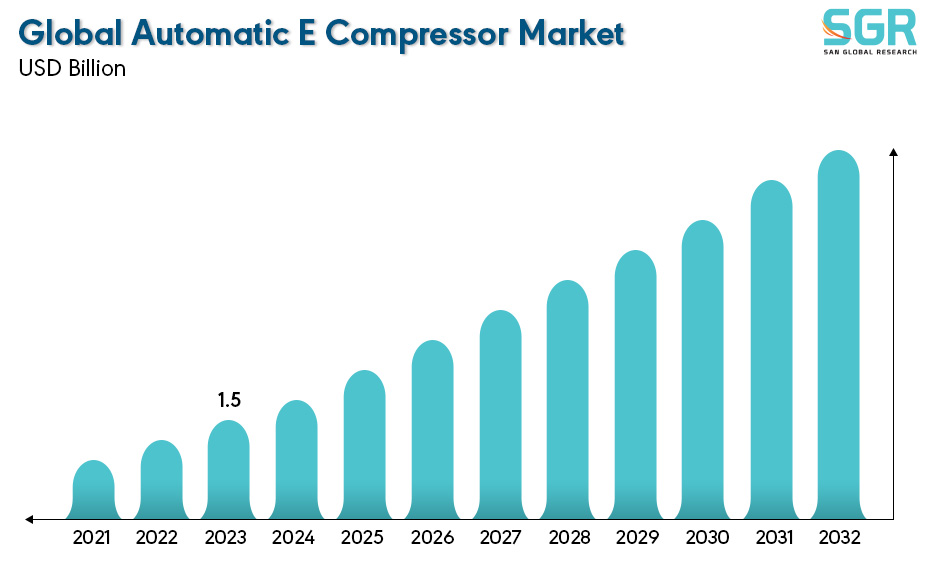

Global Automatic E Compressor Market is estimated to be worth USD 1.5 Billion in 2022 and is projected to grow at a CAGR of 28.5% between 2023 to 2032. The study has considered the base year as 2022, which estimates the market size of market and the forecast period is 2023 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by Sales Channel, by Type, by component and by region/country.

Global Automatic E Compressor Market Size (Historic to Forecast Data)

The global Automatic E Compressor Market represents a crucial segment within the automotive industry, specifically within the realm of electric and hybrid vehicles. The automatic e-compressor, an integral component of electric and hybrid vehicle air conditioning systems, serves the purpose of regulating and maintaining the required pressure levels within the vehicle's air conditioning refrigerant circuit. This compressor operates automatically without relying on an engine belt, as seen in traditional internal combustion engine vehicles. The market for automatic e-compressors has been witnessing steady growth, driven primarily by the increasing adoption of electric and hybrid vehicles globally. Factors such as government incentives, stringent emissions regulations, and the growing consumer preference for eco-friendly and energy-efficient vehicles contribute significantly to market expansion. The continuous advancements in electric vehicle technology, aimed at improving range, efficiency, and overall performance, further drive the demand for advanced automatic e-compressor solutions. Geographically, regions with a higher adoption rate of electric vehicles, such as Europe, North America, and certain parts of Asia-Pacific, are key contributors to the global automatic e-compressor market. Nonetheless, as the automotive industry continues to transition toward electrification, the market for these components is poised for further growth and innovation.

.jpg)

Region wise Comparison:

The United States and Canada are key contributors to the global electric vehicle market. As these countries witness increasing electric vehicle sales and a growing focus on sustainability, the demand for automatic e-compressors in this region is noteworthy.

Europe stands as another prominent market for automatic e-compressors due to the region's stringent emissions regulations and the push towards electric mobility. Countries like Germany, France, and Norway witness higher electric vehicle adoption rates, thus driving the demand for associated components like automatic e-compressors.

.jpg)

Asia-Pacific, comprising countries like China, Japan, and South Korea, leads the electric and hybrid vehicle market and is likely a significant contributor to the automatic e-compressor market. The region's extensive electric vehicle production and advancements in automotive technology contribute significantly to the adoption of e-compressors.

Latin America, Africa, and the Middle East might have a smaller market share in the global automatic e-compressor market, but they contribute based on the gradual adoption of electric vehicles and initiatives promoting eco-friendly transportation. The precise market shares and geographical breakdowns might have evolved since then due to changing industry dynamics.

.jpg)

Segmentation:

The Global Automatic E Compressor Market is segmented by Sales Channel, by Type, by component and by region/country.

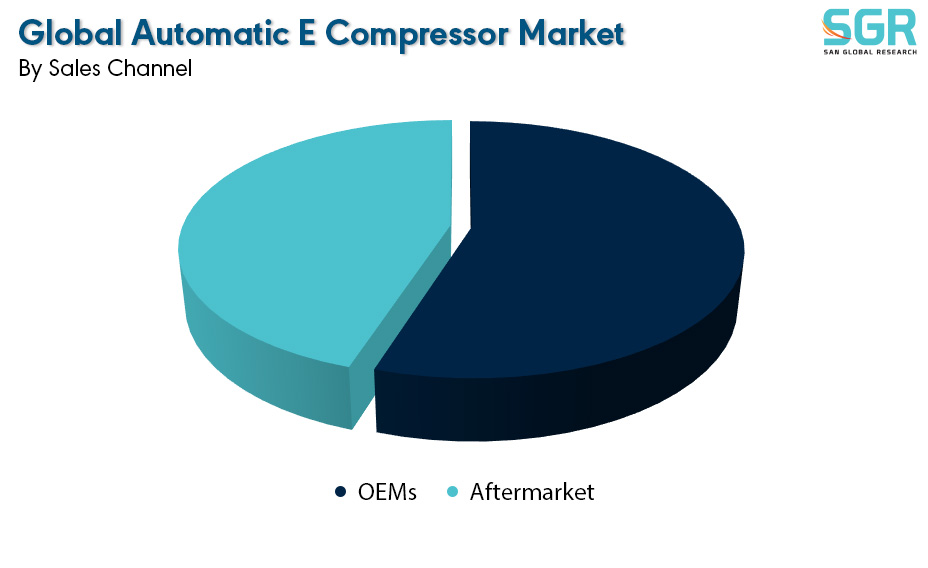

By Sales Channel:

Based on the Sales Channel, the Global Automatic E Compressor Market is bifurcated OEMs & Aftermarket – where OEMs are dominating and ahead in terms of share.

Original Equipment Manufacturers (OEMs) play a pivotal role as providers of these specialized components for electric and hybrid vehicles. OEMs in the automotive industry, including companies like Denso Corporation, Valeo S.A., and Hanon Systems, among others, manufacture automatic e-compressors as integral parts of electric vehicle air conditioning systems. These components are specifically designed and integrated into the vehicles during the manufacturing process. OEMs collaborate closely with automakers to develop efficient and technologically advanced automatic e-compressors that meet stringent performance standards, including energy efficiency, compactness, and reliable operation.

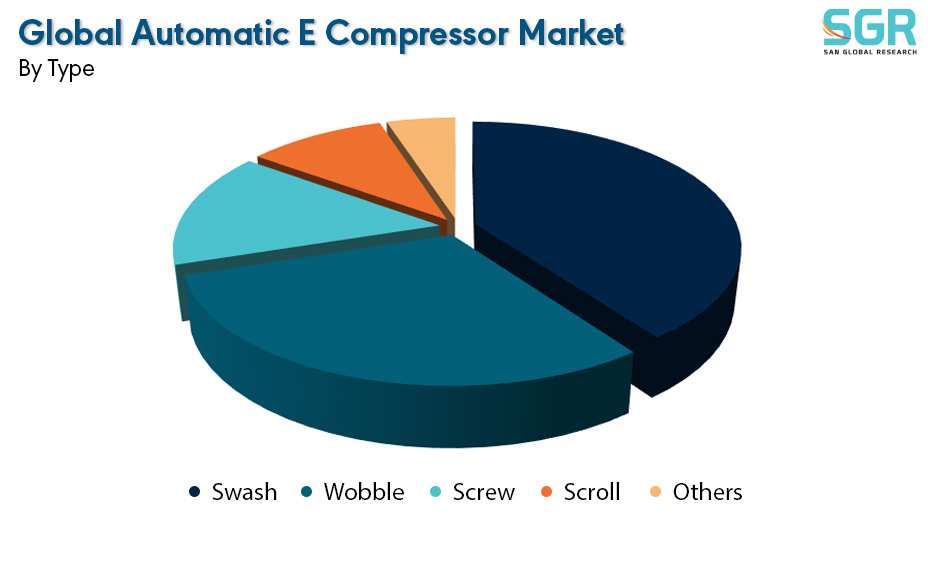

By Type:

Based on the Type, the Global Automatic E Compressor Market is bifurcated into Swash, Wobble, Screw, Scroll, and Others – where Swash is dominating and ahead in terms of share.

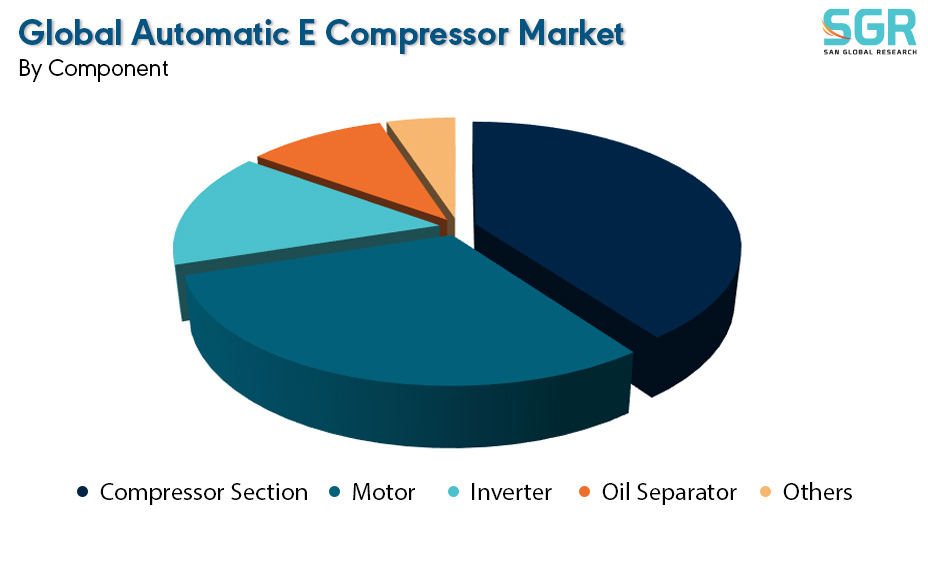

By Component:

Drivers:

Growing sector across the globe

The global automatic e-compressor market is driven by several key factors that underscore the increasing demand for electric and hybrid vehicles worldwide. Government initiatives promoting clean energy, coupled with stringent emissions regulations, serve as significant drivers propelling the adoption of electric vehicles. As automakers strive to expand their electric vehicle portfolios to meet these regulations and consumer preferences, the demand for components like automatic e-compressors surges. Additionally, advancements in electric vehicle technology, including improvements in battery efficiency and range, influence the market growth by enhancing the overall performance and appeal of electric vehicles. The rising awareness among consumers regarding environmental sustainability and the benefits of electric mobility further boosts the market, driving manufacturers to innovate and develop more efficient and compact automatic e-compressors. Moreover, incentives, subsidies, and investments in charging infrastructure for electric vehicles contribute to the market's expansion by encouraging broader acceptance and adoption of these eco-friendly vehicles, consequently driving the demand for automatic e-compressor technology.

Based on the Component, the Global Automatic E Compressor Market is bifurcated into Compressor Section, Motor, Inverter, Oil Separator, and Others – where Compressor Section is dominating and ahead in terms of share.

On the basis of region

• North America

• Europe

• Asia Pacific

• South America and

• Middle East and Africa

In 2022, North America is anticipated to dominate the Global Automatic E Compressor Market with market revenue of XX USD Million with a registered CAGR of XX%.

Key Players:

The key market players operating in the Global Automatic E Compressor Market include

• Denso Corporation

• Hanon Systems

• Valeo

• Mahle GmbH

• Sanden Holdings Corporation

• Mitsubishi Heavy Industries

• Hitachi Automotive Systems

• LG Electronics

• Panasonic Corporation

• Calsonic Kansei Corporation

| Report Attribute | Details |

| Market Value in 2022 | 1.5 Billion |

| Forecast in 2032 | 26.1 Billion |

| CAGR | CAGR of 28.5% from 2024 to 2032 |

| Base Year of forecast | 2023 |

| Historical | 2019-2022 |

| Units | Revenue in USD Billion and CAGR from 2023 to 2032 |

| Report Coverage | Revenue forecast, Industry outlook, competitive landscape, growth factors, and trends |

| Segments Scope | By Component, By Vehicle Type |

| Regions Covered | North America, Europe, Asia Pacific, SA and MEA |

| Key Companies profiled | Denso Corporation, Hanon Systems, Valeo, Mahle GmbH, Sanden Holdings Corporation, Mitsubishi Heavy Industries, Hitachi Automotive Systems, LG Electronics, Panasonic Corporation, Calsonic Kansei Corporation |

Description

Description

Table of Content

Table of Content

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355