Report Overview

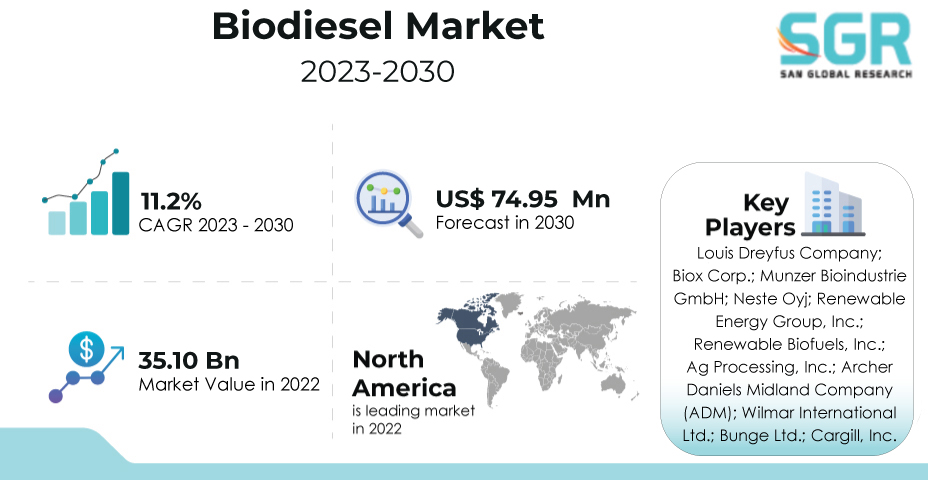

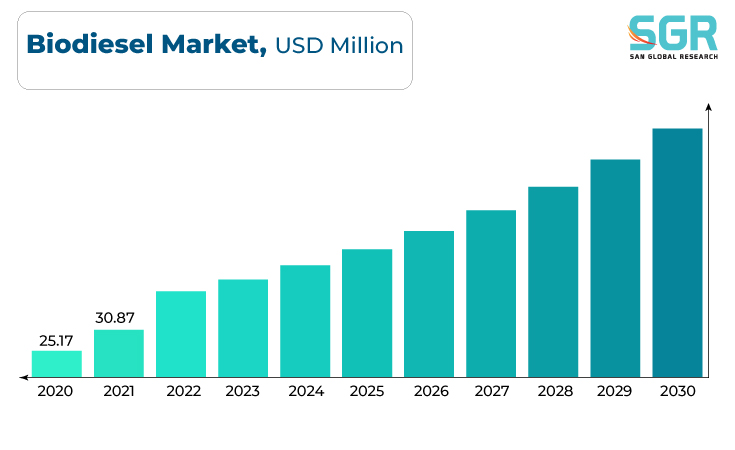

The Biodiesel Market was valued at 35.10 Billion in 2022 and expected to grow at CAGR of 11.2% over forecast period.

The biodiesel market is propelled by a complex interplay of factors that highlight its critical role in shaping a more sustainable and environmentally friendly energy landscape. Rising environmental concerns, combined with the need to reduce carbon emissions and reliance on fossil fuels, drive biodiesel adoption as a renewable alternative for transportation and industrial sectors.

Government mandates, mandates, and incentives to promote the use of biofuels accelerate market growth. Technological advancements in biodiesel production, feedstock sourcing, and refining processes improve efficiency and increase biodiesel's economic viability. The push for energy security, rural development, and sustainable agriculture all help to drive demand for biodiesel, which provides a way to add value to agricultural residues and byproducts.

Feedstock Outlook

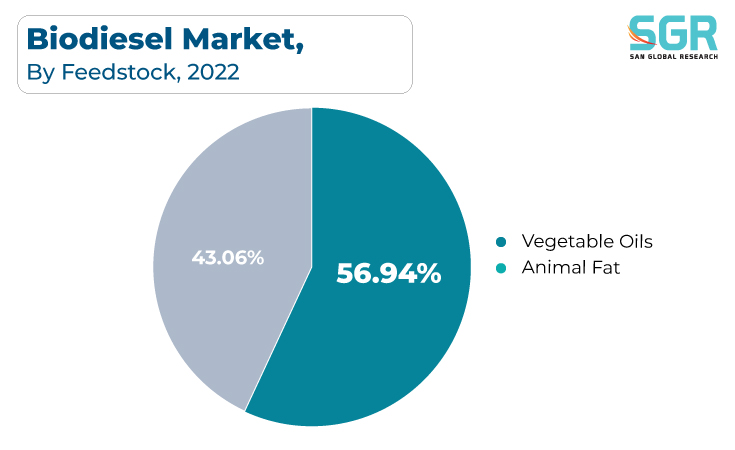

Based on Method, the Biodiesel Market is segmented into Vegetable Oils and Animal Fats. Vegetable Oils segment accounted for largest share in 2022. Government policies, mandates, and incentives that encourage the use of biofuels help to drive market growth. Technological advances in manufacturing processes, such as transesterification, improve efficiency and enable cost-effective biodiesel production from a variety of vegetable oil sources. Collaborations between energy companies, agricultural sectors, and research institutions drive innovation by optimizing vegetable oil selection, refining production techniques, and solidifying their critical role in advancing a sustainable and environmentally conscious biodiesel market.

The market for Animal Fats Biodiesel is being propelled by a dynamic mix of influential factors that highlight its critical role in sustainable energy solutions and waste utilization. The growing need to reduce greenhouse gas emissions and reliance on fossil fuels drives the use of animal fats as a biodiesel feedstock. Using animal fats as a resource reduces waste and improves resource efficiency in the agricultural and food processing sectors.

Application Outlook

Based on Application, Biodiesel Market is segmented into Fuel and Power Generation. Fuel accounted for largest share in 2022. The Biodiesel Fuel market is being driven by a dynamic interplay of factors that highlight its critical role in fostering a more sustainable and eco-friendly energy landscape. Concerns about climate change, emissions reduction, and energy security are driving the use of biodiesel as a renewable substitute for conventional diesel fuel. Stringent government regulations, mandates, and incentives to encourage the use of biofuels, combined with increased consumer awareness about the environmental impact, drive market growth. Technological advancements in biodiesel production methods, feedstock diversity, and refining processes improve biodiesel fuel efficiency, quality, and cost-effectiveness.

Regional Outlook

North America is emerged as leading market for Biodiesel Market in 2022. Increasing environmental awareness, combined with stringent regulations and mandates aimed at reducing greenhouse gas emissions, drives biodiesel adoption as a cleaner alternative to conventional diesel fuel. The region's abundant agricultural resources, particularly soybeans and used cooking oils, contribute to biodiesel feedstock availability. Government policies, renewable fuel standards, and incentives accelerate market growth even further. Technological advances in biodiesel production processes and infrastructure, as well as collaborations between energy companies, agricultural stakeholders, and policymakers, foster innovation, optimize feedstock utilization, and boost biodiesel adoption as a key driver of greener transportation and energy diversification across North America.

Biodiesel Market Report Scope

| Report Attribute | Details |

| Market Value in 2022 | USD 35.10 Billion |

| Forecast in 2030 | USD 74.95 Million |

| CAGR | CAGR of 11.2% from 2023 to 2030 |

| Base Year of Forecast | 2022 |

| Historical | 2018-2021 |

| Units | Revenue in USD million and CAGR from 2023 to 2030 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Feedstock, By Application |

| Regions Covered | North America, Europe, Asia Pacific, CSA and MEA |

| Key Companies profiled | Louis Dreyfus Company; Biox Corp.; Munzer Bioindustrie GmbH; Neste Oyj; Renewable Energy Group, Inc.; Renewable Biofuels, Inc.; Ag Processing, Inc.; Archer Daniels Midland Company (ADM); Wilmar International Ltd.; Bunge Ltd.; Cargill, Inc. |

Global Biodiesel Market, Report Segmentation

Biodiesel Market, By Feedstock

- Vegetable Oils

- Animal Fats

Biodiesel Market, By Application

- Fuel

- Power Generation

- Others

Biodiesel Market, Regional Outlook

- North America

- U.S.

- Canada

- Mexico

Europe

- Germany

- UK

- Spain

- Russia

- France

- Italy

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia

CSA

- Brazil

- Argentina

MEA

- UAE

- Saudi Arabia

- South Africa

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355