Global AI in Banking Market is estimated to be worth USD 8.6 Billion in 2022 and is projected to grow at a CAGR of 30.4% between 2023 to 2032. The study has considered the base year as 2022, which estimates the market size of market and the forecast period is 2023 to 2032. The report analyzes and forecasts the market size, in terms of value (USD Billion), for the market. The report segments the market and forecasts it by component, by technology, by enterprise size, by application and region/country.

The global Artificial Intelligence (AI) in banking market is experiencing significant growth as financial institutions embrace AI technologies to enhance customer experiences, improve operational efficiency, and drive innovation. AI is being applied across various banking functions, including customer service, fraud detection, risk management, and personalized financial services. The AI in banking market has witnessed substantial growth in recent years and is expected to continue expanding. The integration of AI technologies in the financial sector is driven by the need for advanced analytics, automation, and data-driven decision-making. AI-powered chat bots and virtual assistants are deployed to interact with customers, answer queries, provide account information, and assist with basic banking tasks.

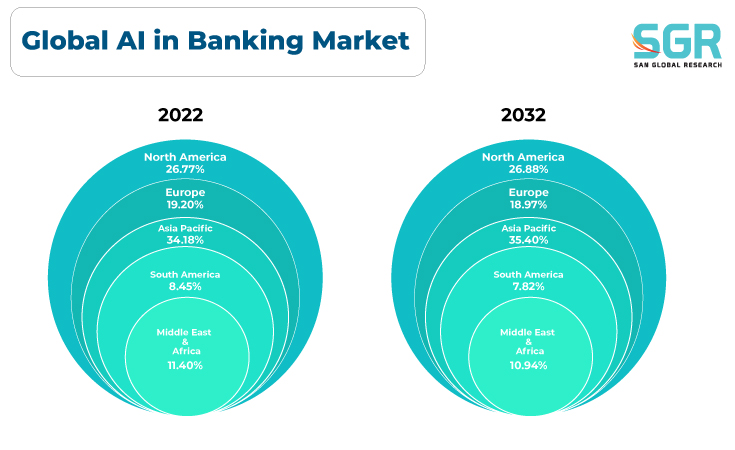

Region wise Comparison:

North America, particularly the United States, has been a major adopter of AI technologies in banking. Large financial institutions and fintech companies in the region invest heavily in AI to enhance customer experiences, improve operational efficiency, and drive innovation.

European countries, including the United Kingdom, Germany, and France, have also witnessed significant adoption of AI in banking. Regulatory support and a competitive landscape contribute to the growth of AI applications in the European banking sector.

The Asia-Pacific region, with countries such as China, Japan, and Singapore, is experiencing rapid growth in AI adoption in banking. Fintech innovation, government initiatives, and a tech-savvy population contribute to the expansion of AI applications.

While Latin America may not have the same level of adoption as some other regions, there is growing interest in AI applications in banking. Fintech startups and established banks are exploring AI solutions to stay competitive.

AI adoption in banking in Africa is emerging, with some banks exploring AI technologies for improved customer service, fraud detection, and risk management.

Countries in the Middle East, such as the United Arab Emirates and Saudi Arabia, are investing in AI to modernize their banking infrastructure and enhance customer services.

Segmentation:

The Global AI in Banking Market is segmented by component, by technology, by enterprise size, by application and region/country.

By Component:

Based on the Component, the Global AI in Banking Market is bifurcated Solution & Service – where the Service is dominating and ahead of Solution in terms of share.

The AI in banking market encompasses various service types that leverage artificial intelligence technologies to enhance different aspects of financial services.

AI is used to analyze customer data and preferences, enabling the delivery of personalized financial advice, product recommendations, and targeted marketing.

By Technology:

Based on the Deployment Mode, the Global AI in Banking Market is bifurcated into ML & Deep Learning, NLP, Computer Vision & Others – where ML & Deep Learning is dominating and ahead of others in terms of share.

By Enterprise Size:

Based on the Application, the Global AI in Banking Market is bifurcated into Large Enterprises & SME’s – where the Large Enterprise is dominating and ahead of SME’s in terms of share.

By Application:

Based on the Application, the Global AI in Banking Market is bifurcated into Risk Management Compliance & Security, Customer Service, Back Office/Operations, Financial Advisory and Others – where the Risk Management Compliance & Security is dominating and ahead of others in terms of share.

On the basis of region

- North America

- Europe

- Asia Pacific

- South America and

- Middle East and Africa

In 2022, North America is anticipated to dominate the Global AI in Banking Market with market revenue of XX USD Million with a registered CAGR of XX%.

Key Players:

The key market players operating in the Global AI in Banking Market include

International Business Machines Corporation

SAP SE

SAS Institute Inc.

Rapid Miner Inc.

BigML Inc.

CISCO Systems

AWS

Microsoft

HP Enterprises

Drivers:

Growing across the globe

The adoption of Artificial Intelligence (AI) in the banking industry is driven by various factors that contribute to its growth and transformative impact. The exponential growth of data in the banking sector, including customer data, transaction records, and market data, creates opportunities for AI to extract valuable insights and drive informed decision-making. Increasing customer expectations for personalized, efficient, and convenient banking services are compelling banks to leverage AI technologies to deliver tailored and seamless experiences. AI enables automation of routine and manual tasks, leading to operational efficiency, cost savings, and improved workflows. This efficiency gains are attractive for banks seeking to streamline processes. Banks are leveraging AI to gain a competitive edge. The adoption of innovative AI solutions allows banks to differentiate themselves, attract customers, and stay ahead in a rapidly evolving financial landscape. AI contributes to better risk assessment by analyzing market conditions, predicting economic trends, and identifying potential risks in investment portfolios, aiding banks in making informed decisions. AI technologies, including machine learning, contribute to more sophisticated fraud prevention mechanisms, identifying unusual patterns and behaviors to prevent financial crimes.

Opportunity:

Evolving Market

The adoption of Artificial Intelligence (AI) in the banking industry presents various opportunities for financial institutions to enhance their operations, improve customer experiences, and stay competitive in a rapidly evolving landscape. AI enables personalized customer interactions, allowing banks to offer tailored services, product recommendations, and targeted marketing, thereby enhancing overall customer engagement. AI technologies offer advanced fraud detection capabilities, presenting opportunities for banks to enhance security measures, reduce financial losses, and protect customer assets. AI facilitates automated compliance monitoring, helping banks adhere to regulatory requirements and reducing the risk of non-compliance, thus ensuring a smoother regulatory landscape. AI-driven voice recognition technology creates opportunities for secure and convenient authentication, allowing customers to access banking services through voice commands. AI and blockchain integration can enhance security, transparency, and efficiency in banking operations, offering opportunities for improved cross-border transactions and settlement processes.

Description

Description

Gera Imperium Rise,

Gera Imperium Rise,  +91 9209275355

+91 9209275355