, it is a primary source of sugar, and the growing demand for biofuels has led to its use in ethanol production, particularly in countries with biofuel mandates.

Corn-based biofuels, particularly ethanol, are critical to meeting fuel blending mandates and carbon reduction targets. Furthermore, the agricultural abundance of corn, combined with technological and crop yield advancements, increases the feasibility of large-scale biofuel production. Concerns about energy security and the desire to reduce reliance on imported fossil fuels drive the market even further, while the potential for rural economic growth through corn cultivation and biofuel processing cements its position as a sustainable energy solution.

Application Outlook

Based on Application, Biofuels Market is segmented into Transportation, Aviation. Transportation accounted for largest share in 2022.

The transportation biofuels market is supported by a complex set of drivers, including rising environmental awareness and the need to reduce the transportation sector's carbon footprint. Demand for biofuels as a cleaner alternative to traditional fossil fuels is being driven by stricter emissions regulations and sustainability goals.

Stricter emissions regulations, as well as the aviation industry's commitment to reducing its carbon footprint, have created a demand for environmentally friendly alternatives to traditional jet fuels. Aviation biofuels derived from algae, waste oils, and plant-based feedstocks have the potential to significantly reduce greenhouse gas emissions while also improving overall fuel efficiency. Furthermore, collaborations among airlines, governments, and biofuel producers, as well as research and investment in advanced biofuel technologies, are propelling the development and adoption of aviation biofuels. As a result, the market is increasingly focused on achieving more sustainable air travel while ensuring the aviation industry's long-term energy security.

Form Outlook

Based on Form, Biofuels Market is segmented into Biodiesel, Ethanol. Biodiesel accounted for largest share in 2022. Liquid biofuels, such as biodiesel and ethanol, are being driven by a number of factors, including a growing global emphasis on reducing carbon emissions, the need for diverse and sustainable energy sources, and government policies that encourage the use of renewable fuels. These biofuels can be used in place of traditional fossil fuels in transportation and industry, assisting in the transition to a greener energy landscape.

Solid biofuels, such as wood pellets, agricultural residues, and biomass briquettes, are being propelled by a confluence of factors such as the push for renewable energy sources, efforts to reduce greenhouse gas emissions, and the need for sustainable waste management. Because of their lower carbon intensity and potential to replace fossil fuels, these biofuels are increasingly being used for heat and power generation in residential, commercial, and industrial settings.

Product Outlook

Based on Product, Biofuels Market is segmented into Solid, Liquid. Liquid accounted for largest share in 2022. Liquid biofuels, such as biodiesel and ethanol, are being driven by a number of factors, including a growing global emphasis on reducing carbon emissions, the need for diverse and sustainable energy sources, and government policies that encourage the use of renewable fuels. These biofuels can be used in place of traditional fossil fuels in transportation and industry, assisting in the transition to a greener energy landscape.

Ethanol, which is typically made from sugarcane, corn, or other plant-based feedstocks, is a greener alternative to gasoline that has the potential to reduce greenhouse gas emissions and improve air quality. Government regulations and policies encouraging the use of renewable fuels, as well as a growing emphasis on environmentally friendly transport solutions, drive ethanol demand.

Regional Outlook

North America is emerged as leading market for Biofuels Market in 2022. A combination of factors, including stringent environmental regulations, a focus on energy security, and a desire to reduce reliance on fossil fuels, is driving the North American biofuels market. Government policies that encourage the use of renewable fuels, as well as commitments to carbon reduction targets, boost demand for biofuels in the region. The region's vast agricultural resources, particularly in the United States and Canada, contribute to the availability of biofuel feedstocks like corn and soybeans. Technological advancements in biofuel production processes, combined with increased public awareness of climate change, promote the use of biofuels as a cleaner alternative.

Europe is expected to be the second-most prominent area in terms of Biofuels Market share. Biofuels are required by European Union policies such as the Renewable Energy Directive (RED) and the Fuel Quality Directive (FQD) to reduce greenhouse gas emissions and promote sustainable energy sources. The region's limited domestic fossil fuel resources, as well as concerns about energy security, increase the demand for biofuels. Europe's well-developed agricultural sector serves as a foundation for the production of biofuel feedstock, such as rapeseed and wheat for biodiesel and bioethanol. Technological advancements in biofuel production, combined with rising consumer demand for environmentally friendly alternatives, drive market growth.

Biofuels Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 90.14 Billion |

| Forecast in 2030 | USD 16.98 Billion |

| CAGR | CAGR of 10.8% from 2023 to 2030 |

| Base Year of forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Feedstock, By Application, By Form, By Product |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Royal Dutch Shell Plc; CropEnergies AG; Air Liquide; Scandinavian Biogas Fuels International AB; Abengoa; Archer Daniels Midland Company; Green Plains Inc.; Petrobras; Valero Energy Corp.; Alto Ingredients Inc.; Gevo; Butamax Advanced Biofuels LLC; Wilmar International Ltd. |

Global Biofuels Market Report Segmentation

Biofuels Market, By Feedstock

- Corn

- Sugarcane

Biofuels Market, By Application

- Transportation

- Aviation

Biofuels Market, By Form

- Biodiesel

- Ethanol

Biofuels Market, By Product

- Solid

- Liquid

Biofuels Market, Regional Outlook

North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355